Dealerships Need to Strengthen Contact with Customers between Purchase and Delivery to Offset Dissatisfaction with Longer Delivery Times, J.D. Power Finds

Lexus Ranks Highest in Sales Satisfaction among Luxury Brands; Nissan Ranks Highest among Mass Market Domestic Brands

TOKYO: 18 Aug. 2022 — It is increasingly important for dealerships to enhance their activities between closing each new-vehicle purchase and the delivery to prevent customer dissatisfaction caused by longer delivery times, according the J.D. Power 2022 Japan Sales Satisfaction Index (SSI) Study,SM released today.

“The longer delivery times, which have become an issue since the onset of COVID-19, and the start of the war in Ukraine, have no prospect of resolution in the foreseeable future to return to the time when delivery within a few weeks was normal,” said Taku Kimoto, senior managing officer of research at J.D. Power. “It is therefore increasingly important for dealerships to take care of their customers between closing the deal and the delivery to prevent them from feeling dissatisfied with longer delivery times. Dealers need to determine how often they should contact their customers and arrange delivery schedules quickly enough to satisfy them.”

Following are some of the key findings of the 2022 study:

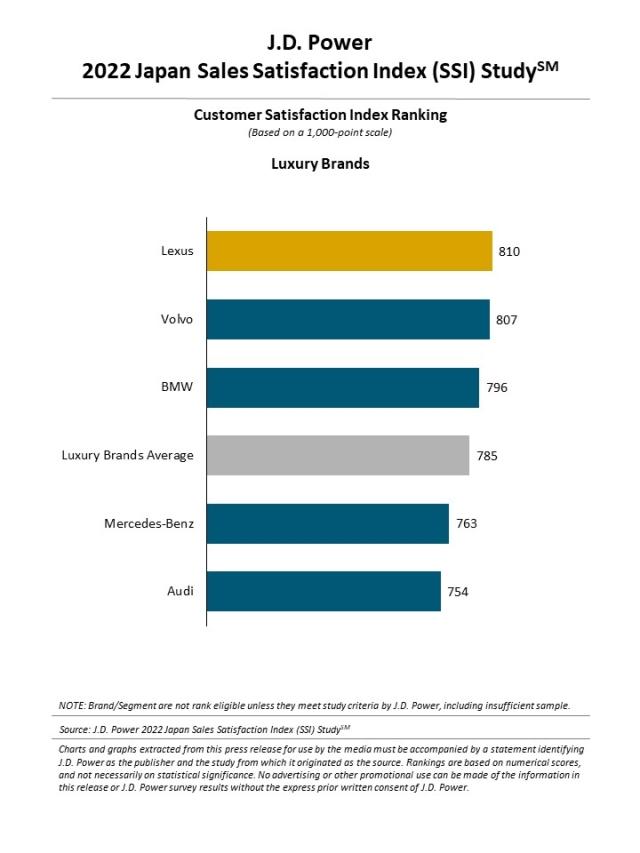

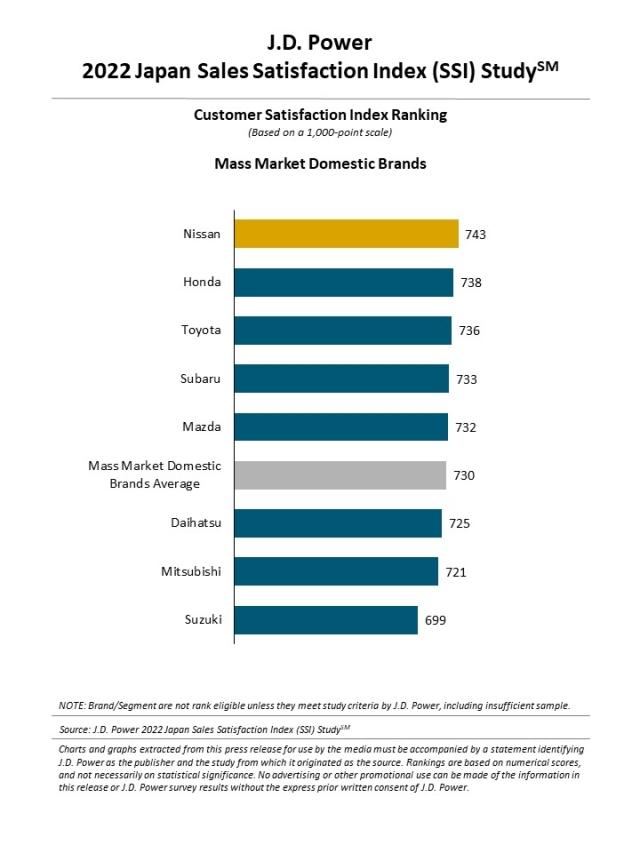

- Overall sales satisfaction is up slightly from 2021: In 2022, overall sales satisfaction averages 733 points (on a 1,000-point scale), up 4 points from 2021. By factor, sales satisfaction with dealer facilities and support is 738, while the score for negotiations is 733, followed by 737 for contract procedure and 726 for delivery. By segment, sales satisfaction for luxury brands averages 785, while the mass market domestic brands average is 730.

- Longer delivery time is more frequently seen for mass market domestic brands: In the domestic new-vehicle market, the shortage of semiconductor parts caused by the COVID-19 pandemic and growing demands overseas for certain vehicle models have resulted in delayed deliveries and order suspensions. In these market conditions, the sales satisfaction score for the delivery factor in 2022 remains the same as in 2021 in the luxury segment. During the same period, the score in the mass market domestic segment has dropped from 7.02 to 6.93. Among luxury brands, 38% of customers (up 7% from 2021) received their vehicle more than two months after closing the deal, compared with 42% (up 16%) among mass market domestic brands. This indicates that longer delivery time has impacted more of the mass market domestic brands. Additionally, mass market brands have lost sales opportunities more often than luxury brands due to the longer delivery times. In 2022, the percentage of those who consider but do not purchase a new mass market brand vehicle has increased to 17% from 10% in 2021, while the percentage for luxury brands has remained at 16%, similar to 2021.

- Dealer activities prior to the delivery influence customer satisfaction: Satisfaction is above average when customers receive contacts from their dealer more than once between the sale and delivery of their vehicle, and increases when dealers contact their customers more frequently. More than half (55%) of customers received two or more contacts, compared with 36% who received one contact and 9% who received no contact. By segment, 64% of customers in the luxury segment received contacts from their dealer more than once, which exceeds 55% for the mass market domestic segment. Fully 60% of customers indicate that the best time to decide the exact delivery date and time is two weeks prior to delivery. Overall sales satisfaction is well above the average when the customer’s first choice of delivery date and time is met; however, just 51% of luxury segment customers’ first choices were available compared with only 44% in the mass market domestic segment.

Study Rankings

Luxury Brands

Among the five luxury brands included in the study, Lexus (810) ranks highest. Lexus performs particularly well in the dealer facilities and support and negotiations factors. Volvo (807) ranks second and BMW (796) ranks third.

Mass Market Domestic Brands

Among the eight mass market domestic brands included in the study, Nissan (743) ranks highest. Nissan performs particularly well in the dealer facilities and support and delivery factors. Honda (738) ranks second and Toyota (736) ranks third.

The study, now in its 21st year and redesigned this year, is based on responses from 7,190 buyers. The data for those who purchased their new vehicle at a manufacturer-authorized dealer was collected between April 2021 and March 2022, after two to 13 months of ownership. The online survey was fielded from May through June 2022.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit https://japan.jdpower.com/.

Media Relations Contacts

Kumi Kitami; Japan; 81-3-6809-2996; release@jdpa.com

Geno Effler; USA; 714-621-6224; media.relations@jdpa.com

About J.D. Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info