To Increase Customer Satisfaction, Vehicle Dealers in Japan Need to Increase Use of Digital Tools During Sales Negotiation, J.D. Power Finds

Lexus Ranks Highest in Sales Satisfaction among Luxury Brands; Honda and Nissan Rank Highest in a Tie among Mass Market Domestic Brands

TOKYO: 19 Aug. 2021 — Regardless of traditional sales methods, providing a creative explanation of a vehicle during purchase negotiations by using digital tools is an effective way for dealers to increase vehicle appeal, according to the J.D. Power 2021 Japan Sales Satisfaction Index (SSI) StudySM, released today.

“Dealers who want to offer highly satisfactory customer experiences during sales negotiations need to give their customers an opportunity to experience the attractiveness of the vehicle,” said Taku Kimoto, senior managing officer of research at J.D. Power. “This can be done by flexibly using actual vehicles or digital equipment, based on what and how they want to share information about the vehicle, irrespective of traditional methods. In addition to face-to-face negotiations, it is important for dealers to convince their customers of the effectiveness and advantages of online negotiation tools, as well as to provide them with new consideration benefits and to improve their satisfaction.”

Following are some key findings of the 2021 study:

- Overall sales satisfaction is 729: In 2021, overall sales satisfaction averages 729 (on a 1,000-point scale). By factor, the sales satisfaction score for dealer facilities and support is 731, while the score for negotiations is 726; 733 for contract procedure; and 727 for delivery. By segment, the sales satisfaction score for the luxury brands averages 782, while the score for the mass market domestic brands averages 725.

- Dealerships need to get creative with digital tools during sales negotiations: The study examines what kinds of tools were used to provide customers with information about the vehicle during sales negotiations. Customers most frequently refer to catalog/documents on various samples (77%); test drive (42%); computer/tablet (34%); and car display (34%). This indicates that dealers use not only paper-based materials but also actual vehicles and digital equipment when they discuss the vehicles with their customers. The study also finds that customers are more satisfied when dealers use actual vehicles and digital equipment than when they do not. For instance, sales satisfaction scores for car display (761); test drive (757); and computer/tablet (762) are higher among customers who receive an explanation using such tools.

- Use of online negotiation tools is limited but future efforts expected to increase use of such tools: In response to the COVID-19 pandemic, more dealers have partially adopted online negotiation tools. According to the study, customers who used an online business tool/web conference system are highly satisfied with their dealer. However, only 2% of customers used those tools or systems, and just 6% of customers cite the expansion of online business services as a future expectation for dealers. While online negotiations satisfied some customers who experienced it, they are not widely used at present because the advantages of online negotiations have not yet been universally recognized.

Study Rankings

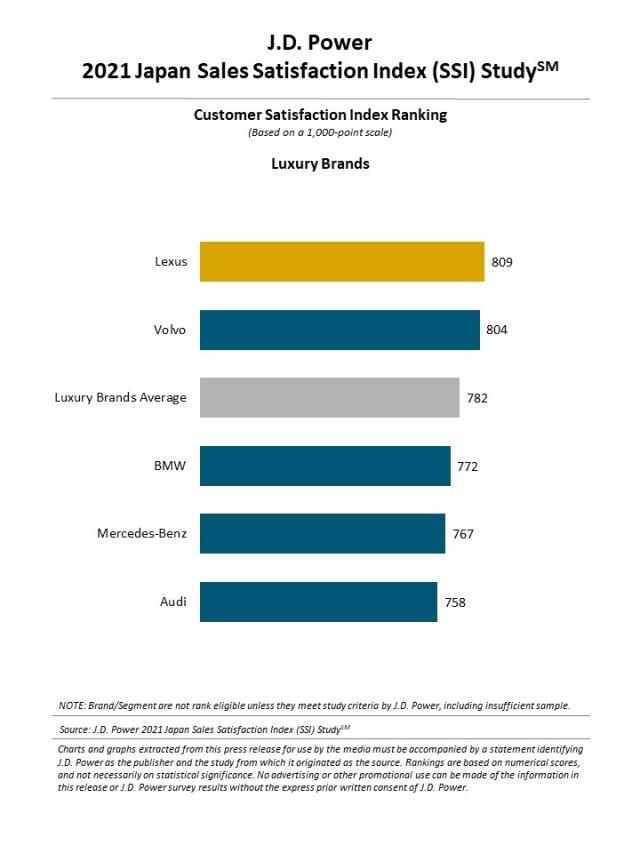

Luxury Brands

Among the five luxury brands included in the study, Lexus (809) ranks highest. Lexus performs particularly well in three factors: dealer facilities and support, negotiations and contract procedure. Volvo (804) ranks second.

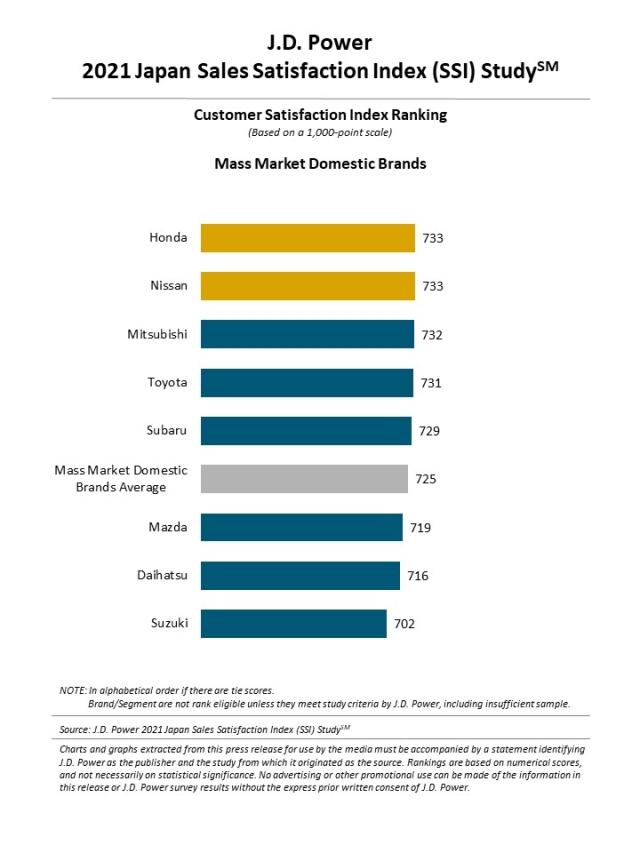

Mass Market Domestic Brands

Among the eight mass market domestic brands included in the study, Honda and Nissan rank highest in a tie, each with a score of 733. Honda performs particularly well in dealer facilities and support. Nissan performs above the segment average in all factors. Mitsubishi (732) ranks third.

The 2021 Japan Sales Satisfaction Index (SSI) Study measures satisfaction with the sales process at automotive dealerships among new domestic and import vehicle purchasers. Customer satisfaction is based on four factors that are comprised of multiple attributes (in order of importance): delivery (26%); dealer facilities and support (26%); negotiations (26%); and contract procedure (21%).

The study, now in its 20th year and redesigned this year, is based on responses from 7,189 buyers. The data for those who purchased their new vehicle at a manufacturer-authorized dealer was collected between April 2020 and March 2021, after two to 13 months of ownership. The online survey was fielded from May through June 2021.

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies. J.D. Power has offices in North America, Europe and Asia Pacific.

Media Relations Contacts

Kumi Kitami; Japan; 81-3-4570-8410; release@jdpa.com

Geno Effler; USA; 714-621-6224; media.relations@jdpa.com

About J.D. Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info

# # #

NOTE: Two charts follow.