In Japan Initial Quality Study, Android Auto and Apple CarPlay Prove Problematic, J.D. Power Finds

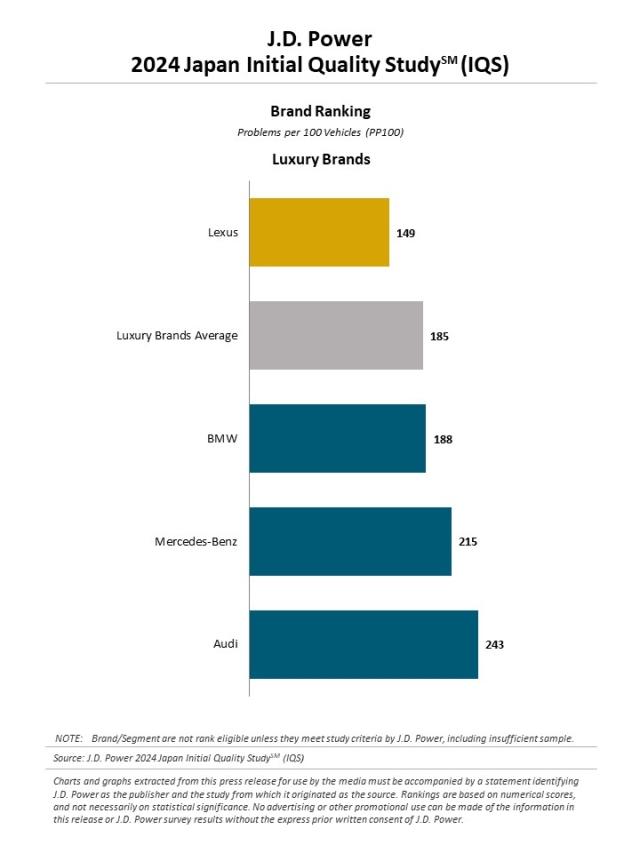

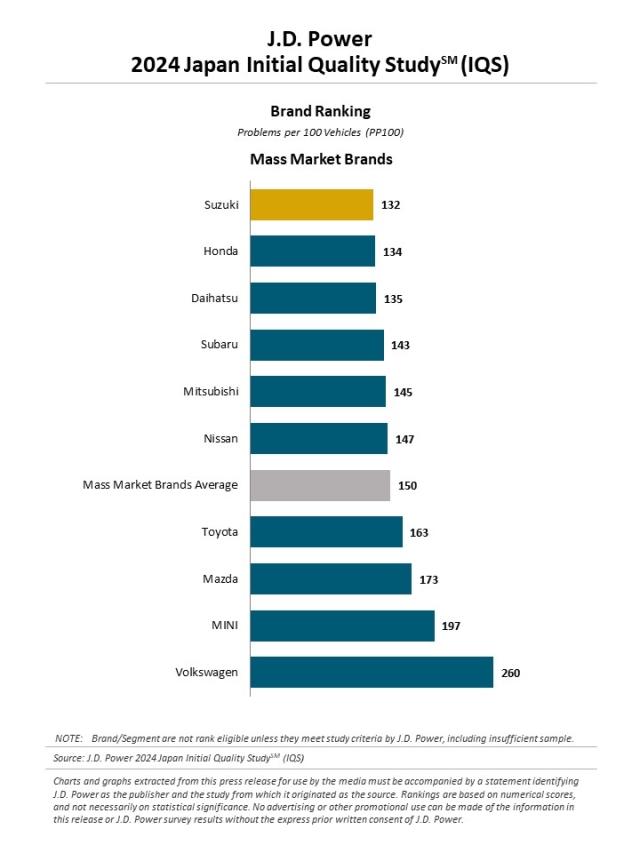

Lexus and Suzuki Rank Highest Overall in Initial Quality in Respective Segments

TOKYO: 11 Sept. 2024 — Vehicle owners in Japan who have Android Auto or Apple CarPlay features indicate twice as many problems with infotainment compared with vehicle owners who do not have those features, according to the J.D. Power 2024 Japan Initial Quality StudySM (IQS), released today. Specifically, among vehicles with Android Auto and/or Apple CarPlay features, initial quality in the infotainment category averages 44.7 problems per 100 vehicles (PP100), twice as frequent as 21.7 PP100 for vehicles without these features.

In 2024, initial quality remains flat compared with 2023, averaging 152 PP100 vs. 151 PP100 in 2023. This score is the highest since 2021. Specifically, a large portion of problems are design-related (117.8 PP100), including features that are hard to understand/difficult to use, while defects and malfunctions, including those that are broken/not working, are again this year at a low score of 31.8 PP100.

“Recently, problems in the infotainment category have been the most problematic,” said Taku Kimoto, senior managing officer of research at J.D. Power. “It is noteworthy that initial quality varies depending on whether or not the vehicles are equipped with the Android Auto/Apple CarPlay features and how often they are used. Owners who use the Android Auto/Apple CarPlay features more frequently experience problems with quality in connectivity between their smartphone and the built-in systems. These features have been installed on more new vehicles year over year, and thus it is imperative for manufacturers to improve the quality in connectivity. In the meantime, nearly 40% of owners do not use these features even though they are installed on their vehicle. Among these owners, built-in voice recognition and navigation systems have been more problematic in terms of user-unfriendliness, indicating the need for improvement of built-in systems.”

Following are some of the key findings of the 2024 study:

- Suzuki ranks highest in overall initial quality for the first time; Lexus ranks highest among the luxury brands: Among the 14 brands included in the study, Suzuki has the fewest problems (132 PP100). Suzuki ranks highest in overall initial quality this year for the first time since 2011, when the study was inaugurated in Japan. Among luxury brands, Lexus ranks highest with a score of 149 PP100.

- Owners experience problems in the infotainment category most frequently: Among the nine categories by which new-vehicle initial quality is evaluated in the study, the most problematic is in the infotainment category, a score of 31.2 PP100, which represents a year-over-year increase of 2.0 PP100 from 2023. In this category, the gap between the brand with the fewest problems and the brand with the most problems is 80 PP100, reinforcing that quality in infotainment-related features is an important key to improvement in initial quality.

- Problems related to fuel consumption increase: Owners of gasoline- or diesel-fueled internal combustion engine (ICE) vehicles and hybrid electric vehicles (HEVs) this year say they have experienced excessive fuel consumption slightly more frequently than three years ago. Compared with the 2021 Japan IQS, the scores for fuel consumption this year have increased to 3.6 PP100 from 2.7 PP100 for ICE vehicles and to 2.2 PP100 from 1.5 PP100 for HEVs. Based on survey questions that asked about actual fuel consumption, in-use fuel economy has not worsened, but the scores imply, despite the same fuel economy performance, that more customers perceive experiencing a problem due to the recent rise in fuel prices.

- Annoying alert problems of lane departure warning and lane keeping assistance continuously improve: Among the problem areas, the feature for lane departure warning/lane keeping assistance - alerts annoying/bothersome has been the most problematic for four consecutive years. However, this problem area, which scores 4.4 PP100 this year, has improved by 1.0 PP100 from 2023 and by 1.9 PP100 since 2021.

Highest-Ranked Brands and Models

Suzuki is the highest-ranking brand overall in initial quality with a score of 132 PP100, and Lexus (149 PP100) ranks highest in the luxury segment.

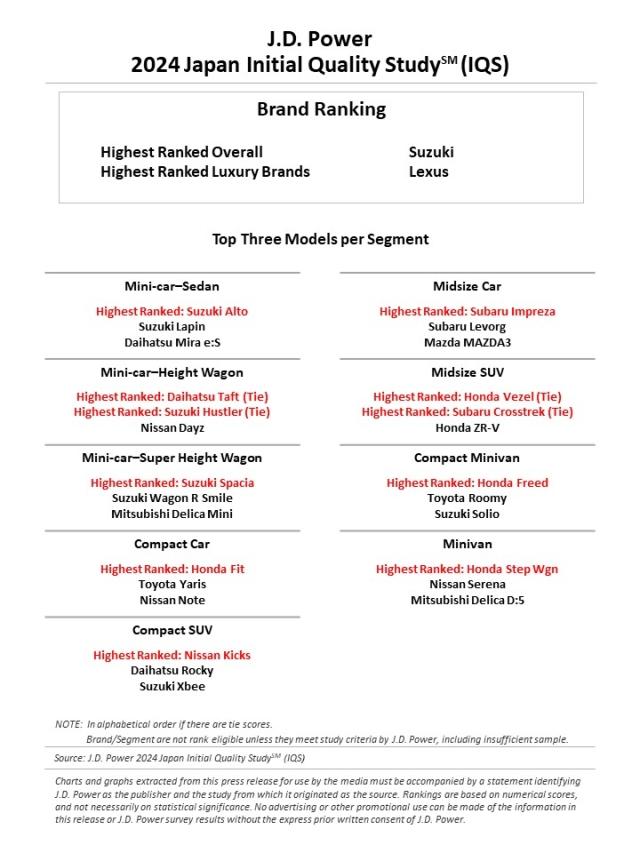

By segment, the highest-ranking models are:

- Mini-car–Sedan segment: Suzuki Alto

- Mini-car–Height Wagon segment: Daihatsu Taft, Suzuki Hustler (Tie)

- Mini-car–Super Height Wagon segment: Suzuki Spacia

- Compact Car segment: Honda Fit

- Compact SUV segment: Nissan Kicks

- Midsize Car segment: Subaru Impreza

- Midsize SUV segment: Honda Vezel, Subaru Crosstrek (Tie)

- Compact Minivan segment: Honda Freed

- Minivan segment: Honda Stepwgn

The 2024 Japan Initial Quality Study is based on responses from 21,412 owners of new vehicles in the first two to 13 months of ownership. Vehicle quality is evaluated by owners across 225 questions organized into nine vehicle categories: infotainment; features, controls and displays; exterior; driving assistance; interior; powertrain; seats; driving experience; and climate. The study was fielded in May through June 2024. The study was redesigned in 2021.

About J.D. Power

J.D. Power is a global leader in automotive data and analytics, and provides industry intelligence, consumer insights and advisory solutions to the automotive industry and selected non-automotive industries. J.D. Power leverages its extensive proprietary datasets and software capabilities combined with advanced analytics and artificial intelligence tools to help its clients optimize business performance.

J.D. Power was founded in 1968 and has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit https://japan.jdpower.com/.

Media Relations Contacts

Kumi Kitami; Tokyo; 81-3-6809-2996; release@jdpa.com

Geno Effler; J.D. Power, USA; 714-621-6224; media.relations@jdpa.com

About J.D. Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info