Lexus Ranks Highest in Luxury Segment; Toyota Ranks Highest in Mass Market Segment

Decreased gaps in satisfaction are seen among mass market brands

Increased interest in security-related functions or applications

TOKYO: 2 Oct. 2020 — The satisfaction levels for factory- and dealer-installed navigation systems in new vehicles have increased overall since 2019; however, there is still room for improvement in the ease of use, according to the J.D. Power 2020 Japan Navigation Systems Customer Satisfaction Index StudySM—OEM, released today.

Now in its 13th year, the study measures satisfaction with factory- and dealer-installed navigation systems. Six factors comprised of 20 attributes are examined (listed in order of importance): navigation function (23%); display screen (19%); audio and video function (18%); ease of use (17%); design and texture (16%); and other functions, apps and services (7%). Satisfaction is calculated on a 1,000-point scale.

“Although overall satisfaction with navigation systems has steadily improved, users still indicate a relatively lower level of satisfaction with the ease of use,” said Hayato Iwakura, manager of the automotive division at J.D. Power Japan. “This suggests that manufacturers need to analyze the causes for low satisfaction in this area in order to find solutions. Also, as vehicle navigation systems are now more frequently equipped with connectivity, it will become critical for manufacturers to offer additional value and to develop more appealing products to differentiate themselves from their competitors as well as to distinguish their product from smartphones, which are also used to facilitate connectivity.”

Following are some of the key findings of the 2020 study:

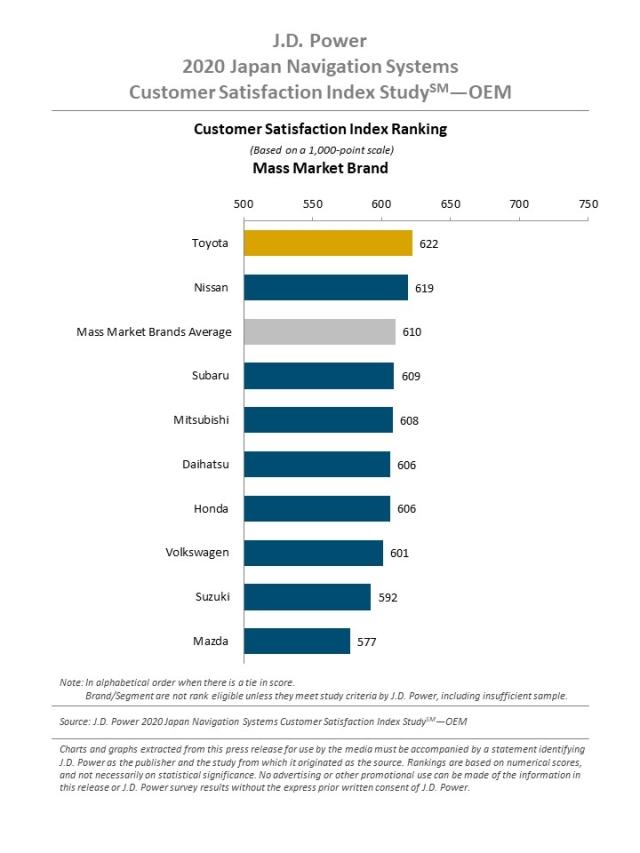

- Decreased gaps in satisfaction are seen among mass market brands: Overall satisfaction with vehicle navigation systems shows a slower improvement year over year to 613 in 2020, an increase of only 13 points from 2019 (as compared with the 26-point increase from 2018 to 2019). In the mass market segment, the gaps in overall satisfaction are narrowing among brands.

- Satisfaction with display screens considerably improves: Among the six factors comprising overall satisfaction, the highest satisfaction this year is in the display screen factor (635), a substantial increase of 46 points during the past two years. Additionally, larger improvements have occurred in all three attributes of this factor during the same period of time: Screen size, clarity of screen and screen location.

- There is room for improvement in the ease of use: Among all factors, the lowest level of satisfaction during the past two years has been in the ease of use factor (590 in 2020), with ratings this year of 5.83 points (on a 10-point sale) for ease of understanding menu structure and operation procedure and 5.84 for ease of operating navigation system by voice. Among age groups, satisfaction with ease of use varies widely and decreases by age of user: 626 points among those 30 years old or under; 586 points among those ages 40 to 59; and 570 points among those 60 years old or older. However, satisfaction is lower among users who have used a touch panel or switches located on the center console to operate their navigation system than among users who have used other tools.

- Connectivity is more frequently installed on navigation systems: About two-thirds of owners (62%) say that they have a navigation system with smartphone connectivity, an increase of 10 percentage points during the past two years, while 41% have a vehicle DCM , an increase of 6 percentage points during the past two years.

- Increased interest in security-related functions or applications: Three-fourths of owners (75%) have had a dashboard camera installed on their vehicle, an increase of 24 percentage points during the past two years. The study also asks owners if they have an interest in functions/applications or services on a navigation system using a communication network. The most frequently cited answer is an anti-theft or an accident emergency call function or application (38%), the highest interest level in the past two years.

Study Rankings

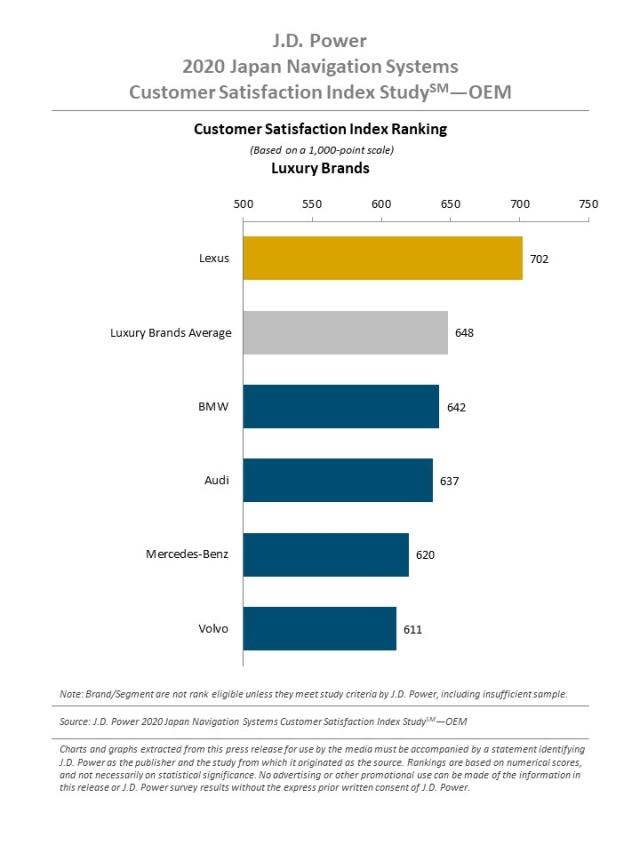

Among the five brands in the luxury segment, Lexus ranks highest for a ninth consecutive year with a score of 702. Lexus achieves the highest scores in all six factors. Lexus is followed by BMW (642) and Audi (637).

Among the nine brands in the mass market segment, Toyota ranks highest for a third consecutive year with a score of 622. Toyota receives the highest scores in three factors: navigation function; other functions, apps and services; and ease of use. Toyota is followed by Nissan (619) and Subaru (609).

The 2020 Japan Navigation Systems Customer Satisfaction Index Study—OEM is based on responses from 974 luxury vehicle owners and 6,323 mass market vehicle owners who purchased a new vehicle equipped with a factory- or dealer-installed navigation system from April 2019 through March 2020. The study was fielded in July 2020.

About J.D. Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info