2018 Japan Automotive Performance, Execution and Layout (APEAL) Study

Overall Vehicle Appeal Remains the Same Level as in 2017, While Satisfaction with Fuel Economy Decreases

TOKYO: 20 Sept. 2018 — While overall new-vehicle appeal in Japan remains the same as in 2017, according to the J.D. Power 2018 Japan Automotive Performance, Execution and Layout (APEAL) StudySM released today, APEAL scores for motor-driven vehicles such as plug-in hybrids and electrical vehicles have increased, compared to scores for fuel-powered vehicles.

The study finds that “electric powertrain vehicles[1]” have a greater appeal for new-vehicle owners than do “internal combustion engine (ICE) vehicles” such as gasoline or diesel-fueled vehicles and hybrids.

The overall APEAL score averages 676 points for electric powertrain vehicles, while the score averages 636 points for ICE vehicles, representing a 40-point gap in score between vehicle types. Additionally, electric powertrain vehicles outperform ICE vehicles in engine/ transmission (a 107-point gap); fuel economy (an 85-point gap); and driving dynamics (a 44-point gap), which are typical advantages for electric powertrain vehicles.

Those who owned a hybrid but purchased a plug-in hybrid or electric vehicle as a replacement are less satisfied with fuel economy than are owners of gasoline- or diesel-fueled vehicles, a 42-point gap in score. The study also finds that the proportion of those who owned a hybrid when they purchased a plug-in hybrid or electric vehicle as a replacement to the household has increased to 10% in 2018 from 6% last year.

“As the domestic sales share of electric powertrain vehicles has grown, more customers have purchased such a vehicle as a replacement, i.e., from a hybrid to a plug-in hybrid.” said Atsushi Kawahashi, Senior Director of the Automotive Division at J.D. Power, Tokyo. “For such users, it is more difficult for them to perceive the good fuel economy of the electric powertrain vehicles, an advantage of those vehicles, than for owners who used a gasoline- or diesel-fueled vehicle. It will become more important for manufacturers to show consumers types of new-vehicle appeal other than fuel efficiency in order to differentiate their vehicles from those of their competitors.”

The overall APEAL score in 2018 increases from 2017 by just 1 point to 638 (on a 1,000-point scale). Among all categories, the largest improvement is in engine/ transmission (638 points, up 4 points from 2017), followed by 3-point increases in driving dynamics (649); visibility and safety (646); seats (622); and HVAC (621) and a 2-point increase in storage and space (618). However, the APEAL score has decreased in the fuel economy category by 4 points (627).

By vehicle segment, the overall APEAL scores have increased since 2017 in the mini-car and large segments, by 5 points and 1 point, respectively. In the mini-car segment, the largest improvement is in engine/ transmission, increasing by 10 points to 593, while visibility and safety in the large segment has increased by 7 points to 719. However, the overall APEAL scores have decreased by 5 points in the midsize segment and by 1 point in the minivan segment as you will see detailed below.

Key Findings by Segment

- Mini-car segment: The overall APEAL score increases by 5 points year over year to 607 in 2018. Satisfaction has improved across all categories, particularly in engine/ transmission (up 10 points) and seats and driving dynamics (up 8 points each).

- Compact segment: The overall APEAL score remains at 624 points, the same as in 2017. Satisfaction has improved by 4 points in visibility and safety (627), while satisfaction has slightly decreased in six categories, including interior (down 5 points to 607).

- Midsize segment: The overall APEAL score deceases this year by 5 points from last year to 669. There have been no improved scores year over year in any category. In the engine/ transmission category, satisfaction remains at 690 points, the same as in 2017. Conversely, satisfaction has decreased by a significant 23 points in fuel economy (653).

- Minivan segment: The overall APEAL score decreases by 1 point from last year to 644 in 2018. Satisfaction has improved by 2 points in visibility and safety (657) and by 1 point in storage and space (650) and in seats (638). However, satisfaction has decreased in five categories, the largest of which is a 10-point decline in fuel economy (594).

- Large segment: The overall APEAL score increases year over year by 1 point to 714 in 2018. Satisfaction has improved in six categories, the largest of which is a 7-point increase in visibility and safety (719). From 2017, satisfaction has decreased by 1 point each in exterior (750) and interior (718) but remains the same in ACEN (667) and engine/ transmission (726).

Highest-Ranked Models and Brands

Honda N-BOX ranks highest in the mini-car segment, followed by Suzuki Spacia in second place and Daihatsu Cast and Daihatsu Move Canbus tie for third place.

Toyota AQUA ranks highest in the compact segment, followed by Mazda CX-3 in second place and Mazda Demio in third place.

Honda Civic ranks highest in the midsize segment, followed by Mazda CX-5 in second place and Subaru Levorg in third place.

Toyota Alphard ranks highest in the minivan segment, followed by Toyota Vellfire in second place and

Honda Step WGN in third place.

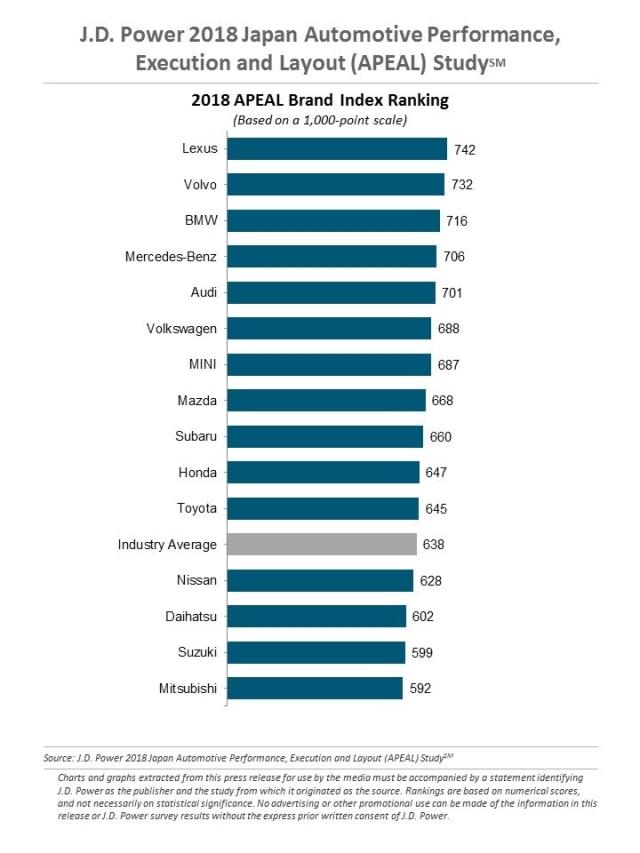

Lexus ranks highest among brands, with an overall APEAL score of 742, followed by Volvo (732) and BMW (716).

The 2018 Japan APEAL Study is based on responses from 22,387 purchasers of new vehicles in the first

two to nine months of ownership. The study was fielded from May through June 2018. The study, now in its eighth year, examines how gratifying a new vehicle is to own and drive. Owners evaluate their new vehicle across 77 attributes, grouped into 10 categories of vehicle performance: exterior; interior; storage and space; audio/ communication/ entertainment/ navigation (ACEN); seats; heating, ventilation and air conditioning (HVAC); driving dynamics (driving performance); engine/ transmission; visibility and safety; and fuel economy.

[1] Electric powertrain vehicles: plug-in hybrids, electric vehicles, Nissan Serena e-POWER and Nissan Note e-POWER