Lexus, Nissan and MINI Rank Highest in Respective Segments

Highly satisfied customers tend to use the same dealer for after-sales service.

Customer treatment by dealership staff other than the service representative influences customer satisfaction.

TOKYO: 27 Aug. 2020 — The more satisfied a vehicle buyer is with the dealership, the more likely they are to use the same dealership for after-sales services, according to The J.D. Power 2020 Japan Customer Service Index (CSI) StudySM, released today.

This year’s study has been redesigned for the first time in seven years in accord with the changes in the automotive environment and sales approaches at dealerships. The redesigned study collects extensive data on after-sales service at authorized dealers, as well as on customer experiences and customer intent to use the same dealerships for after-sales service.

“Dealerships are required to treat the customers in ways that make them feel that not only the service representative but also the rest of the staff is taking care of them,” said Keiko Matsuda, manager of the automotive division at J.D. Power. “For customers’ long-term vehicle ownership and satisfaction with the dealership, it is crucial for dealers to improve satisfaction across the entire customer experience in order to increase intent to use the dealership for the various after-sales services they offer. Dealers should also improve their user-friendliness and offer additional value to customers to ensure a high level of loyalty.”

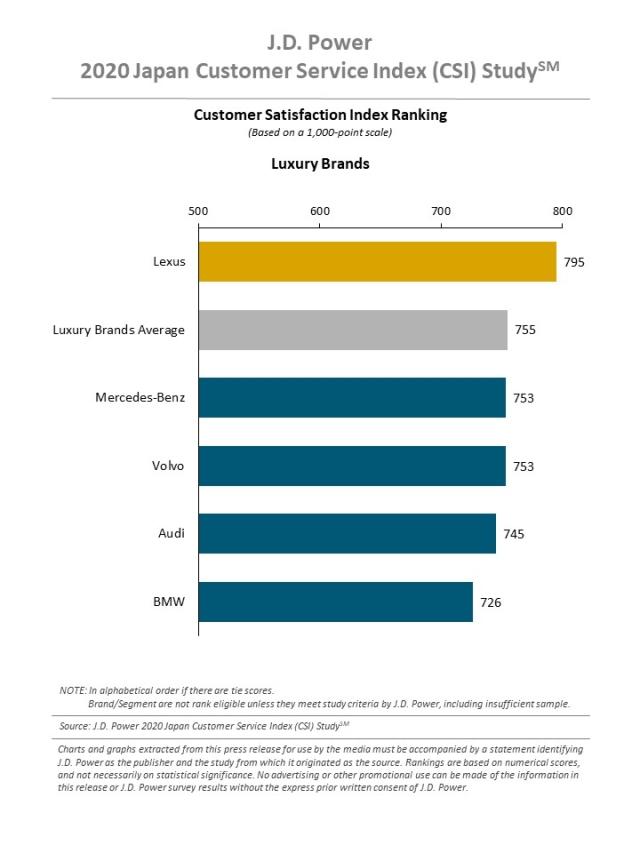

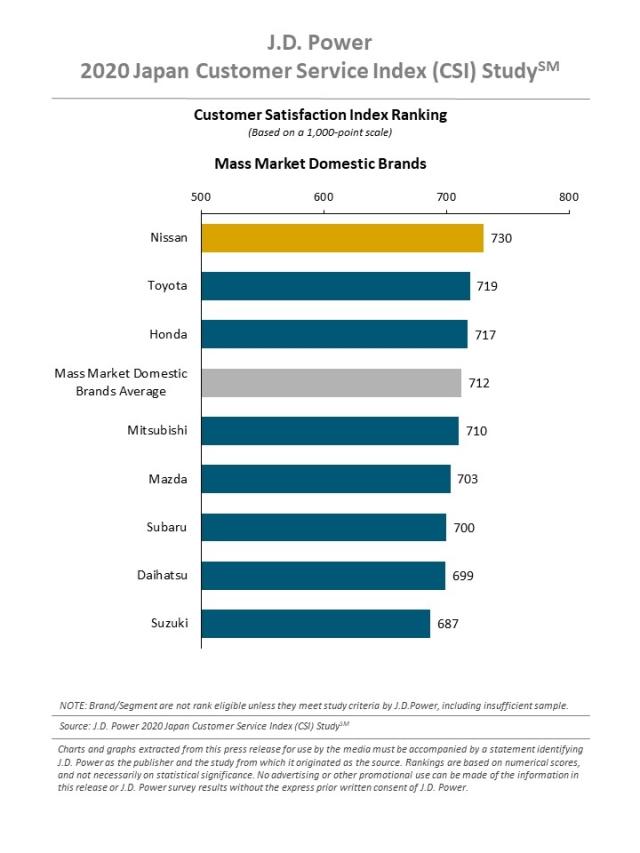

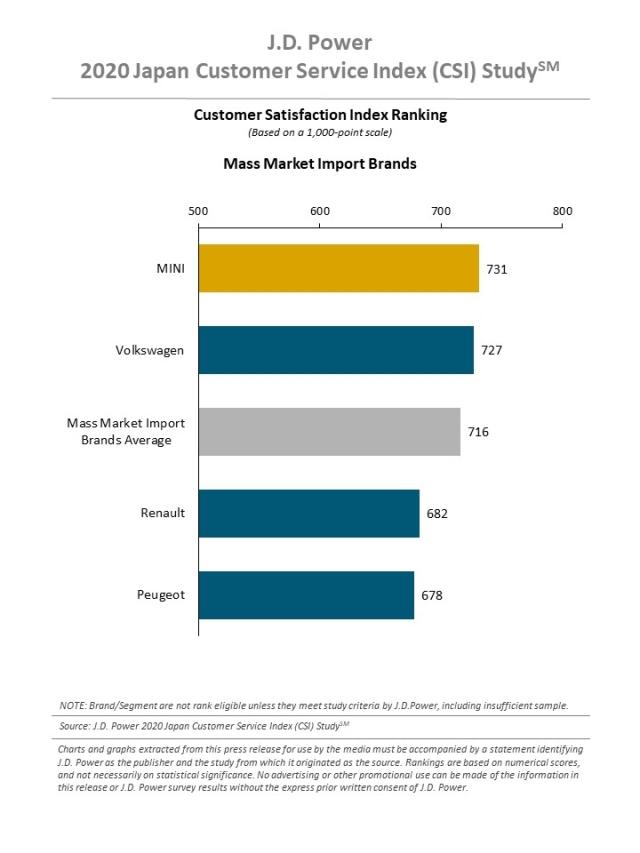

In 2020, overall customer satisfaction averages 714 points (on a 1,000-point scale). By factor, the scores in three categories are: dealer facilities and support, 713; booking/dropping off the car, 721; and service quality/car delivery, 708.The redesigned study measures satisfaction in three segments: luxury, mass market domestic and mass market import. Satisfaction scores this year are: 755 for luxury brands; 712 for mass market domestic brands; and 716 for mass market import brands.

Following are some key findings of the 2020 study:

- Highly satisfied customers tend to use the same dealer for after-sales service: Among customers with high service satisfaction (score of 801 points or higher), 67% say “they would take their vehicle to the same dealer for after-sales service the next time as well, compared with just 23% of customers with moderate satisfaction (score of 601 to 800 points). Additionally, 80% of customers with high satisfaction say they would use the same dealer for a “shaken inspection,” while 51% of customers with moderate satisfaction say the same. Likewise, for purchase and exchange of tires and a coating treatment, 42% and 50%, respectively, of customers with high satisfaction say they would use the same dealer, compared with 20% and 24%, respectively, of customers with moderate satisfaction. These figures suggest that as satisfaction increases, customer intent to use the same dealer for after-sales service also increases.

- Customer treatment by dealership staff other than the service representative influences customer satisfaction: Among customers who say that other staff members were polite enough to respond if the representative was absent or busy with other customers, satisfaction averages 850 points, but substantially decreases to 464 when this does not occur. Similarly, among customers who say that the staff other than the service representative cared about them, satisfaction averages 870, and declines to 505 among for those who do not agree. This suggests that it is important for dealers to educate all their dealer staff members on how to treat customers even though they are not in charge of those customers so that they feel they are being taken care of.

- Customers have high expectations of the dealer concerning the ease of dealership processes, including online booking, benefits and a variety of payment methods: The study finds that customers strongly want dealer processes to become easier to use, including online booking of the date and time of visit (27%); benefits and preferential treatment according to the number of purchases and possession periods (25%); and diversity in payment methods (21%). Only 7% of customers “filled an appointment form on the make/dealer’s website” for booking an after-sales service. This suggests that manufacturers and dealers need to improve the convenience and the user-friendliness of their websites.

Study Rankings

Luxury Segment

Among the five luxury brands included in the study, Lexus ranks highest with a score of 795 points. Lexus performs particularly well in all three factors.

Mass Market Domestic Segment

Among the eight mass market domestic brands included in the study, Nissan (730) ranks highest, performing particularly well in all three factors. Toyota(719)ranks second, Honda(717)ranks third.

Mass Market Import Segment

Among the four mass market import brands included in the study, MINI (731) ranks highest, and performs particularly well in two factors, booking/dropping off the car and service quality/car delivery. Volkswagen(727)ranks second.

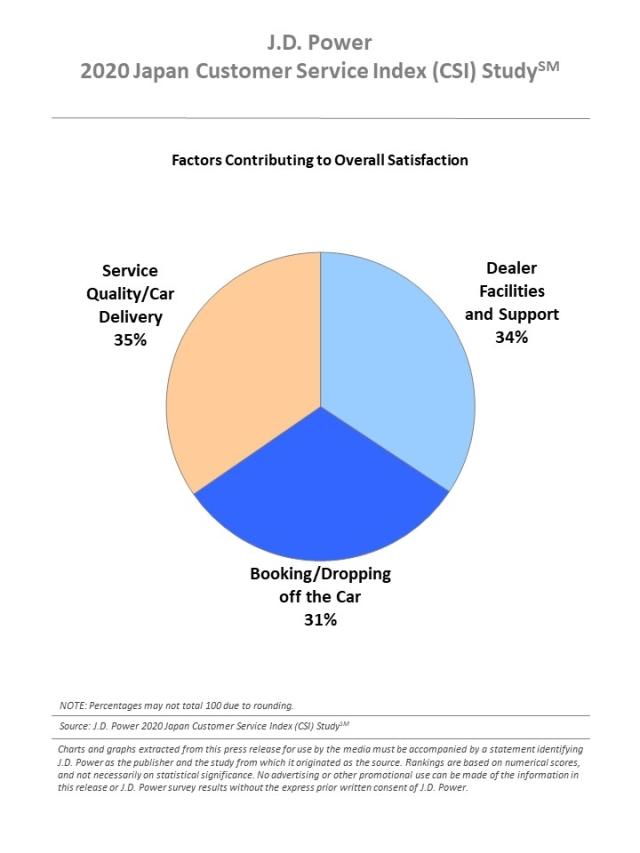

The Japan Customer Service Index (CSI) Study measures overall satisfaction with after-sales service among new-vehicle owners after 14-49 months of ownership. The study surveys owners who visited a manufacturer-authorized service center for maintenance or repair work in the past year. Satisfaction is based on the combined scores of three factors, each of which comprises multiple attributes. These factors are (in order of importance): dealer facilities and support (34%), booking/dropping off the car (31%) and service quality/car delivery (35%).

The study, now in its 19th year and redesigned this year, is based on responses from 8,687 owners who purchased their new vehicle between April 2016 and March 2019. The online survey was fielded in May and June 2020.

About J.D. Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info