Vehicle Dependability in Japan Declines, JD Power Finds

Toyota Ranks Highest among All Brands

TOKYO: 19 Oct. 2017 — Owners of 3- to 5-year-old vehicles report more problems with their cars in 2017 than in 2016, indicating that vehicle dependability in Japan has declined, according to the JD Power 2017 Japan Vehicle Dependability StudySM (VDS).

The VDS is conducted globally and serves as the industry benchmark for vehicle dependability. The Japan study, now in its third year, measures problems experienced during the past 12 months by original owners of vehicles after 3-5 years of ownership. The study examines 177 problem symptoms across eight categories: vehicle exterior; driving experience; features/ controls/ displays (FCD); audio/ communication/ entertainment/ navigation (ACEN); seats; heating, ventilation and air conditioning (HVAC); vehicle interior; and engine/ transmission. Overall dependability is determined by the number of problems reported per 100 vehicles (PP100), with a lower score reflecting higher quality.

“In the 2017 study, the number of reported problem in the ACEN category has increased more than in any other category, compared with 2016,” said Atsushi Kawahashi, Senior Director of the Automotive Division at JD Power, Tokyo. “ACEN devices are becoming increasingly essential for drivers to be comfortable while driving. The study suggests that auto manufacturers need to understand that dissatisfaction with vehicles after 3 years of ownership also exists with the ACEN devices. With an increase in the number of vehicles equipped with navigation systems and Bluetooth, there is likely going to be a rise in the number of ACEN-related problems over the next few years.”

Following are some key findings of the study:

- Seat dependability improves: Vehicle dependability deteriorates in all categories except seats, which improves by 0.4 PP100.

- Exterior, interior and engine/ transmission remain problematic: The vehicle exterior (14.1 PP100), vehicle interior (12.7 PP100) and engine/ transmission (12.5 PP100) categories remain the most problematic areas, accounting for 53% of all problems reported in this study. The most frequently reported problem symptoms are Air vents smells unpleasant (3.5 PP100); Brakes are noisy (1.9 PP100); and Navigation system—difficult to operate (1.8 PP100).

- ACEN-related problems have been more frequently reported since 2016: Top three problem issues that have been more frequently reported since 2016 are Built-in Bluetooth mobile phone/ device has frequent pairing/ connectivity issues; Navigation system—difficult to operate; and Radio has poor or no reception. Overall, these ACEN problems have increased by 0.6 PP100 from 2016.

- Loyalty and advocacy directly related to vehicle dependability: Among owners who do not experience any problems with their vehicles, 70% say they “definitely will” or “probably will” repurchase the same brand and 71% say they “definitely will” or “probably will” recommend the brand to others. However, among owners who experience three or more problems with their vehicle, only 56% intend to repurchase the same brand and 61% intend to recommend the brand to others.

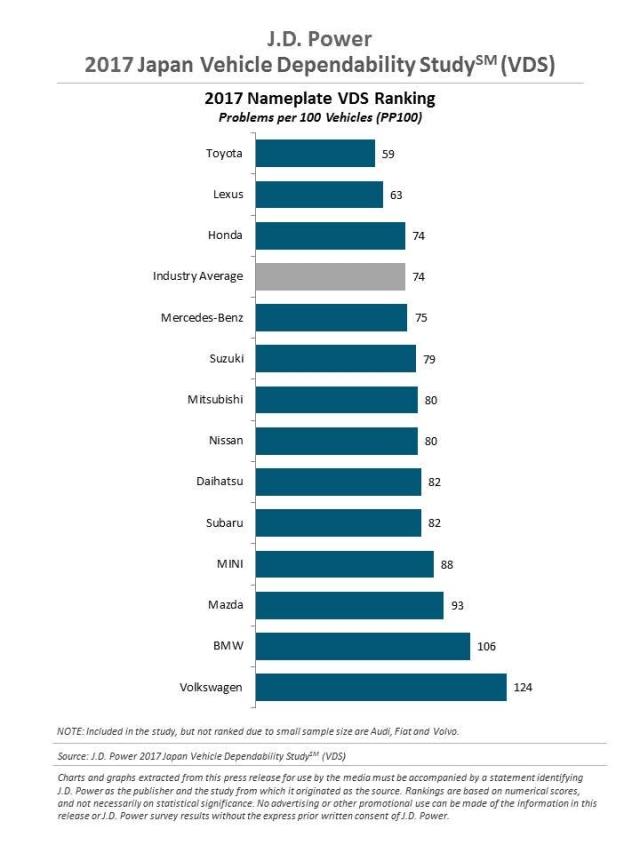

Highest-Ranked Brands

Toyota ranks highest among brands, with a score of 59 PP100. Toyota is followed by Lexus (63 PP100) and Honda (74 PP100).

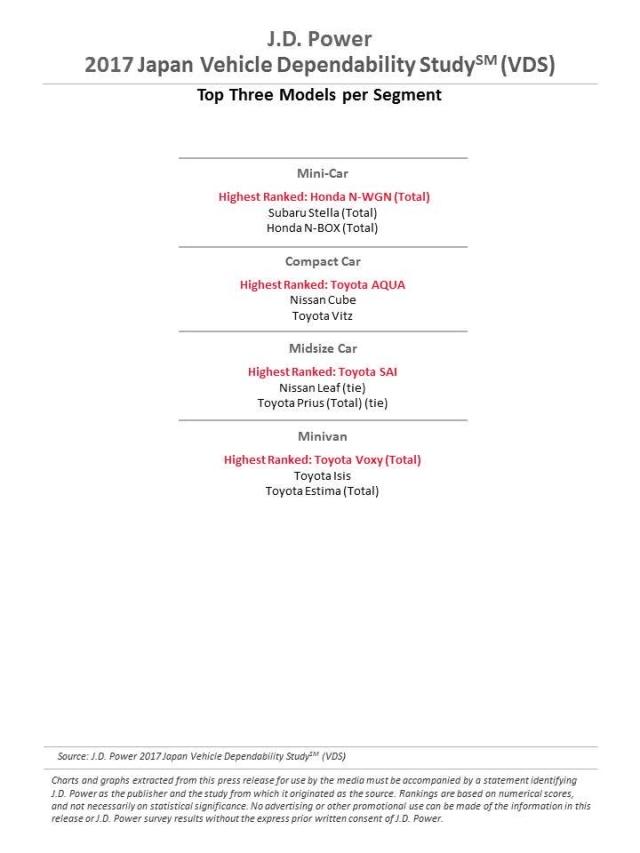

Highest-Ranked Models

Honda N-WGN ranks highest in the mini-car segment with a score of 66 PP100, followed by Subaru Stella (67 PP100) and Honda N-BOX (69 PP100).

Toyota AQUA ranks highest in the compact segment with a score of 49 PP100, followed by Nissan Cube (61 PP100) and Toyota Vitz (62 PP 100).

Toyota SAI ranks highest in the midsize segment with a score of 47 PP100, followed by Nissan Leaf and Toyota Prius in a tie (50 PP100).

Toyota Voxy ranks highest in the minivan segment with a score of 56 PP100, followed by Toyota Isis (69 PP100) and Toyota Estima (70 PP 100).

The 2017 Japan Vehicle Dependability Study is based on responses from 18,872 purchasers of new vehicles in the first 3-5 years of ownership. The study, which includes 16 automotive brands and 118 models, ranks models with a sample size of 100 or more usable questionnaire returns. The study was fielded from June through July 2017.

Media Relations Contacts

Kumi Kitami; JD Power; Tokyo; 81-3-4550-8102; Kumi.katami@jdpower.co.jp

Geno Effler; JD Power; Costa Mesa, Calif., USA; 001-714-621-6224; media.relations@jdpa.com

About JD Power in the Asia Pacific Region

JD Power has offices in Tokyo, Singapore, Beijing, Shanghai, Malaysia and Bangkok that conduct customer satisfaction research and provide consulting services in the automotive, information technology and finance industries in the Asia Pacific region. Together, the six offices bring the language of customer satisfaction to consumers and businesses in Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Taiwan, Thailand and Vietnam. JD Power is a portfolio company of XIO Group, a global alternative investments and private equity firm headquartered in London, and is led by its four founders: Athene Li, Joseph Pacini, Murphy Qiao and Carsten Geyer. Information regarding JD Power and its products can be accessed through the internet at japan.jdpower.com.

About JD Power and Advertising/Promotional Rules www.jdpower.com/about-us/press-release-info