Recall Visits in Japan Generate Lower After-Sales Service Satisfaction, JD Power Finds

Lexus, Nissan and MINI Rank Highest in Their Respective Segments

TOKYO: 5 Sep. 2024 — Among dealership customers in Japan who brought their vehicle in for a recall, satisfaction is 711 (on a 1,000-point scale) compared with those who brought their vehicle in for other after-sales services (725), indicating more negative experiences during the recall visit, according to the JD Power 2024 Japan Customer Service Index (CSI) Study,SM released today.

In 2024, overall customer satisfaction with after-sales service averages 725 points, almost unchanged from 2023 with an increase of 1 point. By factor, satisfaction for booking/dropping off the car is 728, while the satisfaction for service quality/car delivery is 724 and 722 for dealer facilities and support. By segment, overall satisfaction is 775 for luxury brands, 721 for mass market domestic brands and 747 for mass market import brands.

“Recall visits to dealerships have considerably increased in the past year,” said Taku Kimoto, senior managing officer of research at JD Power. “Dealerships are struggling with organizing their schedules due to more owner visits, which is affecting the wait times for all customers. To increase satisfaction for recall appointments, dealerships can work on customer interactions, such as presenting more detailed repair explanations and patiently answer their questions. Customers perceive a recall as an unexpected event and many already have negative feelings when bringing their vehicle to the dealership, so dealerships need to bear this in mind and provide a basic explanation to the customer while checking to see that it was understood, as well as being considerate of customers’ feelings and treating them with care and flexibility.”

Following are some of the key findings of the 2024 study:

- Recall visits increase and satisfaction drops: In recent years, customer expectations have increased for quality and safety, as advanced technologies have evolved and more features have been installed on new vehicles. In this context, recalls are brought to the fore in the after-sales service field, and how to treat customers during a recall visit has received harsh reactions. In this year’s study, among customers who used their dealership for after-sales service, 11% say that they “had their vehicle repaired or a problem fixed,” unchanged from a year ago. However, among these customers, 46% “were subject to recall,” substantially increased from 34% in 2023. Among customers who had a recall repair, satisfaction averages 711, 14 points lower than for overall after-sales service (725), revealing complaints during the recall repair visit.

- Improving time efficiency and enhancing customer responses: Among customers who visited the dealership for a recall, the majority (53%) made the appointment within two weeks before the visit, 8 percentage points higher than the overall average (45%). This indicates that many of these customers made an appointment on short notice. Regarding repair time, 39% of customers who visited the dealership for a recall say within one hour from bringing their vehicle in to being returned, compared with 58% for the overall average. There are also challenges to be addressed during handing the vehicle over to customers who visited the dealership for a recall. In terms of poor responses during recall visits, 35% say that they never experienced that the service representative explained one-sidedly and 46% say that the service representative did not give proper answers to my questions—both of which are 7 points lower than the overall average. This suggests that for customers who visit the dealership for a recall, stress associated with poor communications with the service representative causes the decrease in satisfaction.

Study Rankings

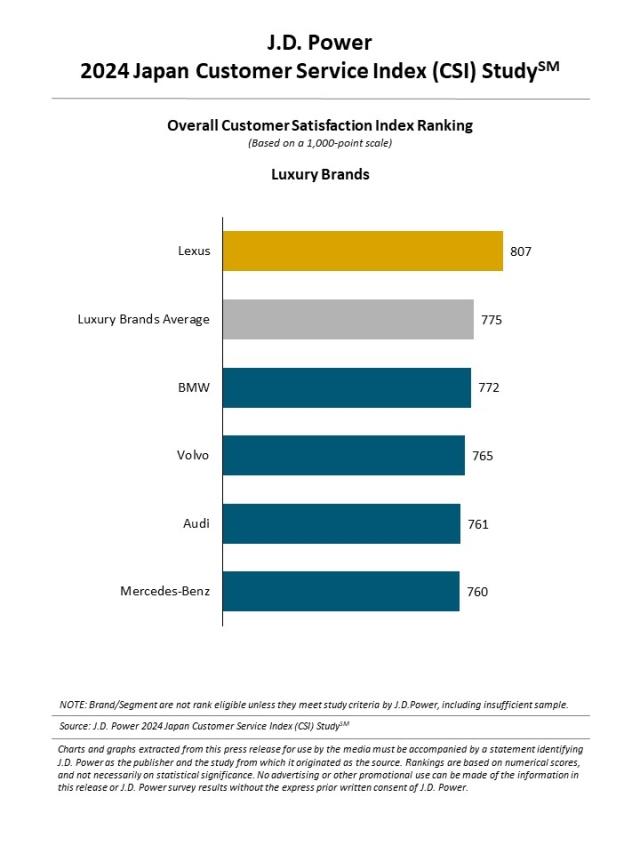

Luxury Brands

Among the five luxury brands included in the study, Lexus ranks highest, with a score of 807. Lexus performs particularly well in all of the three factors: dealer facilities and support; booking/dropping off the car; and service quality/car delivery. BMW (772) ranks second.

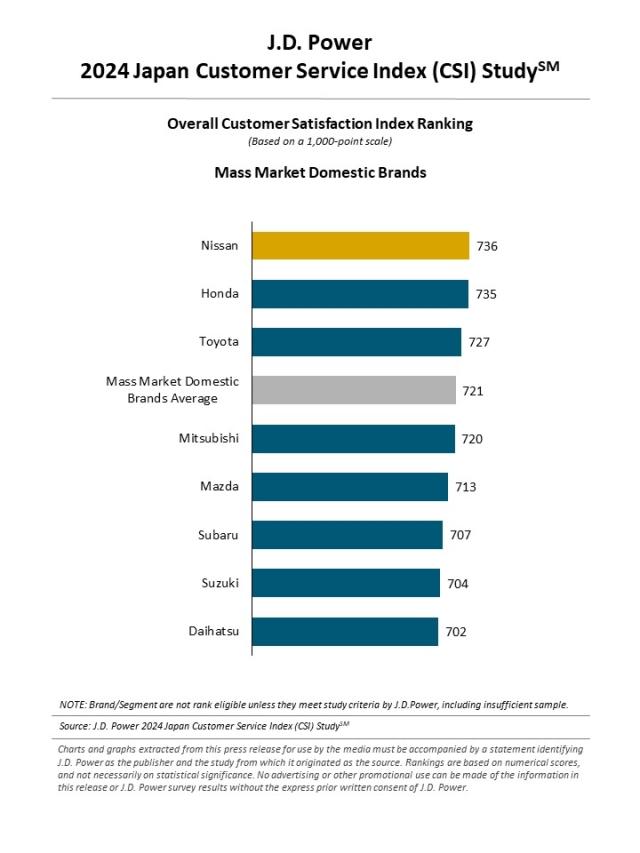

Mass Market Domestic Brands

Among the eight mass market domestic brands included in the study, Nissan ranks highest, with a score of 736. Nissan performs particularly well in two factors, which are dealer facilities and support, and booking/dropping off the car. Honda (735) ranks second and Toyota (727) ranks third.

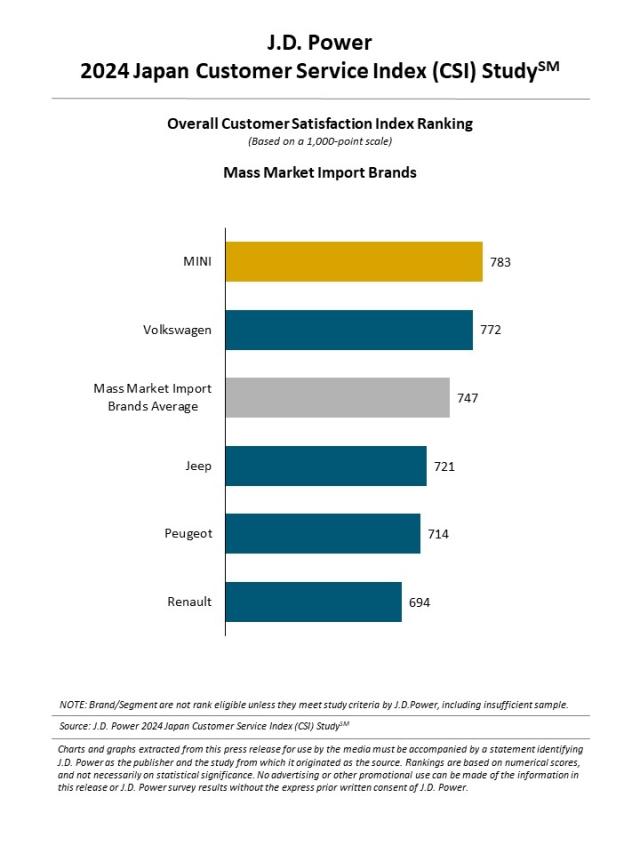

Mass Market Import Brands

Among the five mass market import brands included in the study, MINI ranks highest, with a score of 783. MINI performs particularly well in all the factors: dealer facilities and support; booking/dropping off the car; and service quality/car delivery. Volkswagen (772) ranks second.

The Japan Customer Service Index (CSI) Study measures satisfaction with after-sales service among new-vehicle owners between 14 to 49 months of ownership. The study surveys owners who visited a manufacturer-authorized service center for maintenance or repair work in the past year. The study, now in its 23rd year, this year is based on responses from 8,670 owners who purchased their new vehicle between April 2020 and March 2023. The online survey was fielded in May-June 2024.

About JD Power

JD Power is a global leader in automotive data and analytics, and provides industry intelligence, consumer insights and advisory solutions to the automotive industry and selected non-automotive industries. JD Power leverages its extensive proprietary datasets and software capabilities combined with advanced analytics and artificial intelligence tools to help its clients optimize business performance.

JD Power was founded in 1968 and has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit https://japan.jdpower.com/.

Media Relations Contacts

Kumi Kitami, JD Power; Japan; 81-3-6809-2996; release@jdpa.com

Geno Effler, JD Power; USA; 714-621-6224; media.relations@jdpa.com

About JD Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info