Focus on Improving Existing Vehicle Advanced Technologies in Japan Must Remain a Priority for Manufacturers, J.D. Power Finds

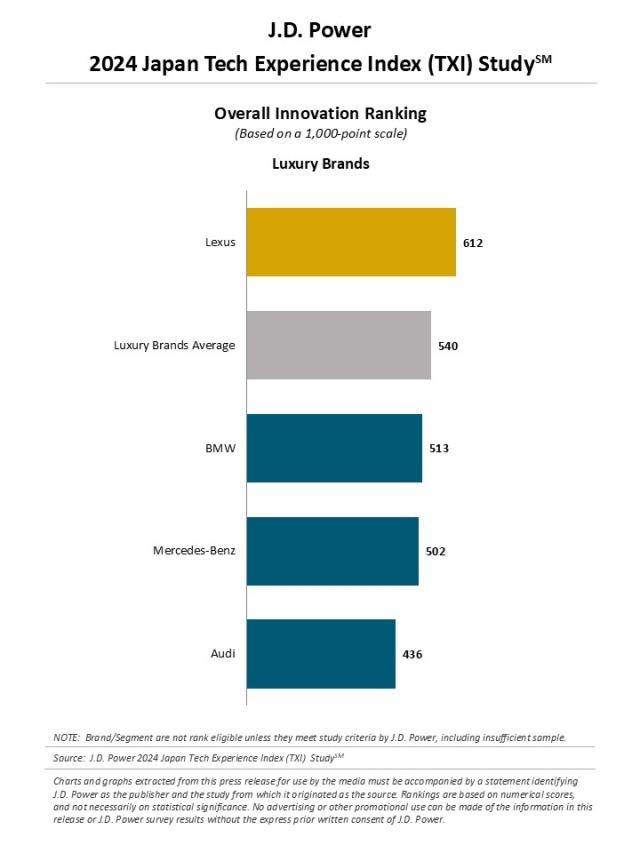

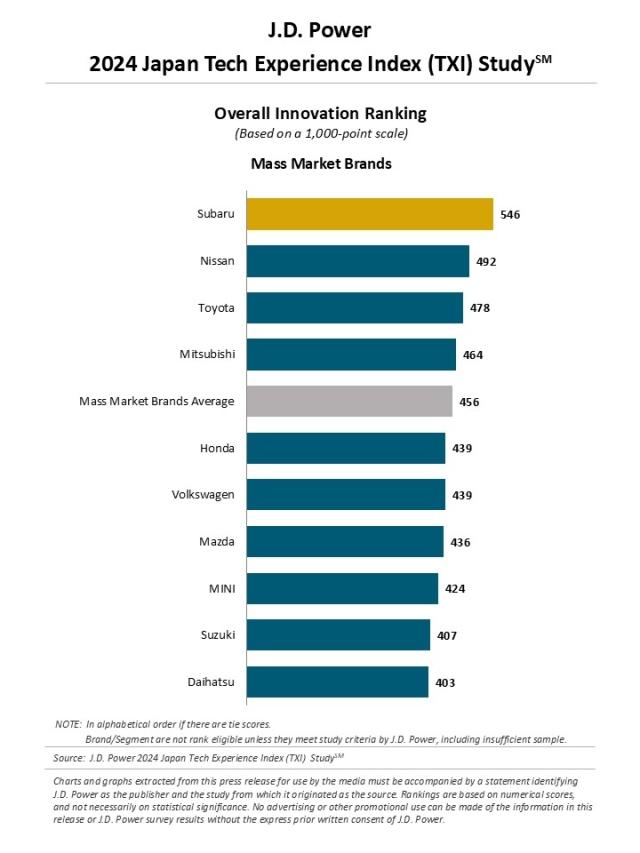

Lexus Ranks Highest Overall for Second Consecutive Year; Subaru Ranks Highest among Mass Market Brands for Fourth Consecutive Year

TOKYO: 13 Nov. 2024 — Vehicles with more advanced technologies tend to attract more customers in Japan, according to the J.D. Power 2024 Japan Tech Experience Index (TXI) Study,SM released today. However, during the past year, manufacturers of mini-cars have increased the installation of only five advanced technologies, while 15 have been more frequently increased in registered cars.

“In general, vehicles equipped with more advanced technologies are likely to attract customers, but often the result is higher-priced vehicles,” said Taku Kimoto, senior managing officer of research at J.D. Power. “Additionally, manufacturers should provide customers with stress-free usability and functionality technologies. Interior gesture controls, facial recognition systems and remote parking assistance systems score the lowest in execution and installation intention. Given the low demand for these technologies, manufacturers may want to consider discontinuing installation of these to eliminate unnecessary technologies and to avoid raising prices.”

Following are key findings of the 2024 study:

- Customers satisfied with and demand EV-specific technologies: Among 18 technologies except augmented reality displays and fingerprint readers which have extremely low usage, the top three technologies in both Execution Index scores and future installation intentions are electric vehicle bidirectional charging systems (Execution Index: 832 points (on a 1,000-point scale); installation intention: 48%); one-pedal driving systems (838 points; 44% intention); and electric vehicle charging schedulers (831 points; 45% intention). Each of these technologies, which are specific to electrified vehicles, indicate that customers are highly satisfied with them and consider them as essential.

- Phone-based digital keys need justification for smartphone use: While customers are relatively satisfied with phone-based digital keys, they express low future installation intentions (Execution Index: 801 points; installation intention: 25%). They do not perceive the benefits or the necessity of using their smartphone as a vehicle key and cite fees as a reason for opting out of or not using this technology. Manufacturers need to reinforce the advantage of using phone-based digital keys and encourage greater adoption.

- Drive recorders need improvement in user friendliness: The installation and future installation intentions of drive recorders are both high, at 72% and 59%, respectively, suggesting that this technology is now critical for vehicle owners. However, the Execution Index score is 773, which ranks this 16th of the 18 technologies included in the study. This low level of satisfaction is primarily due to frequent reports of it being difficult to understand or use, with 36% of customers indicating that they need instructions on how to use it. Manufacturers should improve this technology to ensure it can be operated or used intuitively when needed.

Highest-Ranking Brands

Lexus (612) is the highest-ranking brand overall for innovation. Among mass market brands, Subaru (546) ranks highest, Nissan ranks second and Toyota ranks third.

The 2024 Japan Tech Experience Index (TXI) Study is based on responses from 21,412 owners of new vehicles in the first two to 13 months of ownership. The study was fielded in May-June 2024.

About J.D. Power

J.D. Power is a global leader in automotive data and analytics, and provides industry intelligence, consumer insights and advisory solutions to the automotive industry and selected non-automotive industries. J.D. Power leverages its extensive proprietary datasets and software capabilities combined with advanced analytics and artificial intelligence tools to help its clients optimize business performance.

J.D. Power was founded in 1968 and has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit https://japan.jdpower.com/.

Media Relations Contacts

Kumi Kitami, J.D. Power; Japan; 81-3-6809-2996; release@jdpa.com

Geno Effler, J.D. Power; USA; 714-621-6224; media.relations@jdpa.com

About J.D. Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info