Amid Sales Slowdown, Dealerships in Japan Struggle To Satisfy New-Vehicle Shoppers, J.D. Power Study Finds

Lexus Ranks Highest among Luxury Brands in New-Vehicle Sales Satisfaction in Japan For 10th Consecutive Year; MINI Ranks Highest among Mass Market Brands

TOKYO: 24 August 2016 — Slowing new-vehicle sales in Japan are putting pressure on dealerships, which are struggling to meet customer expectations, especially regarding the vehicle price, according to the J.D. Power 2016 Japan Sales Satisfaction Index (SSI) Study,SM released today. The result is an overall drop in customer satisfaction with the sales process.

A combination of the national consumption tax and sluggish economy is causing a continued slowdown in new-vehicle sales in Japan, which dropped to 4.2 million units in 2015 from 4.7 million 2014 and are expected to remain flat this year.1 With slower sales, dealerships are less willing to negotiate on price, according to customers, resulting in a 5-point decline in overall satisfaction to 660 in 2016 (on a 1,000-point scale) from 2015. While satisfaction in the mass market segment drops 5 points to 658 in 2016, the decline is more pronounced in the luxury segment, which slips by 12 points to 696.

“With new-vehicle sales tapering off, it’s critical for auto dealers to focus on each customer who visits the showroom in order to satisfy them and help them find the vehicle that meets their needs,” said Koichi Urayama, director of the automotive division at J.D. Power. “From the customer’s perspective, the dealers are not doing that, specifically when it comes to negotiating the price of the vehicle.”

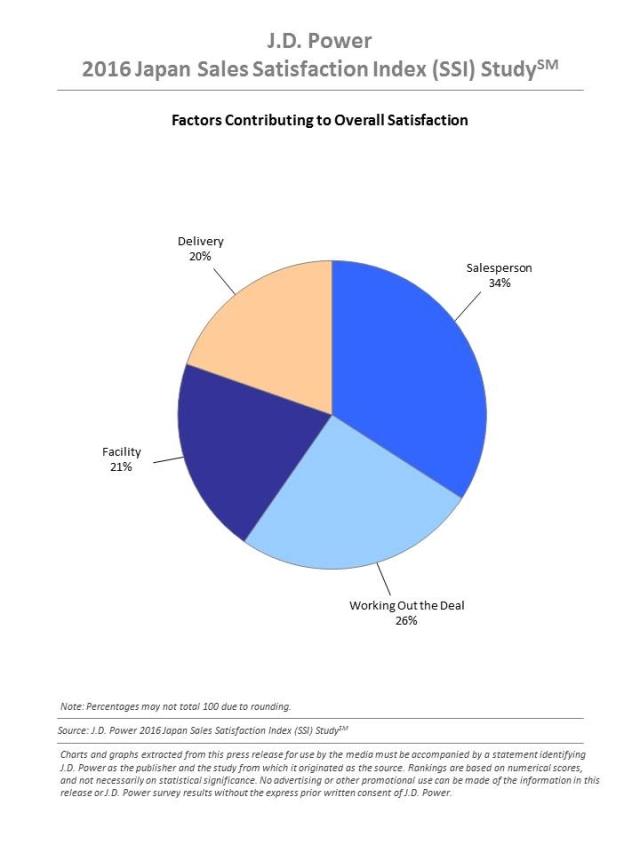

The study, now in its 15th year, measures customer satisfaction with the sales process at automotive dealerships based on four factors (in order of importance): salesperson (34%); working out the deal (26%); facility (21%); and delivery (20%).

In the mass market segment, year-over-year satisfaction declines in all factors, most notably in working out the deal (-12 points). In the luxury segment, year-over-year satisfaction improves in delivery by 2 points, but drops by at least 10 points in each of the remaining three factors.

It’s not just owners who bought from the brand for the first time who are critical of the sales experience. For example, among repeat buyers in the luxury segment, salesperson satisfaction drops 19 points year over year, while satisfaction in working out the deal slips 18 points. Further, 32% of repeat buyers in the luxury segment say the purchase price was higher than their expectations, up 4 percentage points from 2015, and 16% say they “somewhat” or “very much” felt pressure from their salesperson to purchase the vehicle, a 6-percentage-point increase.

“It’s critical for auto dealers to maintain and improve loyalty among existing customers. In fact, in this study, overall satisfaction is higher among existing customers than new customers,” said Urayama. “Yet, the study finds sales satisfaction among existing customers is declining. If auto dealers miss an opportunity to delight their customers, they could lose their foundation for future business.”

Additional key findings of the study include:

- Sales Satisfaction Builds Advocacy: Customers who are satisfied with the sales process are likely to recommend their dealer to family and friends. The study finds that 85% of highly satisfied customers (overall satisfaction scores of 800 or higher) say they “definitely would” or “probably would” recommend their dealership to others, while only 35% of customers with lower satisfaction (scores below 500) say the same.

- Discuss More Than Price: The study finds that customers who indicate they talk with the salesperson about their personal lifestyle or preferences during the sales negotiation are more satisfied with the overall sales process than those who don’t. Among customers who talk about “hobbies/ occupation” with their salesperson, satisfaction averages 716, while satisfaction among customers who talk about “the make/ brand (history, concept, etc.)” averages 709 and averages 693 among those who talk about “who is going to drive the vehicle in question.” In contrast, overall satisfaction averages just 677 when the focus of the conversation is on the vehicle price.

- Mini-Car Segment Slump: Among customers who purchased a mass market mini-car, satisfaction drops significantly to 650 in 2016 from 661 in 2015. The decline in satisfaction is attributed to a 17-point decline in working out the deal. Among mini-car customers who purchased their vehicle with a loan at the dealership, 55% used residual values on auto loans (lease), a 10-percentage-point increase from 2015; however, overall satisfaction among these customers (615) is lower than among those who used standard auto loans (661) and those who purchased with cash (623).

Study Rankings

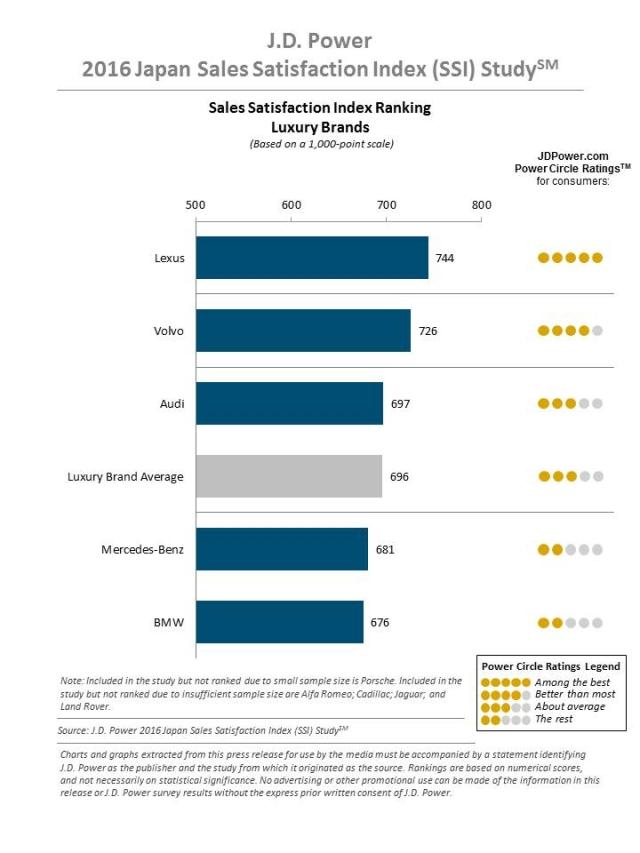

Lexus ranks highest among luxury brands for a 10th consecutive year, with a score of 744. Lexus performs particularly well in the salesperson, facility and delivery factors. Volvo ranks second (726), followed by Audi (697).

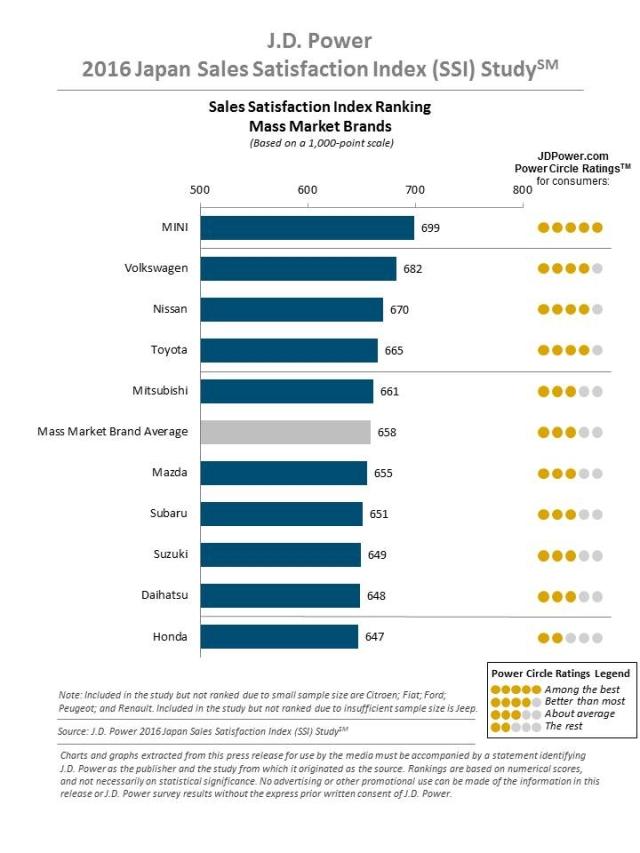

MINI ranks highest among mass market brands, with a score of 699. MINI performs particularly well in the salesperson and delivery factors. Volkswagen ranks second (682), followed by Nissan (670), Toyota (665) and Mitsubishi (661).

The 2016 Japan Sales Satisfaction Index (SSI) Study measures customer satisfaction with the dealer where they purchased their new passenger vehicle. The study is based on responses from 6,943 domestic and import vehicle owners after two to 12 months of ownership. The online survey was fielded from late May through early June 2016.

About J.D. Power in the Asia Pacific Region

J.D. Power has offices in Tokyo, Singapore, Beijing, Shanghai, Malaysia and Bangkok that conduct customer satisfaction research and provide consulting services in the automotive, information technology and finance industries in the Asia Pacific region. Together, the six offices bring the language of customer satisfaction to consumers and businesses in Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Taiwan, Thailand and Vietnam. Information regarding J.D. Power and its products can be accessed through the Internet at asean-oceania.jdpower.com.

About J.D. Power and Advertising/Promotional Rules www.jdpower.com/about-us/press-release-info

1. Sources: Japan Automobile Dealers Association and Japan Automobile Importers Association.