First-Ever Individual Shareholder Satisfaction Study by J.D. Power: Factors Related to Corporate Governance Code Account for 40% of Overall Satisfaction

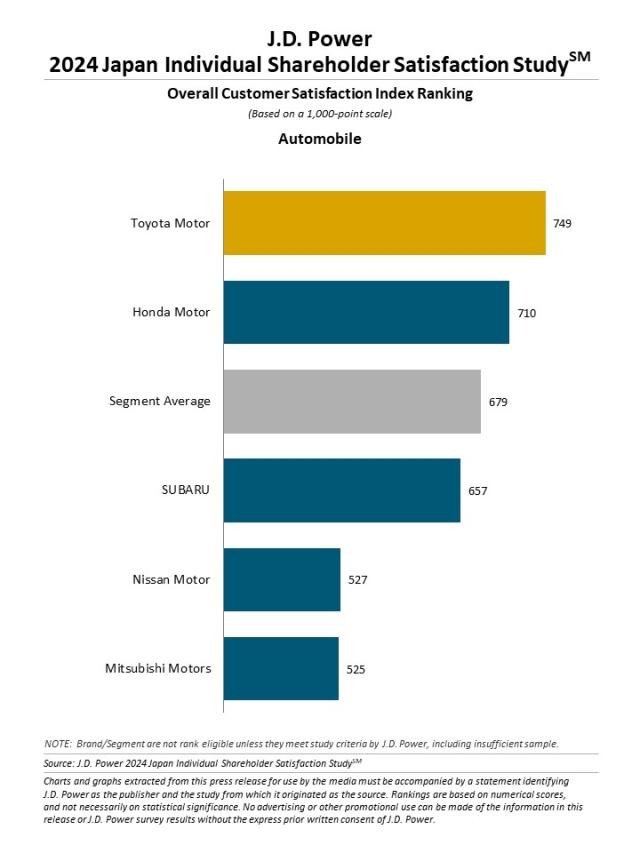

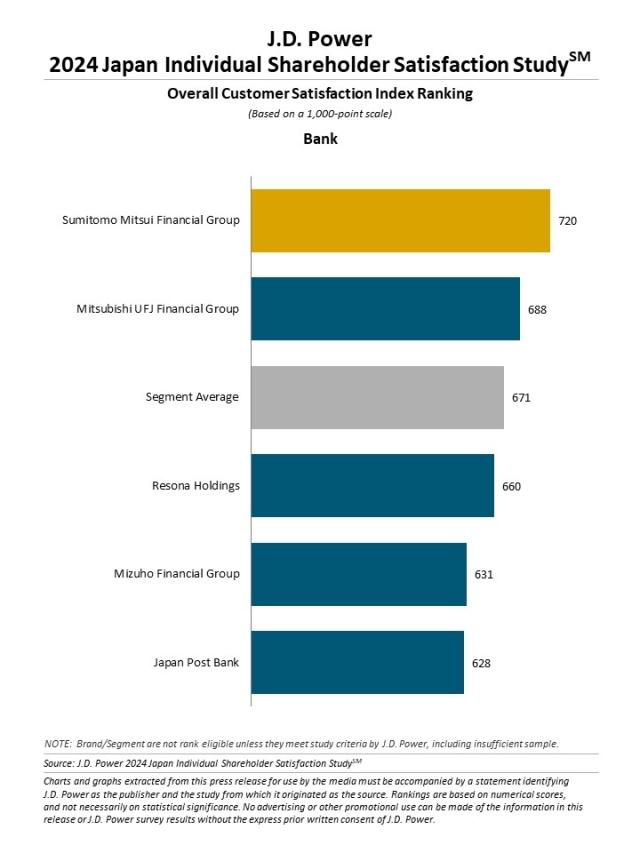

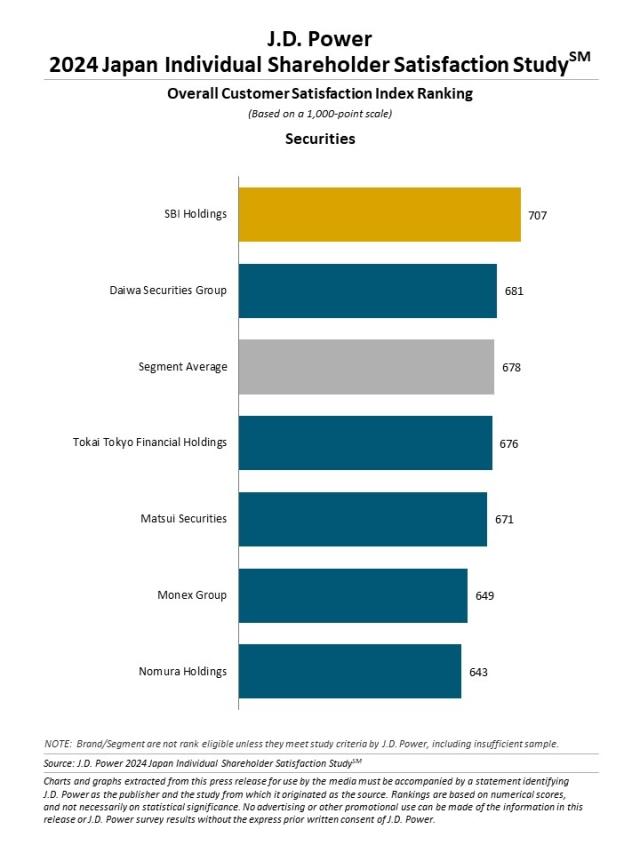

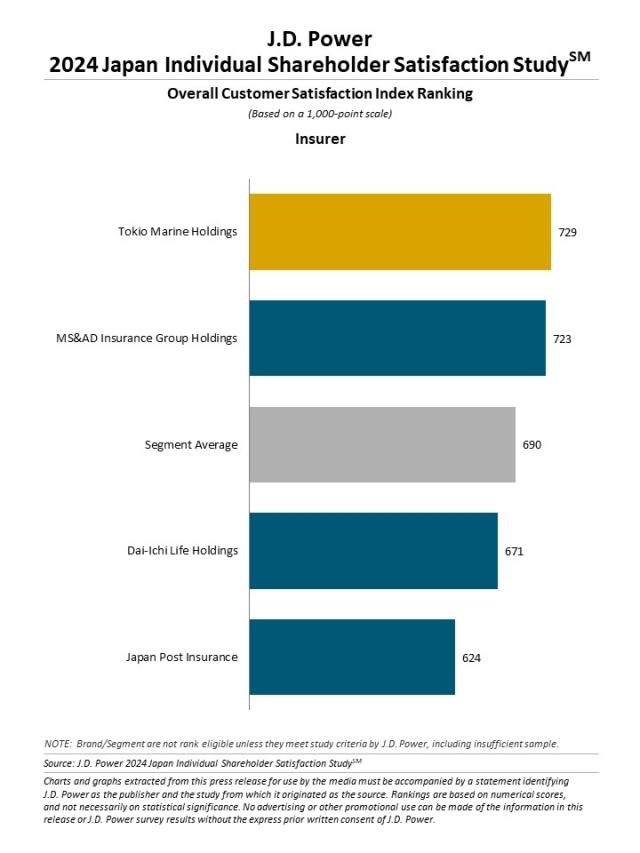

Toyota Motor, Sumitomo Mitsui Financial Group, SBI Holdings and Tokio Marine Holdings Rank Highest in Respective Segments

TOKYO, 19 April. 2024 — With Japan's cross-shareholding ratio falling to an all-time low and the new NISA (a tax exemption program for small investment programs that began in January 2024) with an indefinite tax exemption period, individual shareholders who are part of the long-term stable shareholder base are attracting increasing attention in the financial market. In addition, while pressure from government and institutional investors to improve corporate governance is increasing with growing global awareness of ESG (Environmental, Social, and Governance), issues related to certification fraud and insurer fraud claims have been widely covered in the media. J.D. Power perceives that the inexistence of evaluation with rankings on the comprehensive basis is one of the main reasons that cause asymmetry of information. To address these, J.D. Power has conducted a first-ever study to serve as an indicator for individual shareholders when deciding on mid- to long-term investment targets as well as to help companies in selected segments understand their position, strengths and weaknesses and use the data for improvement activities.

The J.D. Power 2024 Japan Individual Shareholder Satisfaction Study,SM released today, includes four industries (automobile, bank, securities and insurer), and measures overall individual shareholder satisfaction with respective companies, including their profitability and corporate governance efforts.

“This study measures overall satisfaction in terms of whether individual shareholders trust a company for mid- to long-term investment and data may be regarded as a performance report of that company’s management team, including corporate governance,” said Kiichi Umezawa, managing director of Japan Global Business Intelligence at J.D. Power. “Corporate governance aspects have often been discussed at an individual level, such as “diversity in the board” and “fair and reasonable transactions with suppliers,” but an overall evaluation by shareholders that includes data has not often been discussed. This makes it difficult to compare overall company performance, which leads to lenient competition among companies. J.D. Power perceives that this environment does not provide sufficient incentive for companies to improve. By presenting the overall evaluation with rankings, J.D. Power is hopeful that this study will encourage each company to work toward improvement.”

Following are some of the key findings of the 2024 study:

- Factors related to Corporate Governance Code account for 40% of overall shareholder satisfaction: Overall satisfaction of individual shareholders is evaluated based on seven factors: Profitability/Shareholder Return; Business and Products/Services; Financial Stability; Securing the Rights and Equal Treatment of Shareholders; Ensuring Appropriate Information Disclosure and Transparency; Responsibility of the Board; and Appropriate Cooperation with Stakeholders Other Than Shareholders. Four of these factorsSecuring the Rights and Equal Treatment of Shareholders; Ensuring Appropriate Information Disclosure and Transparency; Responsibility of the Board; and Appropriate Cooperation with Stakeholders Other Than Shareholdersare in line with the Corporate Governance Code released by the Tokyo Stock Exchange, Inc. Statistical analysis of the effect of each factor on overall satisfaction finds that the Corporate Governance Code-related factors together account for 40% of overall satisfaction while Profitability/Shareholder Return and Business and Products/Services have the highest importance weights, 21% each. Financial market players generally perceive that individual shareholders are generally more interested in shareholder dividends and benefits and less interested in more difficult issues such as corporate governance. However, as corporate fraud issues and inappropriate transactions with business partners are increasingly covered in the media, more shareholders say they “don’t agree” or “somewhat disagree” with the following statements regarding corporate governance: “the board is constituted in a manner to achieve both diversity and appropriate size” and “independent directors fulfill their roles” than they do for other statements, indicating that individual shareholders are not apathetic about corporate governance.

- Generational gaps in reasons to invest: Among the top three reasons in all four industries included in the study to invest in stocks, the number one reason shareholders cite is “shareholder dividend is attractive” (50%). This is followed by “the stock price is expected to rise in the future” (43%) and “future growth of the company can be expected” (32%). There are no differences in order by industry segment, but there are differences by age group. While there are no significant differences in the top three reasons, there are significant differences among age groups. Shareholders in the 40s and 50s groups cite “the company has a good reputation” (18%) and shareholders in the 60s age group cite the same at 16%; the percentage increases to 31% among those in their 20s and 30s, representing more than a 10-point gap. Furthermore, for the statement “recommended in personal social media/video sharing sites (Facebook, Instagram, YouTube, etc.),” while the range was as low as 1% in the 60s group and 5% in the 40s and 50s groups, the percentage jumps to 17% among those in their 20s and 30s, which confirms the influence of social media and video sites particularly among young people.

- Divergence in overall satisfaction within segment varies across industries: When comparing overall satisfaction scores by brand within all four industry segments, the average scores range from 671 (on a 1,000-point scale) to 690. However, divergences between the top score and the bottom score vary among the four segments. More specifically, whereas the gaps between the top and the bottom are around 100 points in the bank, securities and insurers segments, the divergence widens to more than 220 points in the automobile segment. The difference is not due to scores for the four Corporate Governance Code-related factors but for scores related to the general investment-related factors, i.e., Profitability/Shareholder Return; Business Products/Services; and Financial Stability.

Study Rankings

Toyota Motor ranks highest among automobile companies,1 with a score of 749. Honda Motor (710) ranks second and SUBARU (657) ranks third.

Sumitomo Mitsui Financial Group ranks highest among banks,2 with a score of 720. Mitsubishi UFJ Financial Group (688) ranks second and Resona Holdings (660) ranks third.

SBI Holdings ranks highest among securities companies,3 with a score of 707. Daiwa Securities Group (681) ranks second and Tokai Tokyo Financial Holdings (676) ranks third.

Tokio Marine Holdings ranks highest among insurers,4 with a score of 729. MS&AD Insurance Group Holdings (723) ranks second and Dai-Ichi Life Holdings (671) ranks third.

The 2024 Japan Individual Shareholder Satisfaction Study measures individual shareholder satisfaction with companies, including corporate governance, in four segments: automobile, bank, securities and insurer. Respondents are individual shareholders who have continuously held shares of companies listed on the TSE Prime Market that meet the criteria for more than a year and who owned at least 100 shares at the time of the study. If respondents hold multiple stocks in each segment, they are asked to evaluate the company in which they have the largest amount of investment assets at the time of the study. The study is based on responses from 6,088 individual shareholders and was fielded in March 2024. Overall satisfaction is measured by examining seven factors (listed in order of importance): Profitability/Shareholder Return (21%); Business and Products/Services (21%); Financial Stability (18%); Securing the Rights and Equal Treatment of Shareholders (10%); Ensuring Appropriate Information Disclosure and Transparency (10%); Responsibility of the Board (10%); Appropriate Cooperation with Stakeholders Other Than Shareholders (9%).

1 Automobile: Stocks that fall under the category of "Transportation Equipment" in the TSE 33 sectors that are finished passenger car manufacturers with a market capitalization of 500 billion yen or more as of the last business day of December 2023.

2 Bank: Stocks that fall under the category of "Banking" in the TSE 33 sectors with a market capitalization of at least 1 trillion yen as of the last business day of December 2023.

3 Securities: Stocks that fall under the category of "Securities and Commodity Futures" in the TSE 33 sectors, with securities-related revenues accounting for more than 50% of total revenue and with a market capitalization of 100 billion yen or more as of the last business day of December 2023.

4 Insurer: Stocks that fall under the category of "Insurance" in the TSE 33 sectors that have a market capitalization of 800 billion yen or more as of the last business day of December 2023.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 55 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit https://japan.jdpower.com/.

Media Relations Contacts

Kumi Kitami, J.D. Power; Japan; 81-3-6809-2996; release@jdpa.com

Geno Effler, J.D. Power; USA; 714-621-6224; media.relations@jdpa.com

About J.D. Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info.