Digital Tools, Physical Vehicles and Strong Sales Skills Boost Customer Satisfaction in Japan, J.D. Power Finds

BMW and Mazda Rank Highest in Sales Satisfaction in Respective Segment

TOKYO: 21 Aug. 2025 — Digital vehicle tools used in dealerships in Japan facilitate smoother communication with customers, streamline operating processes and provide additional information to better meet shopper needs, according to the J.D. Power 2025 Japan Sales Satisfaction Index (SSI) Study,SM released today. As a result, digitalization has become a priority, especially since the COVID-19 pandemic. Additionally, the availability of vehicles at the dealership and a personalized shopping experience also elevate sales satisfaction. The study measures customer satisfaction with the purchase experience among new-vehicle buyers as well as among rejecters, defined as those who seriously consider a brand but ultimately buy another brand.

“More new vehicles with advanced features and cutting-edge technologies are appearing on the road,” said Taku Kimoto, Japan CEO at J.D. Power. “When shoppers consider which new vehicle to purchase, it is essential to leverage digital tools and actual vehicle availability. For each dealership, it is becoming increasingly important to develop accurate sales forecasts for popular models to ensure availability and to understand the types of shoppers who visit, along with their specific needs.”

Following are key findings of the 2025 study:

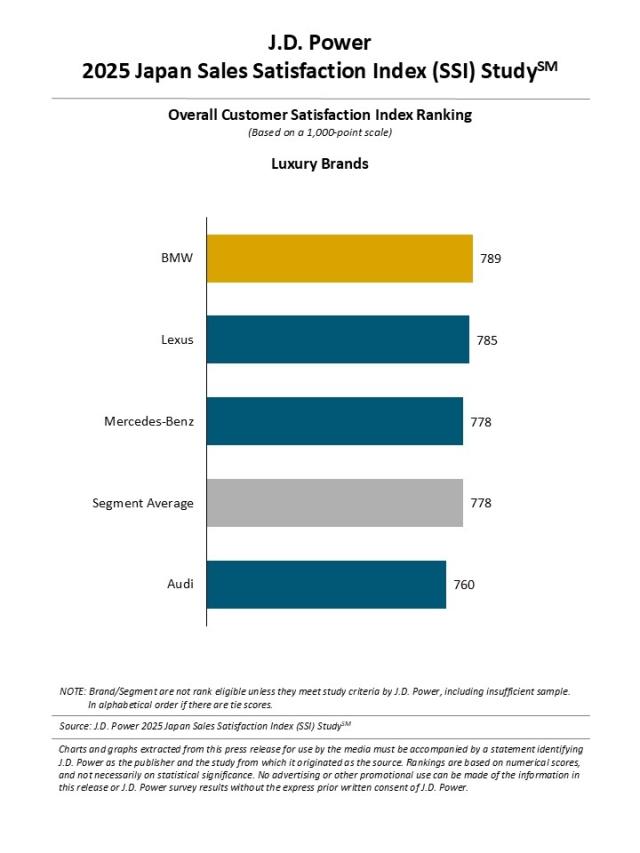

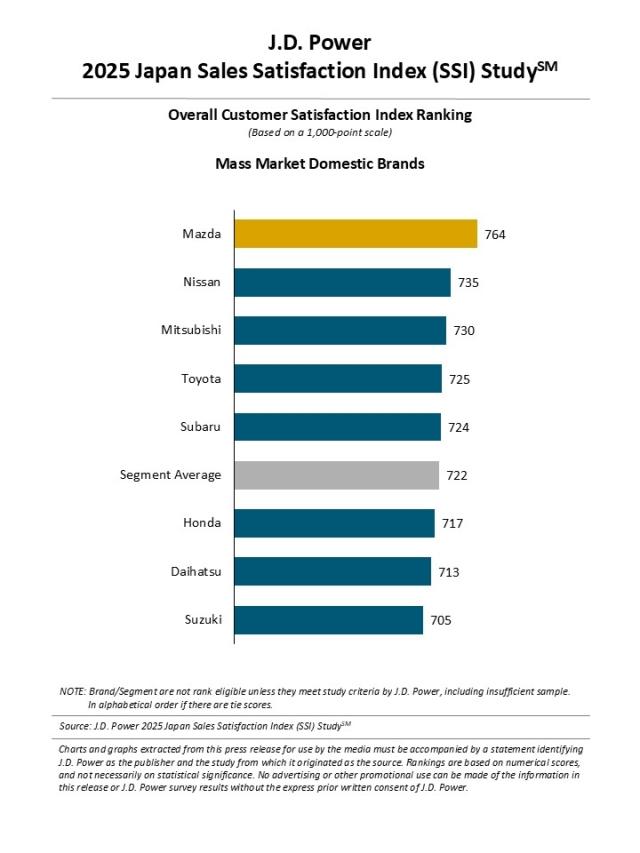

- Overall sales satisfaction slightly improves from 2024: In 2025, overall sales satisfaction averages 726 (on a 1,000-point scale), up 6 points from 2024. By factor, sales satisfaction with dealer facilities and support is 734, while the score for contract procedure is 733, followed by 721 for negotiations and 717 for delivery. By segment, sales satisfaction for luxury brands averages 778 and the mass market domestic brand average is 722.

- Digital tools usage increases during negotiations: The study asks respondents what types of tools the salespersons used during negotiations to explain vehicle design, performance, equipment and how to operate the vehicle. Overall, 45% indicate the use of a computer or tablet. Among luxury brands, the usage rate remains nearly unchanged year over year, at 54% in 2025 compared to 55% in 2024. In contrast, usage among mass market brands has increased by 5 percentage points from 2024 to 44%, suggesting that digital tools are increasingly being used in negotiations in this segment. A correlation is observed between the use of tools and customer satisfaction during negotiations. When a salesperson uses a computer or tablet, customer satisfaction is 743, which is 22 points higher than the overall average.

- Increased use of physical vehicles during negotiations at dealerships is expected: The top two specific information sources shoppers rely on when considering a new vehicle are vehicle catalogs and brochures (including both paper and digital) at 44%, followed by showroom display vehicle/demo vehicle at 39%. This suggests that physical vehicles are just as important an information source for shoppers as are catalogues. Among shoppers who responded “agree” and “somewhat agree” when asked their impression of the display vehicles, 92% say the exterior/appearance of the vehicle was attractive and another 92% say the interior of the vehicle was attractive. These are followed by 83% who say the vehicles were spaciously and comfortably displayed and 62% who say there were a variety of vehicles on display, which is the lowest percentage among the listed items. There is also a correlation between these impressions and customer satisfaction during negotiations. Among shoppers who agree and somewhat agree that there were a variety of vehicles on display, satisfaction averages 772. This is higher than the satisfaction among those who say the exterior/appearance of the vehicle was attractive (735); the interior of the vehicle was attractive (735); and vehicles were spaciously and comfortably displayed (748). These results suggest that satisfaction increases when a diverse range of vehicle models is displayed. However, expanding the variety of display vehicles remains a challenge and is a greater concern than the cleanliness or the display space.

- Despite cost, buyers prefer residual value loan or lease/subscription plans: When examining the reasons for purchasing a new vehicle by payment method, 52% of buyers who used a lease from the dealer/subscription and 48% of those who used a residual value set loan from the dealer indicate the courteous staff/product advisors. In comparison, only 37% of buyers who paid with cash or used a regular loan from the dealer indicate the same. Again, a correlation can be seen between payment methods and customer satisfaction during the contract procedure. Among buyers who used a lease from the dealer/subscription satisfaction averages 754, while among those who used a residual value set loan from the dealer satisfaction averages 753, and both scores are approximately 20 points higher than the overall average. While buyers generally choose a residual value set loan from the dealer or a lease from the dealer/subscription to keep monthly payments low, the study finds that price-related factors—such as receiving a good price or discounts—are not strong motivators. Instead, the decision to purchase a new vehicle is more often influenced by how well they were treated by the salesperson.

Study Rankings

Luxury Brands

Among the four luxury brands included in the study, BMW (789) ranks highest. BMW performs particularly well in the delivery and negotiations factors. Lexus (785) ranks second and Mercedes-Benz (778) ranks third.

Mass Market Domestic Brands

Among the eight mass market domestic brands, Mazda (764) ranks highest. Mazda performs particularly well in all four factors: dealer facilities and support; delivery; negotiations; and contract procedure. Nissan (735) ranks second and Mitsubishi (730) ranks third.

The Japan Sales Satisfaction Index (SSI) Study is now in its 24th year. Satisfaction is measured in four factors (listed in order of importance): delivery (26%); dealer facilities and support (26%); negotiations (26%); and contract procedure (21%). The 2025 study is based on responses from 6,850 buyers who purchased their new vehicle at a manufacturer-authorized dealer. The data was collected between April 2024 and March 2025, after two to 13 months of ownership. The online survey was fielded in May-June 2025.

About J.D. Power

J.D. Power is a global leader in automotive data and analytics, and provides industry intelligence, consumer insights and advisory solutions to the automotive industry and selected non-automotive industries. J.D. Power leverages its extensive proprietary datasets and software capabilities combined with advanced analytics and artificial intelligence tools to help its clients optimize business performance.

J.D. Power was founded in 1968 and has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit https://japan.jdpower.com/.

Media Relations Contacts

Kumi Kitami, J.D. Power; Japan; 81-3-6809-2996; release@jdpa.com

Geno Effler, J.D. Power; USA; 714-621-6224; media.relations@jdpa.com

About J.D. Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info