Overall APEAL Satisfaction in Japan Remains Unchanged from 2024, JD Power Finds

Subaru Ranks Highest among Mass Market brands

TOKYO: 22 Oct. 2025 — Of the 10 categories included in the JD Power 2025 Japan Automotive Performance, Execution and Layout (APEAL) Study,SM released today, vehicle infotainment remains the least appealing to vehicle owners for the fifth straight year with a satisfaction score of 624 (on a 1,000-point scale). Additionally, the overall APEAL Index score this year, combined for mass market and luxury brands, averages 668 points, unchanged from 2024.

“Infotainment is not only the least appealing category—it’s also the most problematic in the JD Power 2025 Japan Initial Quality Study,” said Taku Kimoto, CEO of JD Power Japan. “Given the strong link between vehicle quality and appeal, manufacturers must improve both aspects. Low-scoring features like voice recognition received particularly negative feedback and should be prioritized.

“This year’s study also finds that plug-in hybrid electric vehicles (PHEVs) outperform other electrified vehicles in product appeal and recommendation intent. Despite cost concerns, growing customer loyalty to PHEVs could support stronger sales amid the recent slowdown in electrified powertrain adoption.”

Followings are key findings of the 2025 study:

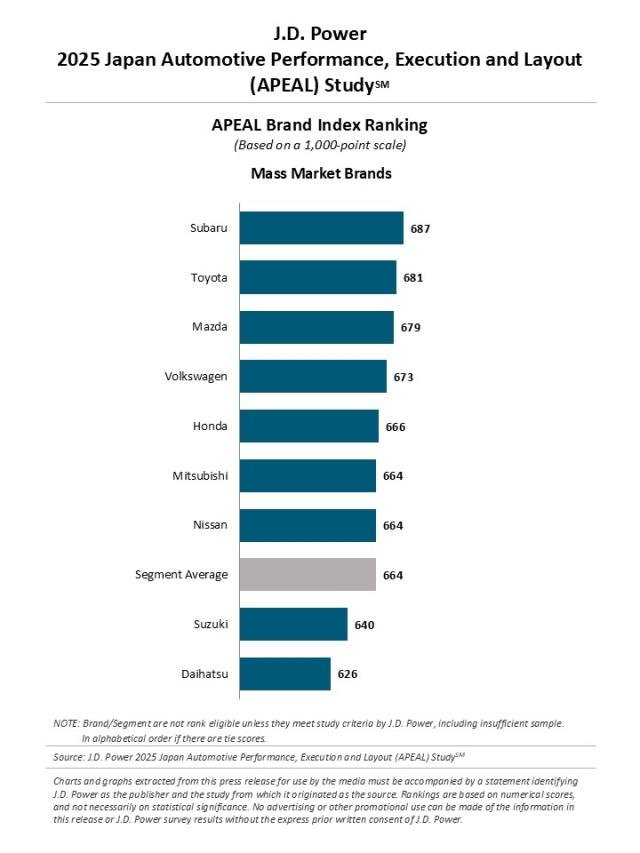

- Overall APEAL satisfaction varies by brand: Among mass market brands, Subaru ranks highest with a score of 687. In the model-level awards, Toyota ranks highest in four segments, while Lexus and Suzuki each lead in two segments, and Honda and Mitsubishi each rank highest in one segment. Among vehicle models, Toyota Harrier and Lexus RX, which rank highest in the midsize SUV and large SUV segments, respectively, also ranked highest in the JD Power 2025 Japan Initial Quality StudySM (IQS) 1, indicating that these models perform well in both quality and appeal.

- Owner satisfaction with exterior decreased: Among the 10 categories in which owners evaluate their new vehicle, the category with the highest satisfaction goes to the exterior category, with a score of 741. However, the APEAL satisfaction has declined by seven points since 2024—the largest decrease among the 10 categories. For reference, the second highest-scoring category is the driving feel index with an overall satisfaction score of 669, 72 points lower than vehicle exterior.

- PHEVs more appealing: In this year’s study, ownership of electrified vehicles—including HEVs, PHEVs, EVs, and FCEVs—has risen to 54%. Satisfaction among PHEV owners increased by 23 points year over year, reaching 753, which is more than 100 points higher than the average for ICE vehicles (651). PHEVs outperform ICEs by over 100 points in key areas such as fuel economy, powertrain performance, driving feel, safety, and comfort. Additionally, 22% of PHEV owners say they would definitely recommend their vehicle—10 percentage points higher than ICE owners.

Highest-Ranking Brand

Subaru ranks highest among mass market brands, with a score of 687. Toyota (681) ranks second and Mazda (679) ranks third.

This year, the luxury brand ranking is not eligible as it did not meet JD Power’s criteria.

Model-Level APEAL Awards

By segment, the highest-ranking models are:

- Mini-car–Sedan segment: Suzuki Lapin

- Mini-car–Height Wagon segment: Suzuki Hustler

- Mini-car–Super Height Wagon segment: Mitsubishi Delica Mini

- Compact Car segment: Toyota AQUA

- Compact SUV segment: Lexus LBX

- Midsize Car segment: Toyota Prius

- Midsize SUV segment: Toyota Harrier

- Large SUV segment: Lexus RX

- Compact Minivan segment: Honda Freed

- Minivan segment: Toyota Vellfire

- The large segment is not eligible for the award because the ranking criteria were not met.

The Japan Automotive Performance, Execution and Layout (APEAL) Study is now in its 15th year. The 2025 study is based on responses from 20,101 owners of new vehicles in the first two to 13 months of ownership. The study, which complements the annual Japan Initial Quality Study (IQS) and the Japan Tech Experience Index (TXI) Study, is used extensively by manufacturers worldwide to help them design and develop more appealing vehicles and is used by consumers to help them in their purchase decisions. The study was fielded from May-June 2025.

About JD Power

JD Power is a global leader in automotive data and analytics, and provides industry intelligence, consumer insights and advisory solutions to the automotive industry and selected non-automotive industries. JD Power leverages its extensive proprietary datasets and software capabilities combined with advanced analytics and artificial intelligence tools to help its clients optimize business performance.

JD Power was founded in 1968 and has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit https://japan.jdpower.com/.

Media Relations Contacts

Kumi Kitami; JD Power, Japan; 81-3-6809-2996; release@jdpa.com

Joe LaMuraglia; JD Power, USA; 714-621-6224; media.relations@jdpa.com

About JD Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info

1JD Power 2025 Japan Initial Quality StudySM (IQS):

https://japan.jdpower.com/en/business/press-releases/2025_Japan_Initial_Quality_Study