Overall Satisfaction Low among Customers in Japan Who Also Have Their Vehicle Repaired during After-Sales Service, JD Power Finds

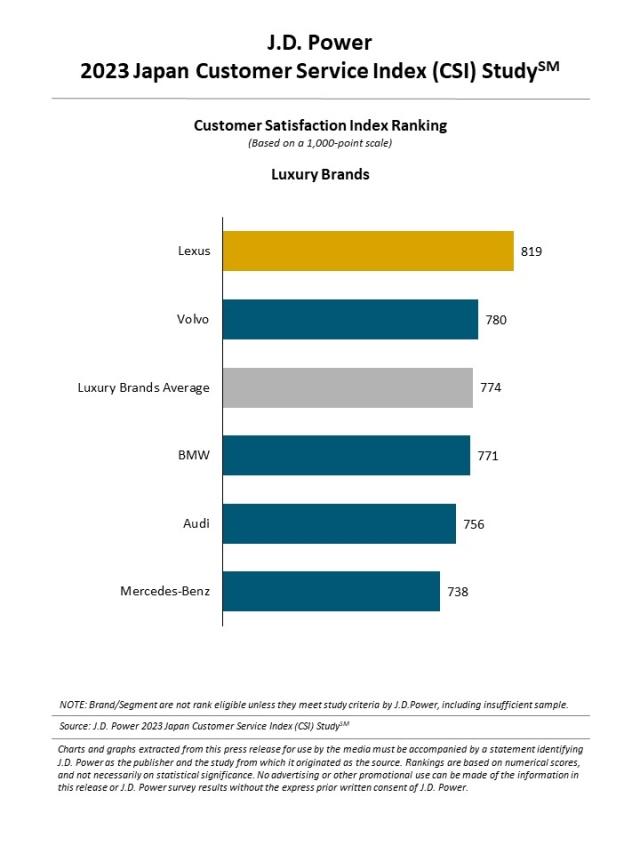

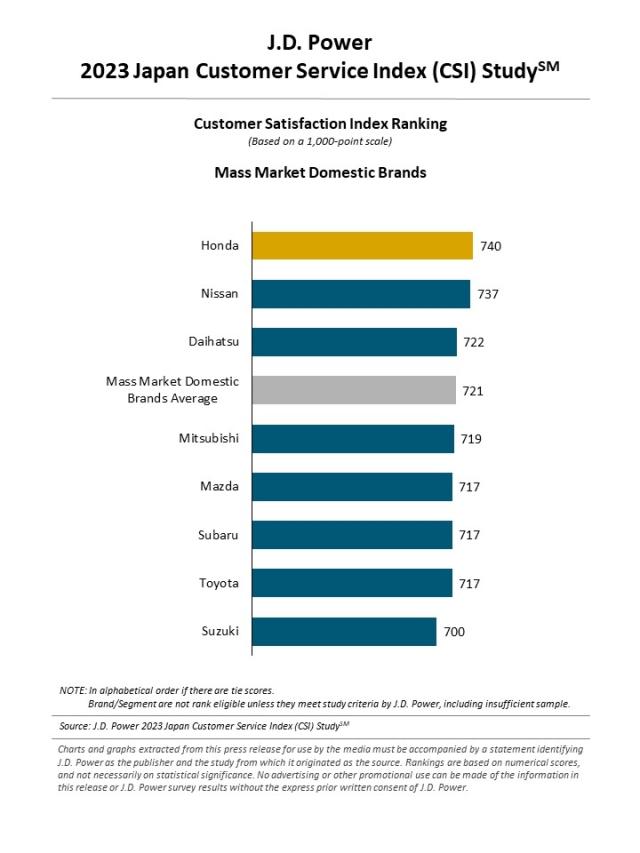

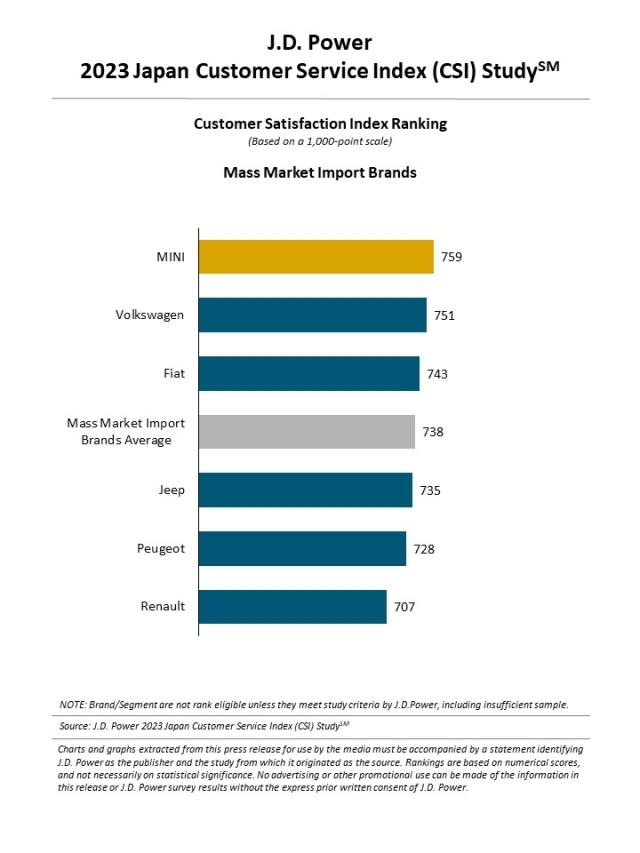

Lexus, Honda and MINI Rank Highest in Their Respective Segments

TOKYO: 31 Aug. 2023 — Vehicle owners in Japan infrequently have their vehicle repaired or a problem fixed during after-sales service–which includes repairs, periodic inspections and compulsory inspection–but when they do, their overall satisfaction decreases, according to the JD Power 2023 Japan Customer Service Index (CSI) Study,SM released today. Among those who did have a repair or problem fixed, overall customer service satisfaction is 699 (on a 1,000-point scale), which is 28 points lower than among those who did not have a repair or problem fixed.

“Dealerships in Japan typically provide high-quality after-sales service, as only 3% of customers ask a dealership to redo service,” said Taku Kimoto, senior managing officer of research at JD Power. “However, when customers do have something fixed during this process, dealerships need to pay attention to the subsequent customer care, such as an explanation of services completed and advice on future maintenance, thus building trust between the customer and the dealer, to ensure high overall customer satisfaction.”

In 2023, overall customer satisfaction with after-sales service averages 724 points, down 3 points from 2022. By factor, the score for booking/dropping off the car is 729, while the scores are 724 for service quality/car delivery and 721 for dealer facilities and support. By segment, overall satisfaction scores are 774 for luxury brands, 721 for mass market domestic brands and 738 for mass market import brands.

Following are key findings of the 2023 study:

- Service charge is one cause of customer dissatisfaction: Among customers who had their vehicle repaired or a problem fixed, 41% say they paid more than the service charge estimated prior to work, a percentage that is much higher than for those who did not have their vehicle repaired (22%). Specifically, among customers who had their vehicle repaired, 26% say they paid 50,000 yen or more for the service charge (including replacement parts).

- Explanations of charges and service follow-up increase satisfaction: More than one-fifth (21%) of customers who had their vehicle repaired or fixed did not receive a prior explanation of the estimated service charge. Additionally, more than 13% of customers who had their vehicle repaired were not given a cost breakdown upon picking up the vehicle. Overall satisfaction for those who had their vehicle repaired but did not receive a pre-service estimate or post-service explanation of costs is 648, compared with 722 who did receive an estimate or explanation.

Study Rankings

Among the five luxury brands included in the study, Lexus ranks highest, with a score of 819. Lexus performs particularly well in all three factors: dealer facilities and support; booking/dropping off the car; and service quality/car delivery. Volvo (780) ranks second and BMW (771) ranks third.

Among the eight mass market domestic brands included in the study, Honda ranks highest, with a score of 740. Honda performs particularly well in two factors: booking/dropping off the car and service quality/car delivery. Nissan (737) ranks second and Daihatsu (722) ranks third.

Among the five mass market import brands included in the study, MINI ranks highest, with a score of 759. MINI performs particularly well in all three factors: dealer facilities and support; booking/dropping off the car; and service quality/car delivery. Volkswagen (751) ranks second and Fiat (743) ranks third.

The Japan Customer Service Index (CSI) Study measures satisfaction with after-sales service among new-vehicle owners between 14 to 49 months of ownership. The study surveys owners who visited a manufacturer-authorized service center for maintenance or repair work in the past year. The study, now in its 22nd year, this year is based on responses from 8,735 owners who purchased their new vehicle between April 2019 and March 2022. The online survey was fielded in May-June 2023.

About JD Power

JD Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, JD Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on JD Power to guide their customer-facing strategies.

JD Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit https://japan.jdpower.com/.

Media Relations Contacts

Kumi Kitami; Japan; 81-3-6809-2996; release@jdpa.com

Geno Effler; USA; 714-621-6224; media.relations@jdpa.com

About JD Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info