株式会社J.D. パワー ジャパンは、2019年日本大型トラック顧客満足度調査SM(2019 Japan Heavy-Duty Truck Ownership Satisfaction StudySM)及び2019年日本小型トラック顧客満足度調査SM(2019 Japan Light-Duty Truck Ownership Satisfaction StudySM)の結果を発表した。

-

「物流ビジネスを支援するパートナー」を目指した顧客との関係強化が重要

今回の調査では、評価対象トラックメーカーを「物流ビジネスを支援するパートナー」と考えているかどうかを質問した。その結果、大型トラック調査では回答者の33%がトラックメーカーを「物流ビジネスを支援するパートナー」であると回答し、さらに、高い満足度(総合CSI 700ポイント以上)を示している層ではこの割合が58%まで高まった。

この様に考える層は同メーカー再購入意向率も高く、95%が同じメーカーを「必ず/たぶん再購入する」と回答している。高い顧客満足度を軸に、単なる車両供給メーカーではなく、一段踏み込んだ顧客との関係構築を目指すことがビジネス基盤の強化に重要と言えよう。

メーカーを物流ビジネス支援パートナーと捉える層では、そうでない層に比べ営業担当者のコンタクト頻度が多く、困りごとのヒアリングや業界動向などの情報提供、納車後のフォローなど、車両の営業にとどまらない活動がより多く行われている。営業対応の良し悪しは、物流ビジネスを支援するパートナーとしての位置づけを勝ち取るためのカギである。

-

故障修理時の入庫のしやすさはアフターサービス満足度改善の一課題

大型トラックのアフターサービスに関する満足度水準は、昨年の598ポイントから584ポイントに14ポイント低下している。整備工場への主な入庫目的(車検、点検・整備、故障修理)別にみると、故障修理入庫者の評価低下が目立った(対前年26ポイント低下)。故障修理入庫者へのサービス対応実態をみると「希望にかなうよう入庫日の調整をしてくれた」との回答割合が前年の83%から77%に低下している。

予めスケジュールを組みやすい車検や点検・整備入庫に対し、突発的な対応が要求される故障修理の入庫に柔軟に対応することは、満足度改善への課題のひとつである。

-

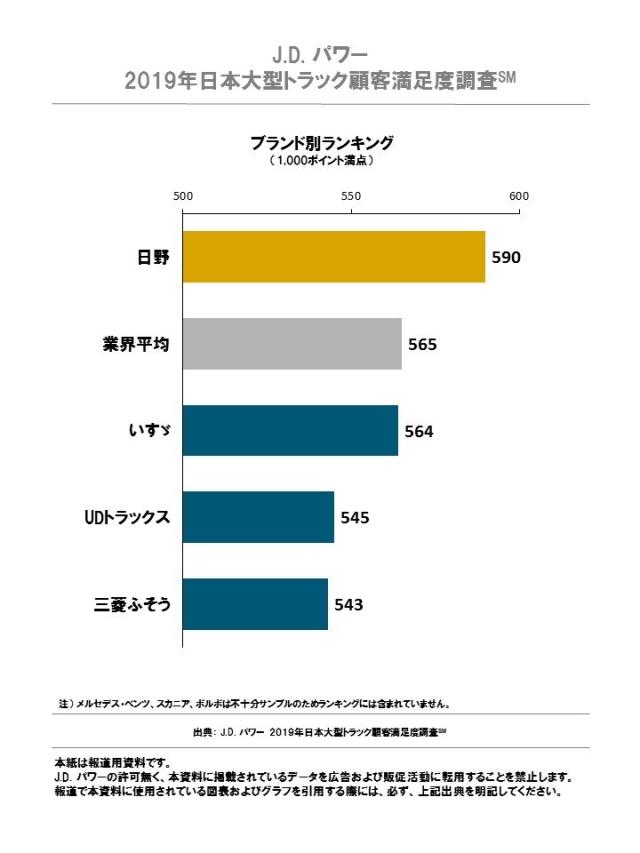

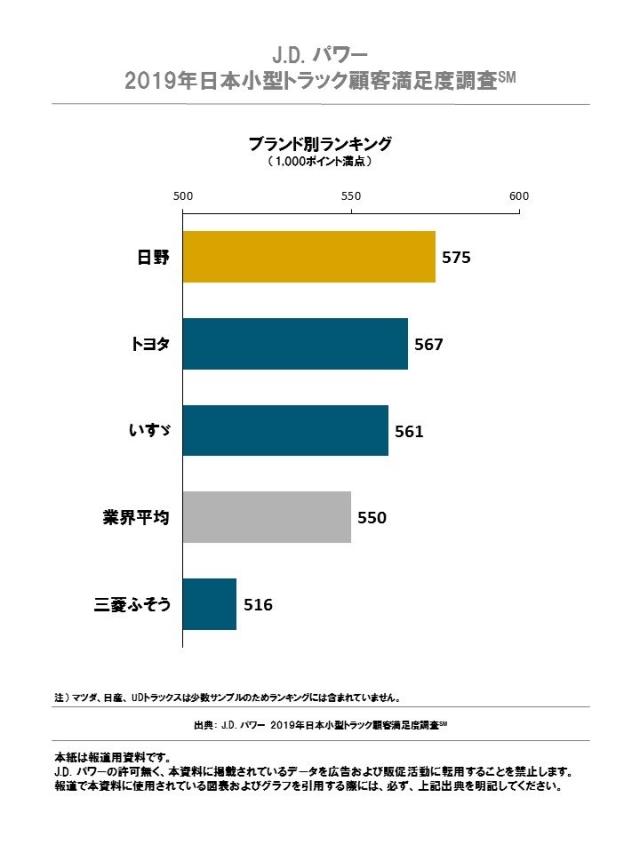

大型トラック、小型トラックともに日野が総合ランキング第1位

大型、小型ともに日野が顧客満足度第1位となった。大型では10年連続、小型では5年連続の1位である。

【大型トラック】(対象4ブランド) 第1位:日野(590ポイント) 第2位:いすゞ(564ポイント)

【小型トラック】(対象4ブランド) 第1位:日野(575ポイント) 第2位:トヨタ(567ポイント)

《J.D. パワー 2019年日本大型/小型トラック顧客満足度調査SM概要》

年1回、全国のトラック貨物輸送事業者を対象に、各事業者が保有するトラック(緑ナンバー)のメーカーおよび販売店に対する総合的な満足度を測定。

■実施期間:2018年9月~10月 ■調査方法:郵送調査

■調査対象:トラック貨物輸送事業者(経営者もしくは車両購入決定関与者)

■調査回答者数:大型:2,303社3,550件 小型:1,945社2,825件

※それぞれ、回答企業1社から最大2メーカーの評価を聴取

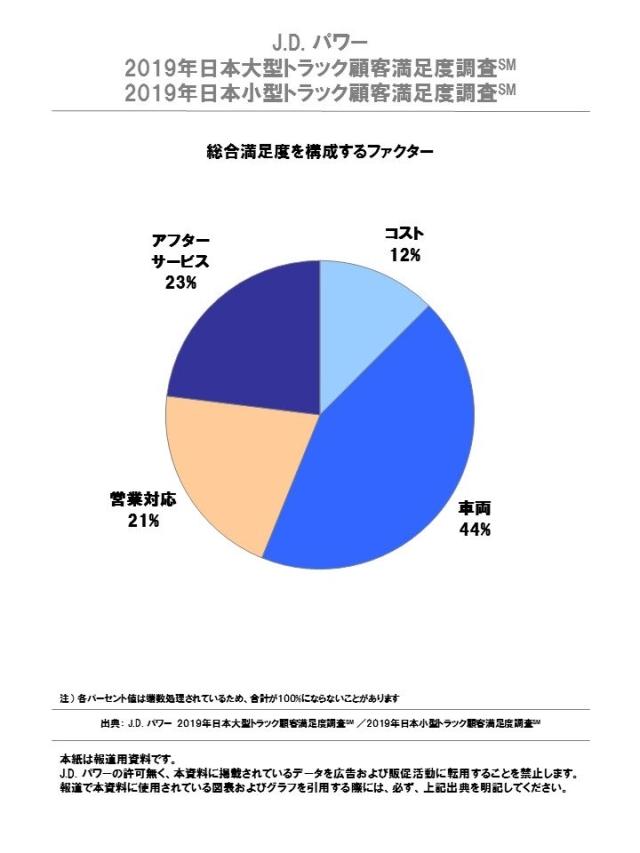

「車両」「アフターサービス」「営業対応」「コスト」の4ファクター、10の詳細項目にて評価を聴取。

満足度に与える各ファクターの影響力は順に、車両(44%)、アフターサービス(23%)、営業対応(21%)、コスト(12%)となっている。満足度に与えるこれら影響力と評価の素点に基づき、1,000点を満点とする総合満足度スコアを算出している。

【注意】本紙は報道用資料です。弊社の許可なく本資料に掲載されている情報や結果を広告や販促活動に転用することを禁じます。