2018 Japan Initial Quality Study (IQS)

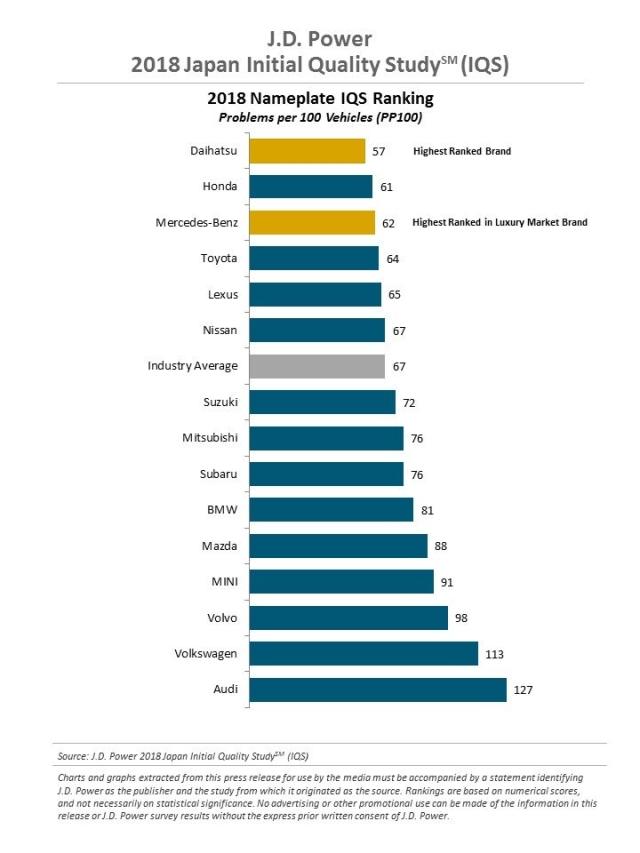

Daihatsu, Honda and Mercedes-Benz Are Three Highest-Ranked Brands

TOKYO: 22 Aug. 2018 — Problems improve year over year in all categories except ACEN, according to the J.D. Power 2018 Japan Initial Quality StudySM (IQS), released today.

J.D. Power initial quality studies are conducted globally and serve as the industry benchmark for new-vehicle quality. In Japan, overall initial quality averages 67 problems per 100 vehicles (PP100) in 2018, compared with 76 PP100 in 2017 and 75 PP100 in 2016, indicating a significant improvement.

“The improvement in overall initial quality suggests that auto manufacturers have worked hard on vehicle quality, while more functions and features are being offered for new vehicles,” said Atsushi Kawahashi, Senior Director of the Automotive Division at J.D. Power. “Considering the progression toward autonomous driving, it is expected that consumers’ interest in safety features and new technologies will grow. With more vehicle owners using such safety features and new technologies, how auto manufacturers should maintain the current car quality could become an industry-wide challenge.”

Following are some of the key findings of the 2018 study:

Overall, problems reported decline: Problems improve year over year in nearly all categories, particularly in vehicle interior (14.1 PP100, a year-over-year decrease of 2.4 PP100) and engine/ transmission (6.6 PP100, a decrease of 1.6 PP100). Vehicle interior problems continue to be the most frequently reported problems among the eight categories, but some problem areas, including unpleasant interior smell/ odor (1.3 PP100, a decrease of 0.5 PP100), have improved. Vehicle interior is followed by features/ controls/ displays (10.9 PP100) and ACEN (10.2 PP100) in the number of reported problems.

Technology comes with its issues: More problems are reported in the ACEN category, compared with last year, including entertainment systems, voice recognition and Bluetooth, and particularly navigation systems—difficult to understand or operate, or installed in a poor location. However, problems related to failures and the accuracy of navigation systems are less frequently reported in 2018 than last year.

The demand for new technologies and safety features is on the rise: The number of new vehicles on which safety features and new technologies are installed has steadily risen, particularly for lane departure warning systems (lane keep assist systems) (up to 62.4% in 2018, 13.9% more than 2017), followed by collision avoidance/ alert systems (up to 71.6%, 9.9% higher than 2017). The increased consumer interest in safety features and new technologies is reflected in the reasons for selecting a new vehicle. The percentage of customers who cite “safety” as a reason for selecting a new vehicle has increased to 31.3% in 2018 up 3.1% from 2017 and the percentage of those citing “advanced technology” has increased by 2.4% to 18.9%.

Quality by Segment

Mini-car segment

Overall initial quality averages 62 PP100, an 8 PP100 improvement from 2017. The number of problems has decreased from 2017 in seven categories, including vehicle interior (-1.9 PP100), HVAC (-1.5 PP100) and engine/ transmission (-1.5 PP100) while it remains the same in FCD as in 2017.

Compact segment

Overall initial quality averages 67 PP100, a 9 PP100 improvement from 2017. Problems in six categories improve year over year, including vehicle exterior (-2.6 PP100) and engine/ transmission (-1.9 PP100), while the number of reported problems have increased slightly in features/ controls/ displays (+0.3 PP100) and HVAC (+0.2 PP100).

Midsize segment

Overall initial quality averages 79 PP100, a 5 PP100 improvement from 2017. While six categories—including seats (-2.0 PP10) and vehicle interior (-1.9 PP100)—improve year over year, the number of reported problems has increased in ACEN (+1.9 PP100) and vehicle exterior (+0.9 PP100).

Minivan segment

Overall initial quality averages 64 PP100, a 12 PP100 improvement from 2017. Problems in six categories—including vehicle interior (-5.0 PP100), features/ controls/ displays (-2.4 PP100) and engine/ transmission (-2.4 PP100)—improve year over year, while the number of reported problems has slightly increased in ACEN (+1.0 PP100) and seats (+0.1 PP100).

Large segment[1]

Overall initial quality averages 63 PP100, an improvement of 13 PP100 from 2017. Problems improve in all categories, including driving experience (-3.8 PP100) and vehicle exterior (-3.3 PP100).

Highest-Ranked Brands and Models

Daihatsu ranks highest among brands, averaging 57 PP100. Daihatsu is followed by Honda (61 PP100) and Mercedes-Benz (62 PP100). Mercedes-Benz ranks highest in the luxury segment.

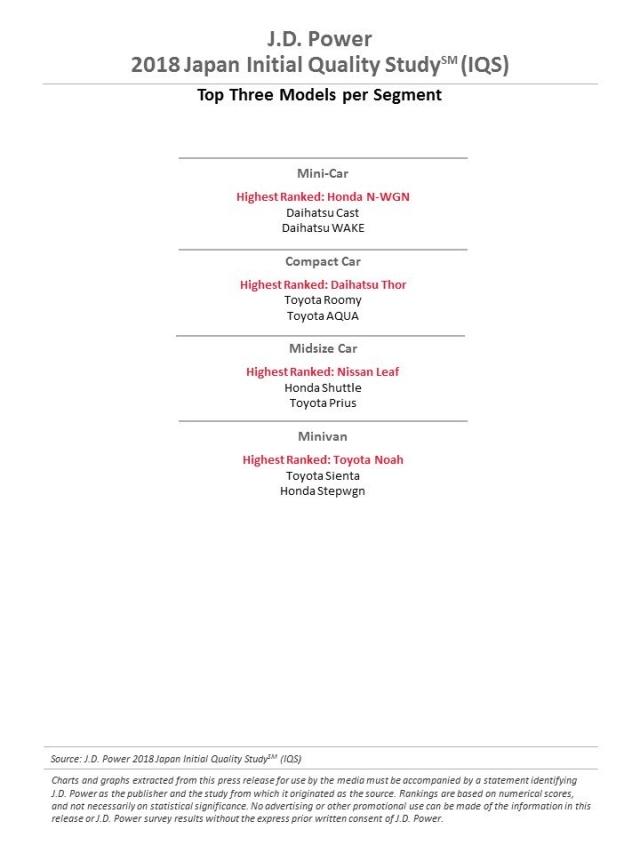

Segment-Leading Models

Mini-car segment: Honda N-WGN ranks highest, followed by Daihatsu Cast and Daihatsu Wake.

Compact segment: Daihatsu Thor ranks highest, followed by Toyota Roomy and Toyota Aqua.

Midsize segment: Nissan Leaf ranks highest, followed by Honda Shuttle and Toyota Prius.

Minivan segment: Toyota Noah ranks highest, followed by Toyota Sienta and Honda Stepwgn.

The 2018 Japan Initial Quality Study is based on responses from 22,387 purchasers of new vehicles in the first two to nine months of ownership. The online survey was fielded from May through June 2018. The study, now in its eighth year, measures new-vehicle quality in the first two to nine months of ownership. Vehicle quality is evaluated by owners across 233 problem areas in eight categories: vehicle exterior; driving experience; features/ controls/ displays; audio/ communication/ entertainment/ navigation (ACEN); seats; heating, ventilation and air conditioning (HVAC); vehicle interior; and engine/ transmission. All problems are summarized as the number of reported problems per 100 vehicles (PP100), with lower scores reflecting a higher quality performance.

[1] No official rankings are published due to an insufficient number of models.