CS(顧客満足度)に関する調査・コンサルティングの国際的な専門機関である株式会社J.D. パワー ジャパン(本社:東京都港区、代表取締役社長:山本浩二、略称:J.D. パワー)は、2019年日本大型トラック顧客満足度調査SM(第2 回)(2019 Japan Heavy-Duty Truck Ownership Satisfaction Study SM -Wave2 )及び2019年日本小型トラック顧客満足度調査 SM(第2 回)(2019 Japan Light-Duty Truck Ownership Satisfaction StudySM -Wave2)の結果を発表した。

アフターサービスの満足度においてやや改善、ただし店舗施設に関しては停滞

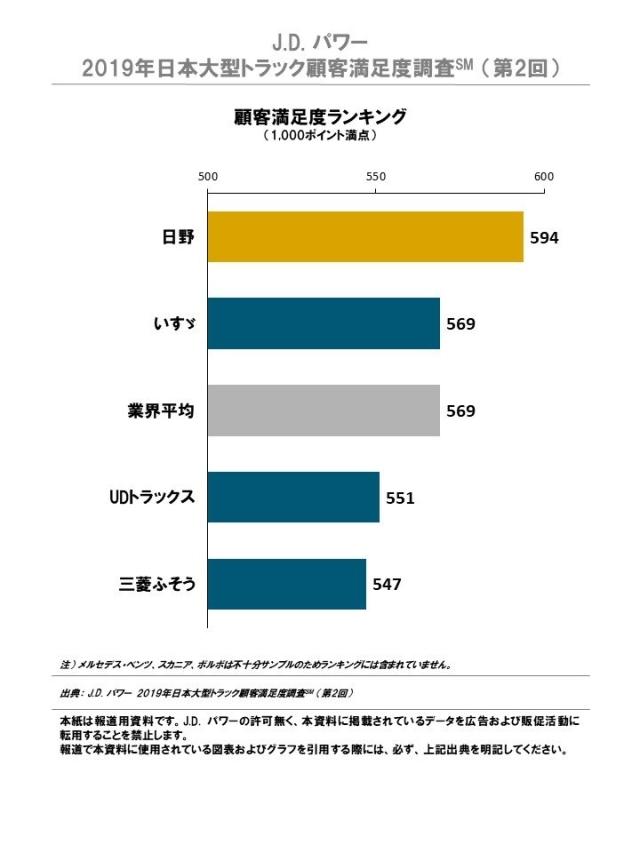

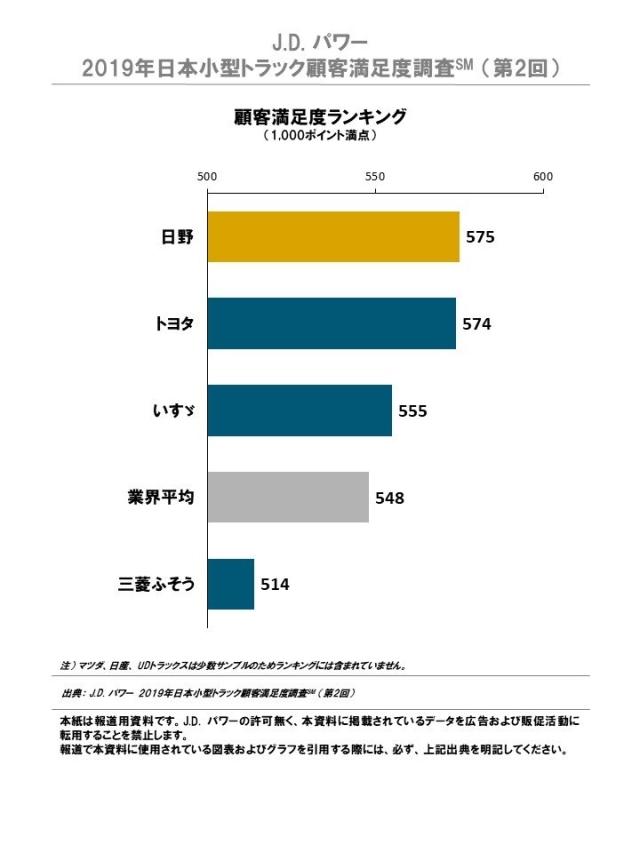

- 本調査の総合満足度の業界平均スコアは、大型トラックが569ポイント(前回比+4ポイント)、小型トラックが548ポイント(前回比-2ポイント)となり、前回調査(2019年1月発表)とほぼ同水準の結果となった。

- ファクター別では、大型トラックの「アフターサービス」(業界平均ポイント595ポイント、前回比+11ポイント)が最も満足度が改善し、特に『部品注文への対応』と『整備・修理の対応』が貢献している。その一方で『店舗施設』に関しては、大型トラックでほぼ横ばい、小型トラックでは満足度が低下している。特に「店内が混雑していた」と回答した割合が大型・小型で年々増加し、今回の調査では大型トラックで30%、小型トラックで28%となっていた。

先進技術の装着が急速に進む

- 本調査では、「衝突被害軽減ブレーキ」「レーンキープアシスト」「居眠り検知システム/ふらつき警報」「側方等の死角監視・警告システム」「アダプティブクルーズコントロール」「テレマティクス(トラックメーカー純正品)」といった、車両の先進技術機能の装備状況とその評価についても聴取している。

- 大型・小型トラック共に登録年度単位での装着率をみると、この3年間での装着が急速に進んでいることが確認できた。特に「衝突被害軽減ブレーキ」「レーンキープアシスト」は、この1年以内に登録された大型トラックでみると装着率が70%以上、小型トラックにおいても40%以上となり、両者の装着率の差も縮小傾向にある。

「物流ビジネスを支援するパートナー」と認識されることが、高い満足度とロイヤルティ醸成につながる

- 物流ビジネスにおける新たなイノベーションが注目される中、当調査では、調査対象であるトラックメーカー各社を「物流ビジネスを支援するパートナー」として認識しているかについても聴取している。その結果、大型トラックでは回答者の33%、小型トラックでは31%となり、現段階では「トラックを売る」から「ビジネスを支援する」存在としての認知には至っていない現状が明らかになった。

- 一方、高い満足度(総合満足度 700ポイント以上)を示している層で区切ってみると、「物流ビジネスを支援するパートナー」として認識しているとする回答の割合は大型では58%、小型で53%まで高まる。さらに同じメーカーの再購入意向率も大型で96%、 小型で95%と高くなっており、顧客満足度の高さがビジネス拡大やロイヤルティ向上に繋がることが確認できた。

大型トラック、小型トラックともに日野が総合ランキング第1位

大型、小型ともに日野が顧客満足度第1位となった。

【大型トラック】(対象4ブランド)

第1位:日野(594ポイント)11回連続の受賞

第2位:いすゞ(569ポイント)

【小型トラック】(対象4ブランド)

第1位:日野(575ポイント)6回連続の受賞

第2位:トヨタ(574ポイント)

《 J.D. パワー 2019年日本大型/小型トラック顧客満足度調査SM(第2回)概要 》

年1回、全国のトラック貨物輸送事業者を対象に、各事業者が保有するトラック(緑ナンバー)のメーカーおよび販売店に対する総合的な満足度を聴取し明らかにする調査。大型トラックは今年で15回目、小型トラックは今年で14回目の実施となる。

■実施期間:2019年9月~10月 ■調査方法:郵送調査

■調査対象:トラック貨物輸送事業者(経営者もしくは車両購入決定関与者)

■調査回答者数:大型:2,192社3,367件 小型:1,850社2,653件

※それぞれ、回答企業1社から最大2メーカーの評価を聴取

総合的な顧客満足度に影響を与えるファクターを設定し、各ファクターの詳細評価項目に関するユーザーの評価を基に1,000ポイント満点で総合満足度スコアを算出。顧客満足度を構成するファクターは、総合満足度に対する影響度が大きい順に、「車両」(44%)、「アフターサービス」(23%)、「営業対応」(21%)、「コスト」(12%)となっている(カッコ内は影響度)。

*J.D. パワーが調査結果を公表する全ての調査は、J.D. パワーが第三者機関として自主企画し実施したものです。

【ご注意】本紙は報道用資料です。弊社の許可なく本資料に掲載されている情報や結果を広告や販促活動に転用することを禁じます。