Used Vehicle Sales in Japan Require Multi-Faceted Appeal to Meet Customer Expectations in Japan, J.D. Power Finds

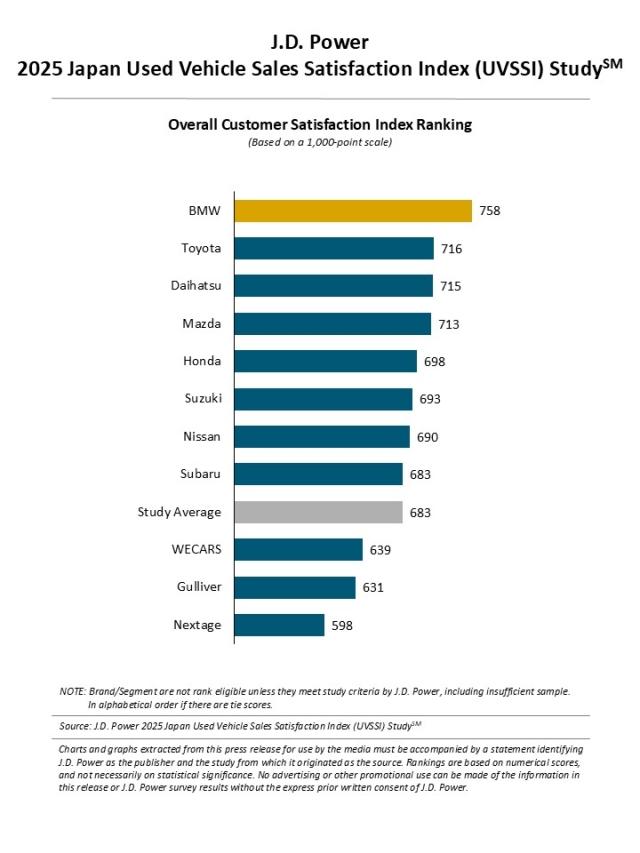

BMW Ranks Highest in Used Vehicle Sales Satisfaction

TOKYO: 23 Oct. 2025 — Overall used vehicle sales satisfaction in Japan averages 683 points (on a 1,000-point scale), up 5 points from 2024, according to the J.D. Power 2025 Japan Used-Vehicle Sales Satisfaction Index (UVSSI) Study,SM released today. Specifically, by study factor, overall average sales satisfaction for used vehicles is 687 for dealer facilities and support; 685 for contract procedure; 684 for delivery; and 681 for negotiations.

The study measures customer satisfaction with the purchase experience among used vehicle buyers as well as rejecters, defined as those who seriously consider a brand but ultimately buy another brand. The study, which provides a comprehensive analysis of the used vehicle purchase experience, is now in its second year following its relaunch in 2024.

“The used vehicle market is a crucial pillar of automobile distribution alongside the new-vehicle market as it offers a wide variety of model years, specifications and affordable prices that attract many consumers” said Taku Kimoto, Japan CEO at J.D. Power. “During the shopping process, used vehicle shoppers tend to pay close attention to vehicle conditions. Dealerships, therefore, need to highlight the appeal of used vehicles from several perspectives, such as features, performance and equipment, to enhance the quality of sales negotiations and present the vehicle based on the shopper’s preferences and lifestyle. This is essential for differentiating themselves from competing dealers.”

Following are key findings of the 2025 study:

- Shoppers prioritize vehicle price and condition: The most important aspect of the shopping experience is vehicle price (73%), followed by vehicle condition (62%). These two aspects suggest that, when making comparisons, shoppers are focused on the areas that most affect the vehicle’s value.

- Need for focus on vehicle features: Nearly one-third (30%) of shoppers consider mileage an appealing factor when evaluating a vehicle, while 25% indicate driving performance and another 18% look for vehicles equipped with the latest technology and features. When examining the relationship between the number of appealing factors buyers receive in their vehicle and satisfaction during the negotiations, satisfaction is 594 for one and 657 for two, both below the overall average of 681. For three to six, satisfaction exceeds the overall average and for more than six, satisfaction is at least 50 points higher than the average. This indicates that shoppers feel confident and secure and are more satisfied when the appeal of used vehicles is successfully conveyed from multiple aspects.

- Strong negotiation skills essential: The study examines shopper comparisons at other dealers besides the one where they eventually purchased their vehicle. More than half (56%) said that visiting a dealership was most important to make comparisons. Among them, 62% say that they received “an explanation about cars in a space for negotiations” at those dealerships. The study indicates that shoppers frequently engage in sales negotiations at multiple dealerships, and these negotiations significantly influence their final purchase decision.

Study Rankings

Among the 11 brands included in the study, BMW (758) ranks highest overall. BMW performs particularly well in three factors: negotiations; contract procedure; and delivery. Toyota (716) ranks second and Daihatsu (715) ranks third.

The Japan Used Vehicle Sales Satisfaction Index (UVSSI) Study is now in its second year. Satisfaction is measured in four factors (in order of importance): negotiations (27%); delivery (26%); dealer facilities and support (25%); and contract procedure (22%). The 2025 study is based on responses from 3,660 buyers who purchased their used vehicle at a manufacturer-authorized dealer or independent used vehicle dealer. The data was collected between April 2024 and March 2025, after two to 13 months of ownership. The online survey was fielded in July 2025.

About J.D. Power

J.D. Power is a global leader in automotive data and analytics, and provides industry intelligence, consumer insights and advisory solutions to the automotive industry and selected non-automotive industries. J.D. Power leverages its extensive proprietary datasets and software capabilities combined with advanced analytics and artificial intelligence tools to help its clients optimize business performance.

J.D. Power was founded in 1968 and has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit https://japan.jdpower.com/.

Media Relations Contacts

Kumi Kitami, J.D. Power; Japan; 81-3-6809-2996; release@jdpa.com

Joe LaMuraglia, J.D. Power; USA; 714-621-6224; media.relations@jdpa.com

About J.D. Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info