J.D. パワー ジャパンは、2018年日本ナビゲーションシステム顧客満足度調査SM<市販ナビカテゴリー>(Japan Navigation Systems Customer Satisfaction Index StudySM– Aftermarket -)の結果を発表した。

◆ 市販ナビユーザーは、ナビ機能や音楽・映像機能にこだわり ◆

本調査ではCSだけでなくナビの購入実態や今後の意向についても聴取しているが、市販ナビユーザーは自動車メーカー純正ナビユーザーに比べ、ナビ機能や音楽・映像関連機能に高い関心やこだわりを持っていることが分かった。

ナビ購入時に重視する点をたずねたところ、「ナビゲーション機能・性能」と回答する割合は、市販ナビが56%、純正ナビが39%であった。さらに「音楽や映像関連機能」と回答する割合は、市販ナビが41%、純正ナビが22%であった*1。

また使用実態をみると、56%の市販ナビユーザーがスマートフォンをナビに接続させて利用しており、これは純正ナビの52%を上回っている。スマートフォン等で目的地検索したデータをナビゲーションシステムへ転送したり、ナビの音楽・映像関連機能やアプリを利用したりするユーザーが純正ナビユーザーよりも多いことも確認できた。

純正ナビではなく、あえて市販ナビを選ぶ理由として、価格の安さを挙げるユーザーがいる一方、市販ナビならではの機能や性能を求め、こだわりをもったユーザーも相当数いることが読み取れる。

*1 各データは1年以内に市販ナビもしくは純正ナビを購入したユーザーに回答者条件を揃えて算出。なお、純正ナビはディーラープションナビ購入者における回答である。

J.D. パワーのオートモーティブ部門 ディレクターである佐々木由至は次のようにコメントしている。

「市販ナビユーザーは、純正ナビユーザーよりもナビゲーションシステムに対する関心やこだわりが強く、高い期待値を持っている。この期待値を満たす商品であれば高い顧客満足を得るが、期待にそぐわない場合の満足度の低下は著しい。顧客ニーズを的確に捉え、顧客の望む機能や性能を備えた商品を提供することが極めて重要である。市販ナビメーカーにおいては、今後、基本的なナビ機能だけではなく、スマートフォンとの接続性、音楽・映像機能の整備や充実において一層改善が望まれるだろう。」

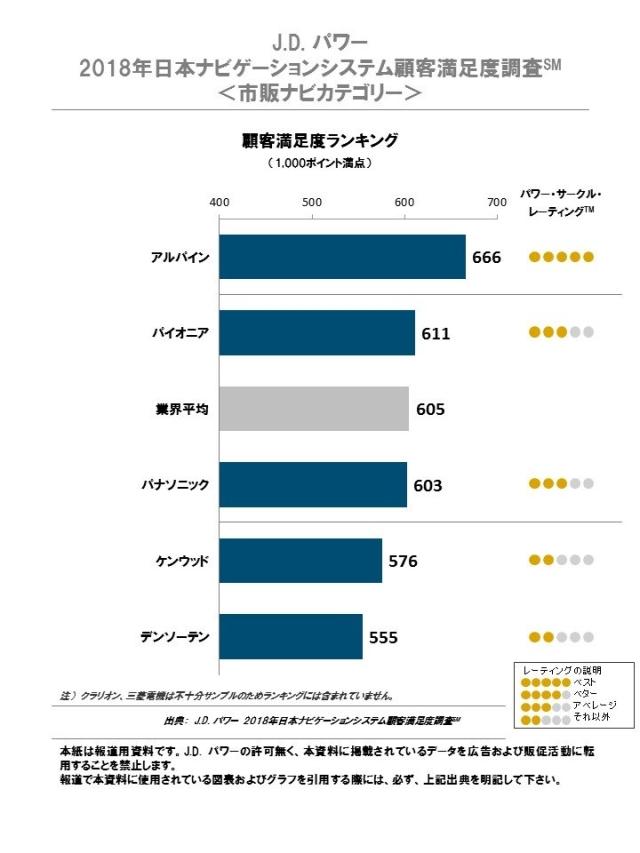

◆ 日本ナビゲーションシステム<市販ナビカテゴリー>顧客満足度ランキング発表! ◆

総合満足度ランキングは下記の通りとなった。

第1位:アルパイン(666ポイント)

全ファクターで業界平均以上の評価。特に「モニター」「デザイン・質感」で高評価。

第2位:パイオニア(611ポイント)

第3位:パナソニック(603ポイント)

《J.D. パワー 2018年日本ナビゲーションシステム顧客満足度調査概要》

市販ナビゲーションシステムに関する顧客満足度を測定する調査。11回目となる本年調査は、デザイン要素やコネクトファクターの評価も含む調査内容に刷新して実施した。

■実施期間:2018年7月 ■調査方法:インターネット

■調査対象:2016年4月~2018年3月に市販ナビゲーションシステムを購入したユーザー

■回答者数:2,105人

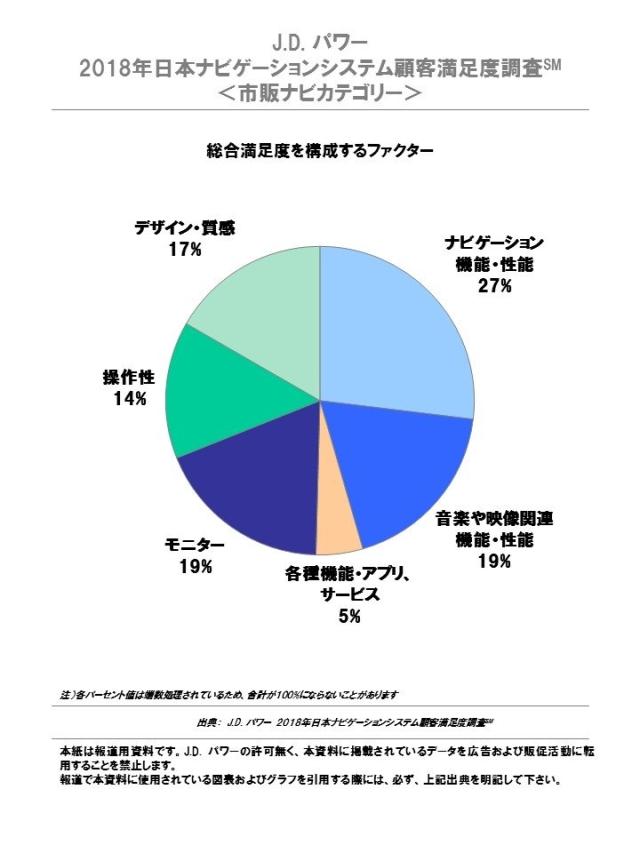

満足度を構成するファクターは下記の通り。

「ナビゲーション機能・性能(27%)」「音楽や映像関連機能・性能(19%)」「モニター(19%)」「デザイン・質感(17%)」「操作性(14%)」「各種機能・アプリ、サービス(5%)」※()内は総合満足度への影響力

*J.D. パワーが調査結果を公表する調査は、J.D. パワーが第三者機関として自主企画実施したものです。

J.D. パワーでは、本調査以外にも、毎年複数の自動車関連調査の結果をリリースとして発表しています。

|

~2018年J.D. パワー 自動車関連調査発表スケジュール~ ■ 日本大型・小型トラック顧客満足度調査 (1月17日) ■ 日本自動車セールス満足度調査 SSI(8月23日) ■ 日本自動車初期品質調査 IQS(8月22日) ■ 日本自動車サービス満足度調査 CSI(8月31日) ■ 日本新車購入意向者調査 NVIS(9月12日) ■ 日本自動車商品魅力度調査 APEAL(9月20日) ■ 日本ナビゲーションシステム顧客満足度調査(純正ナビ:10月5日、市販ナビ:10月26日) ■ 日本自動車耐久品質調査 VDS(10月25日)

|

【ご注意】本紙は報道用資料です。弊社の許可なく本資料に掲載されている情報や結果を広告や販促活動に転用することを禁じます。