新型コロナウイルス感染拡大への懸念が薄れ、生命保険・年金保険ともに顧客満足度は低下

ステート・ファームが「個人向け生命保険顧客満足度調査」で首位、アメリカン・エクイティ・インベストメント・ライフ・インシュアランスが「個人向け年金保険顧客満足度調査」で首位

CS(顧客満足度)に関する調査・コンサルティングの国際的な専門機関である J.D. Power(本社:米国ミシガン州 トロイ)は、現地時間10月13日に、J.D. Power 2022 U.S. Individual Life Insurance StudySM(J.D. パワー 2022年米国個人向け生命保険顧客満足度調査SM)およびJ.D. Power 2022 U.S. Individual Annuity Study SM(J.D. パワー 2022年米国個人向け年金保険顧客満足度調査SM)の結果を発表した。

ステート・ファームが「個人向け生命保険顧客満足度調査」で首位、アメリカン・エクイティ・インベストメント・ライフ・インシュアランスが「個人向け年金保険顧客満足度調査」で首位

個人向け生命保険・年金保険は、長期投資・保険商品の中でも最も長期的な商品のため、顧客とのエンゲージメント*1における問題を生じさせた。本年調査によると、これらの商品に対する顧客満足度は、購入後比較的早い時期に低下し始める。その結果、顧客が自社における他の保険・金融商品への加入を検討する可能性が低下するだけでなく、既に所有している商品に対する全般的な理解も不十分であることがわかった。

両調査でランキング首位となったステート・ファームとアメリカン・エクイティ・インベストメント・ライフ・インシュアランスは、業界が衰退する中でも、前年比で過去最大規模の顧客満足度上昇となったことは注目に値する。

*1 製品やサービスを提供する企業と顧客との間で築かれた信頼関係

2022年調査の主なポイントは以下の通り:

顧客満足度の低迷

個人向け生命保険の業界全体の顧客満足度は、2021年に前年比で過去最大の上昇を示した後、本年調査では「代理店・アドバイザーとのやり取り」、「コールセンター」、「ウェブサイト」に対する満足度の低下により、前年比-2ポイントの774ポイント(1,000ポイント満点)となった。

同様に、個人向け年金保険の業界全体の顧客満足度は、「価格」、「契約内容」、「連絡・案内」に対する満足度が大きく低下し、前年比-13ポイントの789ポイントとなった。

加入期間に伴い低下する生命保険の顧客満足度

顧客が生命保険に加入している期間が長いほど、総合満足度は低下する。加入期間が5年以下の顧客の総合満足度は821ポイントであるのに対し、加入期間が6~10年の顧客の場合は785ポイント、11~20年の場合は759ポイント、20年超の場合は756ポイントと、低下がみられる。

また、加入期間が長くなるほど、代理店やアドバイザーが「顧客の最善の利益のために提案を行う」というKPI(重要な業績評価指標)を満たしていると顧客が感じる可能性が著しく低くなっている。

デジタルが主流になったが、代理店・アドバイザーとのやり取りは依然として重要

半数以上(51%)の顧客が、過去3年間に少なくとも1つのデジタルチャネルを利用して、保険会社とのやり取りをしている。これらの顧客は、デジタルチャネルを利用してやり取りをしたことがない顧客よりも顧客満足度が高い。

年金保険会社はデジタルチャネルを十分に活用できていない

顧客とのコミュニケーションのデジタル化が進んでいるにもかかわらず、年金保険会社各社では顧客とのコミュニケーションを「郵送」で行うことが増えている。本年調査では年金保険の顧客の74%が郵送で書類を受け取るなど、郵送は最も一般的な顧客とのコミュニケーション手段であるが、「郵便」チャネルを利用した顧客の総合満足度は他のチャネルを利用した顧客と比較して最も低かった。

一方、モバイルアプリの利用率は調査時ではわずか8%にとどまるが、モバイルアプリを利用した顧客の総合満足度は他のチャネルを利用した顧客と比べて最も高い水準であった。

ブランドの差別化ができていないことが、インシュアテックに参入の機会を与える

生命保険の顧客の半数以上(55%)が、加入している保険会社のブランド評価を、他の保険会社と同等に評価している。しかし、インシュアテック・ブランドに関しては、顧客はこれらの会社をユニークで革新的、かつ手頃な価格での商品提供する会社であると評価する傾向がある。

J.D. パワー グローバル・インシュアランス・インテリジェンス部門ディレクター ロバート・ラジアックのコメント

「個人向け生命保険・年金保険に対する総合顧客満足度は、パンデミック最盛期に一時的に急上昇したものの、現在は、加入期間が長くなるにつれて顧客満足度が低下するという、これまでの長期トレンドに逆戻りしている。加入期間中に顧客との定期的なコンタクトを維持し、独自の価値提供を強化することに保険会社が苦労していることは、我々のデータから明らかである。これは、将来の潜在的な販売機会を制限するだけでなく、デジタル技術を活用して顧客との関係をよりマルチチャネル化し、顧客の共感を呼ぶインシュアテック新興企業による競争の脅威に、既存企業をさらすことにもつながる。」

顧客満足度ランキング

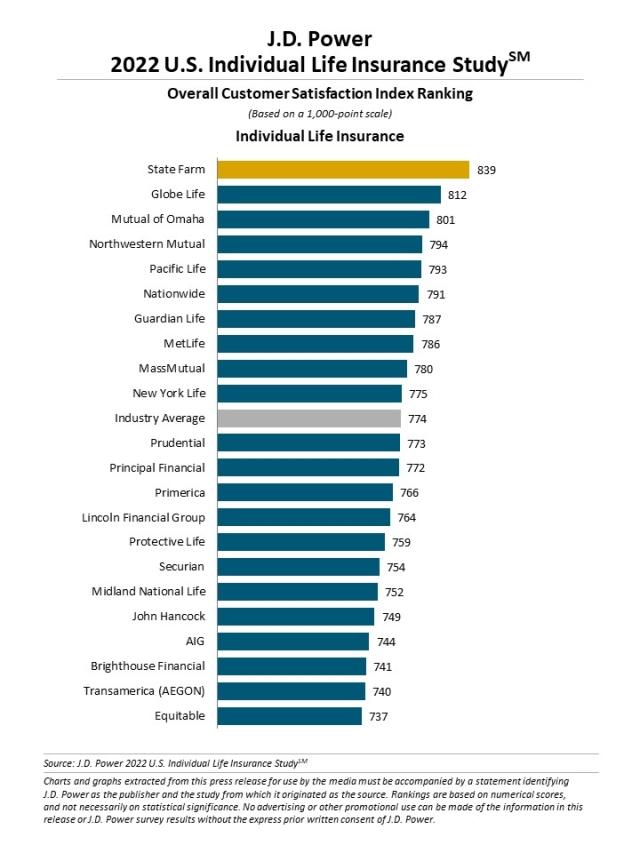

【個人向け生命保険顧客満足度調査】

第1位:State Farm(ステート・ファーム)(839ポイント、3年連続の1位)

第2位:Globe Life(グローブライフ)(812ポイント)

第3位:Mutual of Omaha (ミューチュアル・オブ・オマハ) (801ポイント)

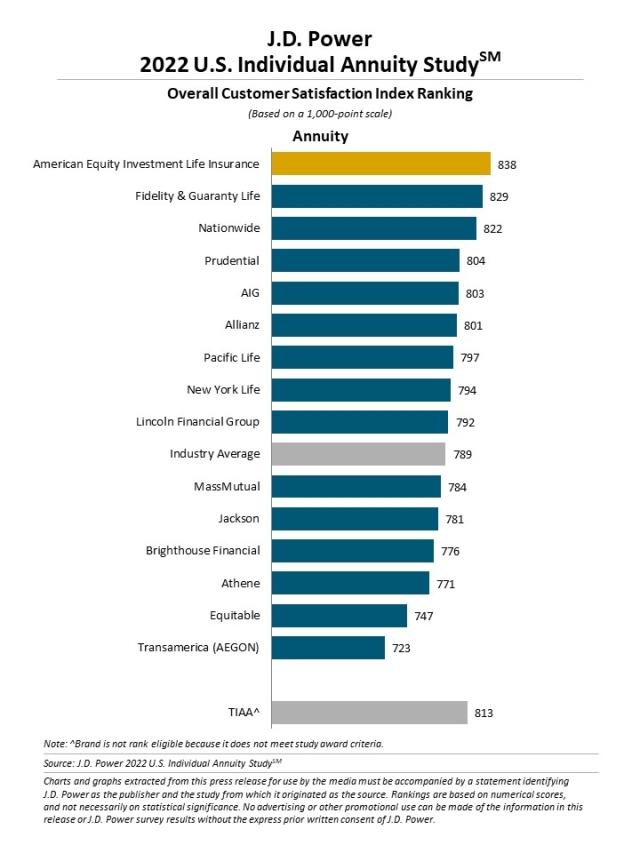

【個人向け年金保険顧客満足度調査】

第1位:American Equity Investment Life Insurance(アメリカン・エクイティ・インベストメント・ライフ・インシュアランス)(838ポイント)

第2位:Fidelity & Guarantee Life(フィデリティ・アンド・ギャランティー・ライフ)(829ポイント)

第3位:Nationwide(ネイションワイド)(822ポイント)

《調査概要》

J.D. パワー 2022年米国個人向け生命保険顧客満足度調査SM/J.D. パワー 2022年米国個人向け年金保険顧客満足度調査SM

年に1回、米国の大手生命保険会社及び年金保険会社が提供する個人向け生命保険・年金保険の加入者を対象に、個人向け生命保険・年金保険に対する満足度を聴取し明らかにする調査。

今回で9回目の実施となる。

■実施期間:2022年6月~8月

■調査方法:インターネット調査

■調査対象: 米国の大手生命保険会社及び年金保険会社が提供する個人向け生命保険・年金保険の加入者

■調査回答者数:個人向け生命保険顧客満足度調査5,583人/個人向け年金保険顧客満足度調査3,152人

総合的な顧客満足度に影響を与えるファクターを設定し、各ファクターの詳細評価項目に関するユーザーの評価を基に1,000ポイント満点で総合満足度スコアを算出。総合満足度を構成するファクターは、アルファベット順に、「連絡・案内」、「顧客対応」、「価格」、「契約内容」、「保険証券」となっている。

*本報道資料は、現地時間 2022年10月13日に米国で発表されたリリースを要約したものです。

原文リリースはこちら

*J.D. パワーが調査結果を公表する全ての調査は、J.D. パワーが第三者機関として自主企画し実施したものです。

【ご注意】本紙は報道用資料です。弊社の許可なく本資料に掲載されている情報や結果を広告や販促活動に転用することを禁じます。

J.D. パワーについて:

J.D. パワー(本社:米国ミシガン州トロイ)は消費者のインサイト、アドバイザリーサービス、データ分析における国際的なマーケティングリサーチカンパニーです。50年以上にわたり、ビッグデータやAI、アルゴリズムモデリング機能を駆使し、消費者行動を捉え、世界を牽引する企業に、ブランドや製品との顧客の相互作用に関する鋭い業界インテリジェンスを提供するパイオニアです。