Presenting Customers with Best Purchase Options During Vehicle Sales Process Increases Satisfaction

Volkswagen Ranks Highest for a Third Consecutive Year; Audi Ranks Highest in Respective Segments for the First Time

TOKYO: 22 Aug. 2019 — It is becoming more important that vehicle sales staff present customers with various purchasing and financing options as prices for vehicles continues to increase, according to the JD Power 2019 Japan Sales Satisfaction Index (SSI) StudySM, released today. Overall, customer satisfaction with the vehicle sales process has increased since 2018, particularly in factors relating to the facility and working out the deal.

“Customer satisfaction with sales staff at new-vehicle dealerships has increased this year. However, because of the rise in new-vehicle prices, satisfaction with contracts and prices has slowed, indicating that dealers must focus more attention in this area to provide customers with satisfying options,” said Koichi Urayama, Senior Director of the Automotive Division at JD Power. “More customers are using residual value financing at the dealerships, and although their satisfaction with payment options has increased, it will become increasingly important to offer them the most advantageous payment and insurance options to further improve their satisfaction.”

Following are some of the key findings of the 2019 study:

-

Satisfaction continues to increase: Overall sales satisfaction averages 678 points (on a 1,000-point scale) in 2019, 7 points higher than last year.

-

Both mass market and luxury brands have improved: Satisfaction with mass market brands averages 676 points (+8 points from 2018), while satisfaction with luxury brands averages 728 points (+11 points from 2018).

-

The largest improvement is in the dealership facility: By factor, the largest improvement is in the facility (up 12 points in 2019 to 682), particularly in the ratings for appearance (+0.14 points on a 10-point scale) and the ease of looking at/condition of dealer's displayed car (+0.14 points). The improvement in satisfaction of the ease of looking at/condition of dealer's displayed car is larger in the mass market segment (+0.15 points) than in the luxury segment (+0.09 points).

-

More customers are using residual value financing: The percentage of customers who used financing/leasing through their dealer has increased slightly, to 31% in 2019 from 30% in 2018. Among these customers, 67% used residual value financing, compared with 62% in 2018. Sales satisfaction among customers who used residual value financing is 15 points higher than among customers who used traditional financing (704 points vs. 689 points, respectively).

-

Financing satisfaction varies depending on the age group: Among customers in their 40s, sales satisfaction is 16 points higher among those who used financing/leasing through their dealer (705 points) vs. those who used outside sources (689 points). However, among customers in their 20s and 30s, satisfaction is 9 points lower among those who used financing/leasing through their dealer (681 points) vs. those who used outside sources (690 points).

-

Whether the salesperson proposed auto insurance impacts customer satisfaction: Satisfaction is 50 points higher among customers to whom their salesperson suggested the consideration and purchase of auto insurance (voluntary insurance) or a review of their current auto insurance and switching their insurance at the dealer than among customers who received no such suggestions (698 points vs. 648 points, respectively). Satisfaction further increases to 707 points when customers actually purchased new auto insurance at the dealer.

Study Rankings

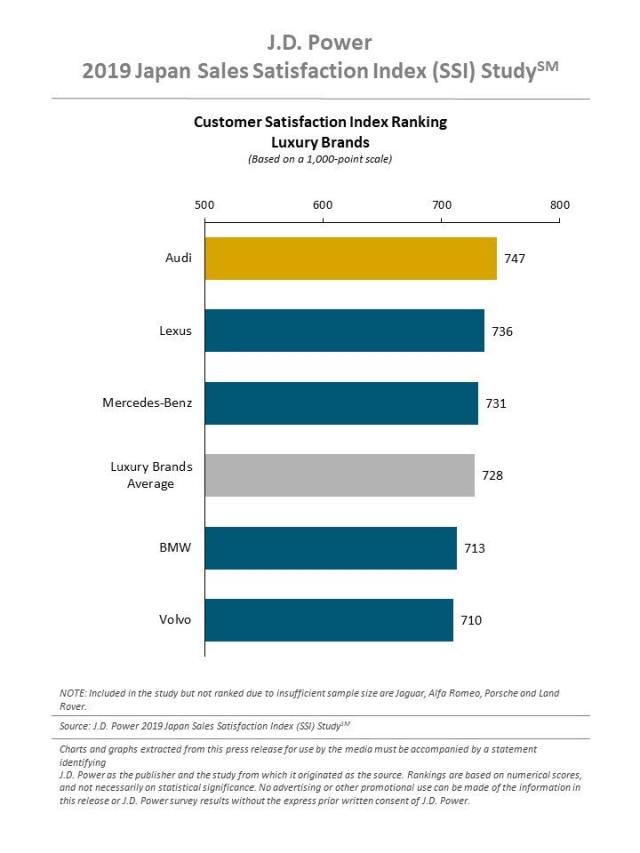

Luxury

Among the five luxury brands included in the study, Audi (747) ranks highest for the first time since the study’s inception. Audi performs particularly well in three factors: salesperson; working out the deal; and delivery.

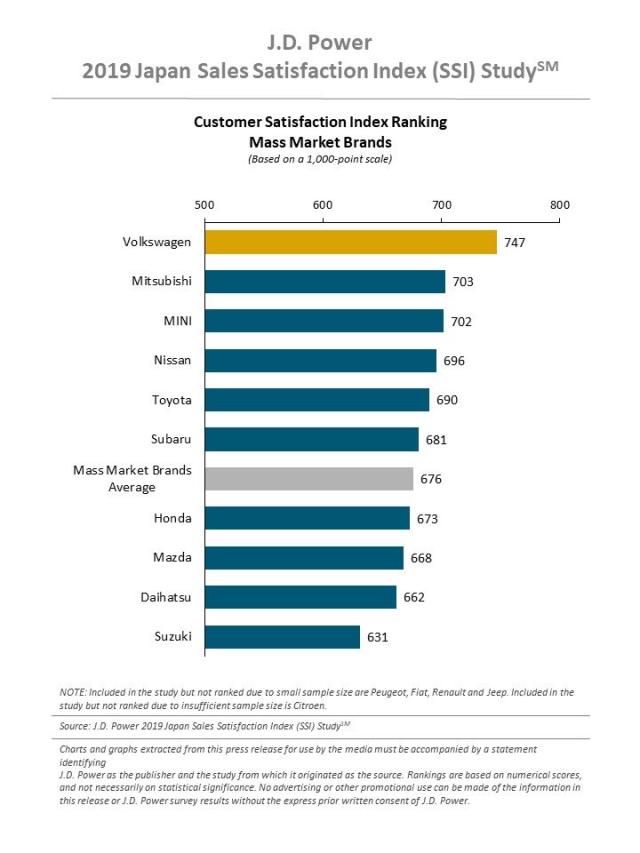

Mass Market

Among the 10 mass market brands included in the study, Volkswagen (747) ranks highest for the third consecutive year. Volkswagen performs particularly well in all four factors: salesperson; working out the deal; facility; and delivery.

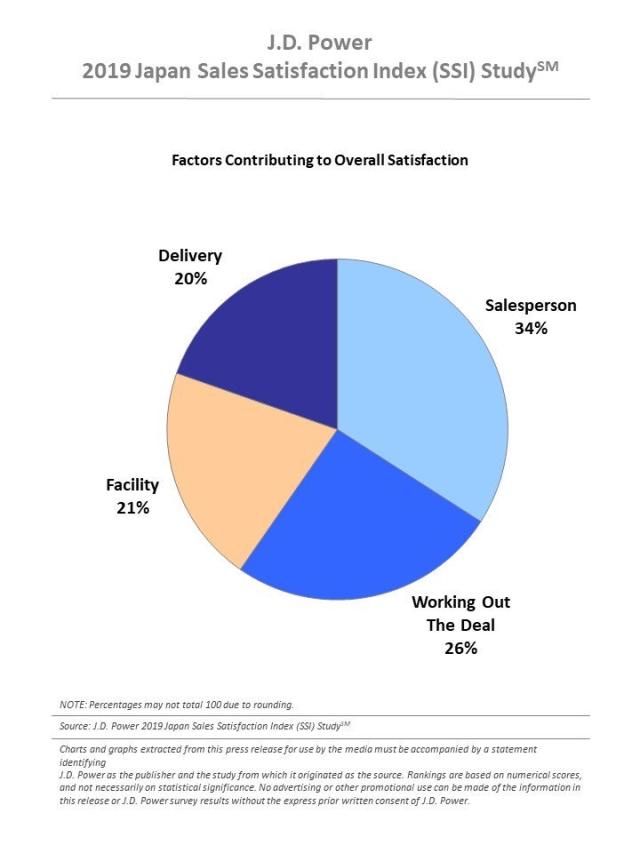

The 2019 Japan Sales Satisfaction Index (SSI) Study measures customer satisfaction with the sales process at automotive dealerships based on four factors that are comprised of 20 attributes (in order of importance): salesperson (34%); working out the deal (26%); facility (21%); and delivery (20%). The study provides auto manufacturers with insights into customer satisfaction with the vehicle sales process at dealerships.

The study, now in its 18th year, includes responses from 7,213 domestic and import vehicle owners who purchased a vehicle between April 2018 and March 2019, after two to 12 months of ownership. The online survey was fielded in May and June 2019. Satisfaction is measured on a 1,000-point index score and is based on the percentage of importance of each of four factors and owners’ evaluations of multiple attributes included within these factors.

About JD Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info

# # #

NOTE: Three charts follow.