Audi Ranks Highest in Sales Satisfaction among Luxury Brands; Toyota Ranks Highest among Mass Market Domestic Brands

Highlighting features and functions is key to a successful sales negotiation

After-sales follow-up activities are also important

TOKYO: 20 Aug. 2020 — The J.D. Power 2020 Japan Sales Satisfaction Index (SSI) StudySM, released today, has been redesigned for the first time in seven years in accord with the changes in automotive environment and sales approaches at dealerships. The redesigned study collects a more extensive amount of data on customer vehicle shopping experiences and purchase behaviors than in previous years.

“While customers utilize vehicle information obtained at the dealership they visit, they have already been exposed to information gathered outside the dealership, such as on the internet,” said Keiko Matsuda, manager of the automotive division at J.D. Power. “Therefore, it is imperative that every manufacturer provides enough information so salespersons are able provide a comprehensive presentation and a personalized shopping experience that convey the appeal of new vehicles to each customer, which will increase satisfaction.”

Following are some of the key findings of the 2020 study:

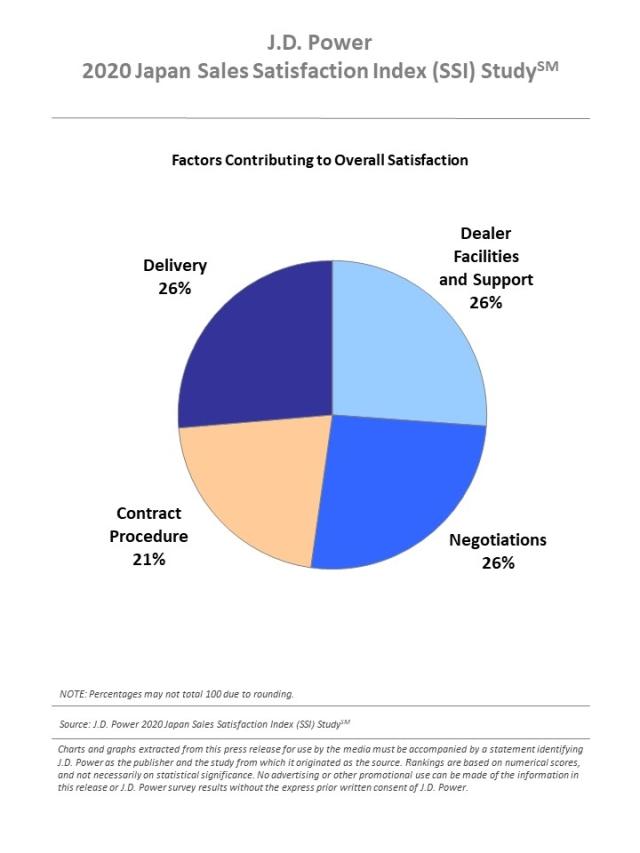

- Overall sales satisfaction is 726 points: In 2020, overall sales satisfaction averages 726 points (on a 1,000-point scale). By factor, the sales satisfaction score for dealer facilities and support is 732, while the score is 722 for negotiations; 730 for contract procedure; and 723 for delivery.

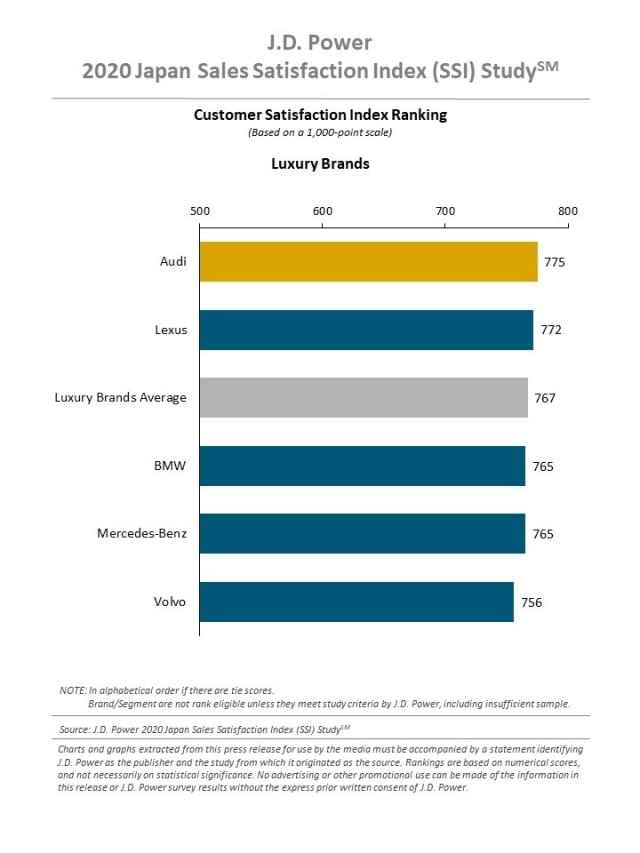

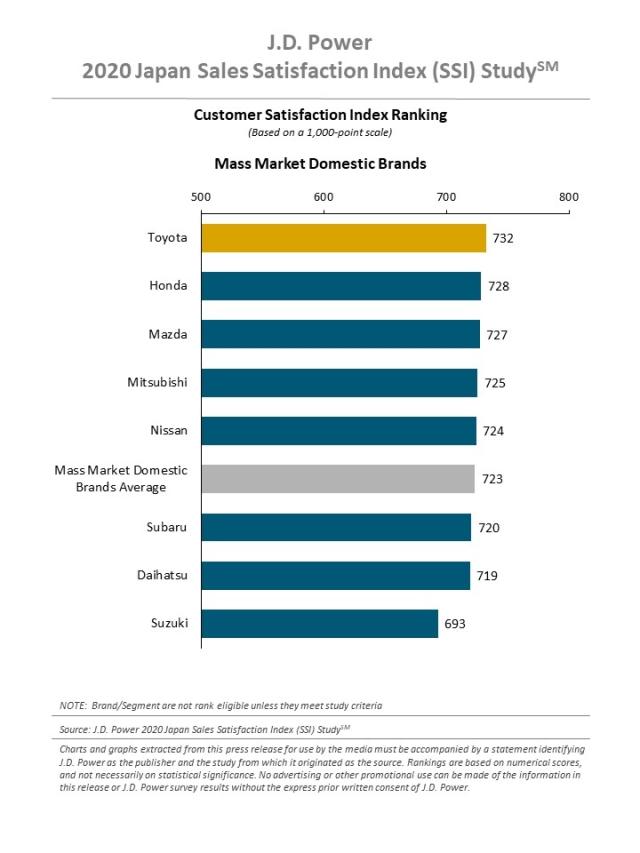

- Luxury brand customers are more satisfied: The redesigned study measures satisfaction in three segments: luxury, mass market domestic, and mass market import. The sales satisfaction score for luxury brands averages 767 compared with 723 for mass market domestic brands. Mass market import brands did not have sufficient sample size to qualify for rankings.

- Highlighting features and functions is key to a successful sales negotiation: Customers considering a vehicle purchase most frequently place importance on price (59%), car size (59%) and safety (52%). However, after negotiations, safety performance (53%), ease of driving (46%) and car size (42%) are considered most often as appeal points. There are some areas that customers are unlikely to consider when gathering advance information that dealers should focus on in demonstrations and negotiations: the latest technology/features (36%) and car navigation/AV systems and other equipment (26%). Additionally, dealers should consider offering customers hands-on experience with these technologies/functions or systems.

- One-third of customers visit manufacturer or dealer websites: During new-vehicle purchase considerations, customers most frequently refer to vehicle brochures or leaflets (52%); showroom display vehicle/demo car (44%); and opinions from dealer sales representatives/product advisor (39%), followed by information gathered on the internet, such as make/dealer websites (33%) and news/information sites (26%). By age group, customers use different devices to visit websites. A majority (82%) of customers ages 10 to 29 years use a smartphone, compared with just 13% of customers who are age 50 and older.

- After-sales follow-up activities are also important: Among customers who received an after-sales explanation or a follow-up from their dealer on how to use vehicle features and functions, sales satisfaction is 753, which declines to 653 among customers who did not receive these activities. Similarly, satisfaction is higher (752) among customers who were asked about how they liked the vehicle or who received an after-sales courtesy call, and is lower (629) among customers who were not asked or did not receive a call. This suggests that follow-up activities from the dealerships are also important.

Study Rankings

Luxury Brands

Among the five luxury brands included in the study, Audi (775) ranks highest. Audi performs particularly well in three factors: negotiations, contract procedure and delivery. Lexus (772) ranks second.

Mass Market Domestic Brands

Among the eight mass market domestic brands included in the study, Toyota (732) ranks highest for the first time since the study’s inception. Toyota performs particularly well in two factors: negotiations and delivery. Honda (728) ranks second and Mazda (727) ranks third.

Mass Market Import Brands

No official rankings are published for this segment due to an insufficient or small sample size.

The 2020 Japan Sales Satisfaction Index (SSI) Study measures satisfaction with the sales process at automotive dealerships among new domestic and import vehicle purchasers. Customer satisfaction is based on four factors that are comprised of multiple attributes (in order of importance): delivery (26%); dealer facilities and support (26%); negotiations (26%); and contract procedure (21%).

The study, now in its 19th year and redesigned this year, is based on responses from 7,180 buyers. The data for those who purchased their new vehicle at a manufacturer-authorized dealer was collected between April 2019 and March 2020, after two to 13 months of ownership. The online survey was fielded from May through June 2020.

About J.D. Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info