Appealing Vehicles Solidify Brand Loyalty, JD Power Finds

Daihatsu MOVE canbus, Nissan KICKS and Suzuki SOLIO Rank Highest in Their Respective Segments

TOKYO: 13 Oct. 2021 — Higher levels of new-vehicle appeal increase brand loyalty, according to the JD Power 2021 Japan Automotive Performance, Execution and Layout (APEAL) Study,SM released today.

“Recently, more new vehicles equipped with advanced technologies and a wider variety of powertrains have influenced changes in owners’ perspectives when evaluating their new vehicle,” said Yuji Sasaki, director of research at JD Power. “In response to changes in the market, JD Power Japan has completely redesigned the study to redefine the appeal of new vehicles from the user’s perspective. The results of this year’s APEAL Study indicate that brand loyalty is enhanced if owners are highly satisfied with their new vehicle. The study also finds that three of the eight models, which rank highest in their respective segments in this study, also ranked highest in the company’s recently published 2021 Japan Initial Quality Study.”

The study, now in its 11th year, measures owners’ emotional attachment and level of excitement with their new vehicle across 37 attributes, ranging from the sense of comfort and luxury they feel when climbing into the driver’s seat to the feeling they get when they step on the accelerator. These attributes are aggregated to compute an overall APEAL Index score measured on a 1,000-point scale. The study complements the annual JD Power Japan Initial Quality StudySM (IQS) and the JD Power Japan Tech Experience Index (TXI) StudySM.

Following are key findings of the 2021 study:

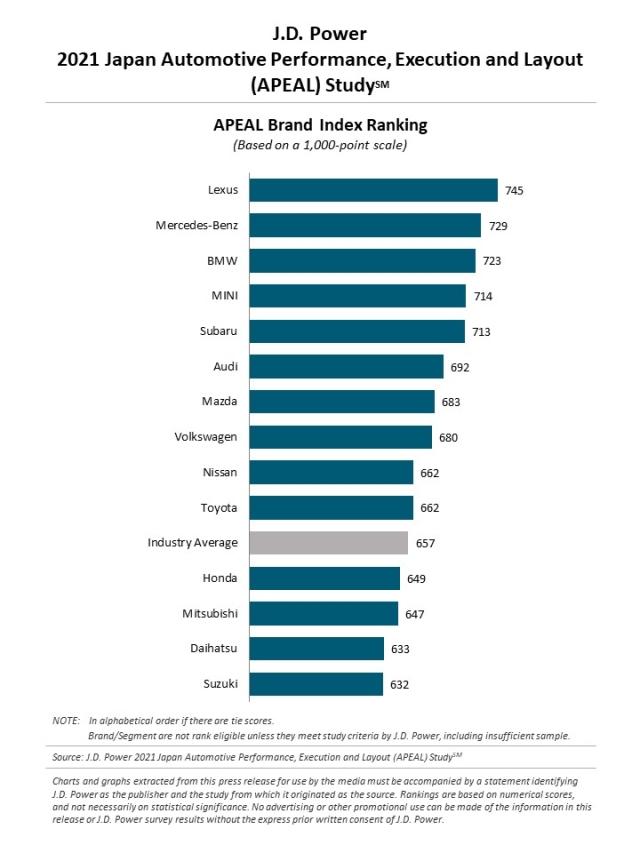

- Ten of 14 brands rank above the industry average: The industry average APEAL score is 657 points. Ten of the 14 brands included in the study rank above the industry average in APEAL Index score. Lexus (745) ranks highest among all brands included in the rankings. Lexus also ranked highest in the 2021 Japan IQS.

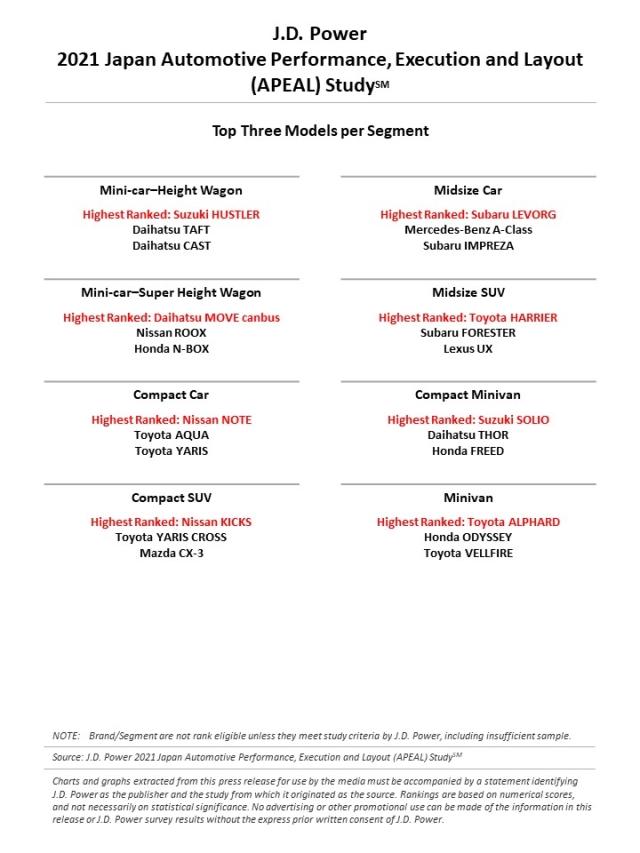

- Three of eight models that rank highest in the APEAL Study also ranked highest in the IQS: Among the eight models that rank highest in APEAL in their respective segments, Daihatsu MOVE canbus (Mini-car–Super Height Wagon segment); Nissan KICKS (Compact SUV segment); and Suzuki SOLIO (Compact Minivan segment) also ranked highest in the 2021 IQS.

- Purchase intent of the same brand increases when owners are more satisfied: Among highly satisfied owners, 39% say that they “definitely will” purchase the same brand, but the percentage drops to 6% among owners with the lowest level of satisfaction. In all 10 categories measured in the study, there are notable gaps in APEAL satisfaction scores between those of highly satisfied owners and owners with the lowest satisfaction. The largest gap is in the powertrain category, a gap of 486 points (891 for highly satisfied owners vs. 405 for owners with the lowest level of satisfaction), followed by the driving feel category, a gap of 479 points (896 vs. 417, respectively).

- Owners are more satisfied with power performance of plug-in hybrids and electric vehicles, but not fuel efficiency and range: The study also examines performance in five power segments: gasoline-powered vehicles, diesel-fueled vehicles, hybrids, plug-in hybrids and electric vehicles. Among these, electric vehicles perform particularly well in the powertrain category (775), followed by plug-in hybrids (746). While owners of electric vehicles are satisfied with not only power and smoothness but also quietness, these vehicles fall behind the other four segments in the fuel economy category (579). However, plug-in hybrids (739) perform particularly well in this category, suggesting that these vehicles have an optimally balanced combination of power performance, fuel efficiency and range.

Highest-Ranked Brands

Lexus ranks highest in overall APEAL. MINI ranks highest among mass market brands.

Segment-Leading Models

- Mini-car–Height Wagon segment: Suzuki HUSTLER

- Mini-car–Super Height Wagon segment: Daihatsu MOVE canbus

- Compact Car segment: Nissan NOTE

- Compact SUV segment: Nissan KICKS

- Midsize Car segment: Subaru LEVORG

- Midsize SUV segment: Toyota HARRIER

- Compact Minivan segment: Suzuki SOLIO

- Minivan segment: Toyota ALPHARD

The 2021Japan Automotive Performance, Execution and Layout (APEAL) Study is based on responses from 19,615 purchasers of new vehicles in the first two to 13 months of ownership.

The study, which complements the annual Japan Initial Quality Study (IQS) and the Japan Tech Experience Index (TXI) Study, is used extensively by manufacturers worldwide to help them design and develop more appealing vehicles, and is used by consumers to help them in their purchase decisions. The study was fielded from May through June 2021.

JD Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, JD Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on JD Power to guide their customer-facing strategies.

JD Power has offices in North America, Europe and Asia Pacific.

Media Relations Contacts

Kumi Kitami; Japan; 81-3-4570-8410; release@jdpa.com

Geno Effler; USA; 714-621-6224; media.relations@jdpa.com

About JD Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info