Providing Shoppers with Time to Test Advanced Features and Technologies in New Vehicles Imperative to Increased Negotiation Satisfaction, JD Power Finds

BMW Ranks Highest in Sales Satisfaction among Luxury Brands; Mazda Ranks Highest among Mass Market Domestic Brands

TOKYO: 23 Aug. 2024 — New-vehicle shoppers currently consider hybrid electric vehicles (HEVs) and plug-in hybrid electric vehicles (PHEVs) more frequently than traditional EVs, according to the JD Power 2024 Japan Sales Satisfaction Index (SSI) Study,SM released today. As all types of EVs include advanced technologies and features, it is important that they are showcased to shoppers during the test drive. Specifically, sales satisfaction during the negotiation process averages 837 points (on a 1,000-point scale) among those shoppers who say they had an opportunity to explore the new vehicle features during the test drive, compared with 807 points among those shoppers who focused more on vehicle size and driving performance.

The study measures customer satisfaction with the purchase experience among new-vehicle buyers as well as among rejecters, defined as those who seriously consider a brand but ultimately buy another brand.

“New-vehicle shoppers have considered HEVs or PHEVs more frequently, implying that more new vehicles have been equipped with advanced technologies,” said Taku Kimoto, senior managing officer of research at JD Power. “Currently, shoppers mainly check how big the vehicle is or how well it drives during a test drive. However, given the increase in new vehicles with advanced technologies, test drives could be an effective way for dealerships to provide shoppers with enhanced experiences of the individual features and their user-friendliness.”

Following are some of the key findings of the 2024 study:

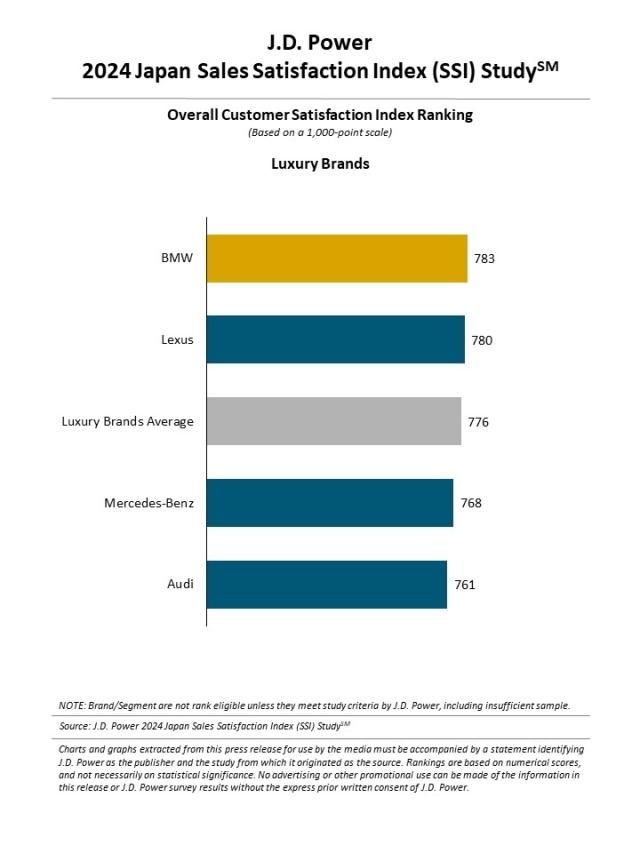

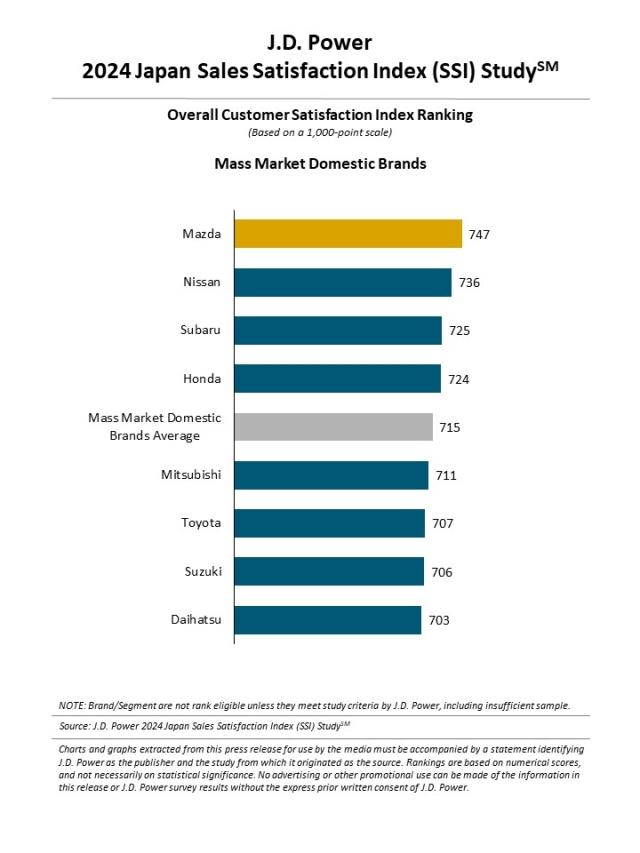

- Overall sales satisfaction remains static from 2023: In 2024, overall sales satisfaction averages 720, unchanged from 2023. By factor, sales satisfaction with dealer facilities and support is 730, while the score for contract procedure is 728, followed by 715 for negotiations and 709 for delivery. By segment, sales satisfaction for luxury brands averages 776, while the mass market domestic brand average is 715.

- More HEVs and PHEVs1 are considered while EVs stagnate: This year’s study finds that for the first time, new-vehicle shoppers in Japan considered HEVs more frequently than internal combustion engine (ICE) vehicles. The percentage of shoppers who considered HEVs increases to 60% in 2024 from 57% in 2023, while shoppers who considered ICE vehicles decreases to 57% from 62%. HEVs, which have been mass produced for 25 years, now are the most frequent type of vehicle that shoppers consider, rather than ICE vehicles. The percentage of shoppers who considered PHEVs has increased to 14% this year from 11% in 2023. Additionally, the percentage of shoppers who considered EVs remains the same as in 2023 at 10%. While the demand for EVs has stagnated, HEVs and PHEVs have become the focus of more attention than in the past.

- Shoppers who consider HEVs and PHEVs conduct more pre-purchase research: These shoppers tend to rely more on specific information sources. When shopping for a new vehicle, they consult digital information more frequently than shoppers who consider ICE vehicles, including manufacturer and dealer websites, their social media accounts and news sites. Specifically, shoppers who considered HEVs or PHEVs this year reviewed the manufacturer or dealer social media accounts more frequently than they did in 2023. This suggests that vehicle manufacturers and dealerships are increasingly utilizing social media to provide information. Boosting information dissemination not only in print form, such as catalogs and brochures, but also digitally will be one of the keys for manufacturers and dealerships in the future.

1 Shoppers who considered HEVs and PHEVs include those who considered vehicles with other engine types, such as gasoline engines, at the same time.

Study Rankings

Luxury Brands

Among the four luxury brands included in the study, BMW (783) ranks highest. BMW performs particularly well in the negotiations factor. Lexus (780) ranks second.

Mass Market Domestic Brands

Among the eight mass market domestic brands, Mazda (747) ranks highest. Mazda performs particularly well in the delivery, dealer facilities and support, negotiations, and contract procedure factors. Nissan (736) ranks second and Subaru (725) ranks third.

The Japan Sales Satisfaction Index (SSI) Study, now in its 23rd year, this year is based on responses from 7,110 buyers who purchased their new vehicle at a manufacturer-authorized dealer. Satisfaction is measured in four factors (listed in order of importance): delivery (26%); dealer facilities and support (26%); negotiations (26%); and contract procedure (21%). The data was collected between April 2023 and March 2024, after two to 13 months of ownership. The online survey was fielded in May-June 2024.

About JD Power

JD Power is a global leader in automotive data and analytics, and provides industry intelligence, consumer insights and advisory solutions to the automotive industry and selected non-automotive industries. JD Power leverages its extensive proprietary datasets and software capabilities combined with advanced analytics and artificial intelligence tools to help its clients optimize business performance.

JD Power was founded in 1968 and has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit https://japan.jdpower.com/.

Media Relations Contacts

Kumi Kitami, JD Power; Japan; 81-3-6809-2996; release@jdpa.com

Geno Effler, JD Power; USA; 714-621-6224; media.relations@jdpa.com

About JD Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info