CS(顧客満足度)に関する調査・コンサルティングの国際的な専門機関である J.D. Power(本社:米国ミシガン州 トロイ)は、現地時間2月28日に、J.D. Power 2022 U.S. Property Claims Satisfaction StudySM (J.D. パワー 2022年米国住宅保険請求対応顧客満足度調査SM)の結果を発表した。

本調査は、年に1回、米国の住宅保険の加入者のうち、請求手続きを行ったことのある顧客の住宅保険会社に対する満足度を測定している。

2021年は、記録的な大災害の連続による甚大な損害、大規模なサプライチェーンの混乱、進行中の労働力不足の問題などが重なり、損害保険業界にとって非常に厳しい1年となった。本調査によると、デジタルチャネルへのサービスの移行に伴うサイクルタイムの遅延や困難により、総合満足度は過去5年間で最低水準に落ち込んだ。

2022年調査の主なポイントは以下の通り:

業界全体で総合満足度が低下

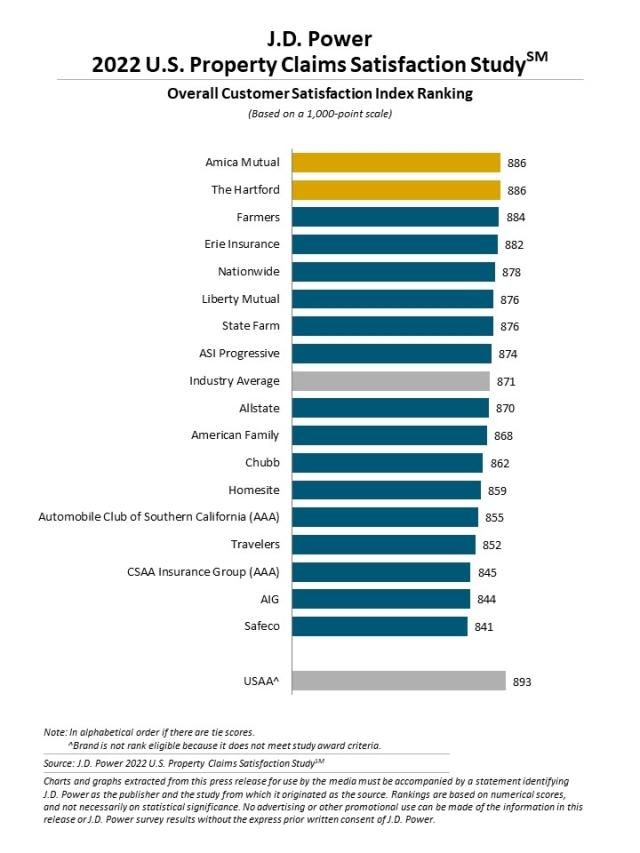

住宅保険の請求に関する総合満足度は、サイクルタイムの遅延、請求プロセスの複雑化、コミュニケーションの難しさが原因でほぼすべての保険会社において低下し、過去5年間で最低水準となる871ポイント(1,000ポイント満点)まで低下した。過去1年間で修繕作業の完了に要した日数の平均値は17.8日で、2021年と比較し2.9日長くなった。

大きな可能性を秘めるデジタル請求、多くの利用者は十分に活用できず

顧客と保険会社の間で最も頻繁に利用されたコミュニケーション手段として、デジタルチャネルである電子メールが2022年の調査で初めて電話を上回った。さらに、顧客のモバイルアプリの利用率は前年比+19%と過去最大の増加を見せた。しかし、こうした大幅な増加が見られたにもかかわらず、デジタルFNOL(最初の損害発生通知)、デジタル見積もり(見積もりに使用する写真の提出)、ステータス更新のモバイルアプリまたはウェブチャネルを介した確認という保険金請求プロセスの主要なステップすべてにおいてデジタルチャネルを活用している顧客は、わずか11%に止まった。これらのデジタルツールを保険金請求プロセスにおいてすべて活用した顧客は、活用しなかった顧客と比較し損害修理の開始が9日早まり、総合満足度も+33ポイント高くなっている。

多くの顧客は不完全な形でデジタルツールを利用

デジタルチャネルをフル活用している顧客は経験するサイクルタイムが短く、総合満足度も高い。一方で、デジタルチャネルを部分的に利用している顧客や、全く利用していない顧客はその逆を経験する。デジタルチャネルを介して写真の提出を行なったが、対面での査定が必要となった顧客の総合満足度は、デジタルチャネルをフル活用している顧客の満足度と比較して、-47ポイント低かった。これは全体のプロセスに時間がかかるだけでなく、プロセスが予想以上に複雑でタッチポイントが多いと顧客が感じやすいためである。

J.D. パワー インシュアランス・インテリジェンス部門ディレクター、マーク・ギャレットのコメント

「2021年、保険会社は自身では制御できない要因も一部あり、非常に苦労した。サイクルタイムの長期化、資材不足、人員不足により、保険会社は顧客への情報提供や顧客の期待値をコントロールすることに苦労した。査定に用いる写真提出にデジタルツールを用いる顧客は増加し、ステータス更新にも積極的に利用されるようになっている。これらのことから、請求プロセスにおけるデジタルツールの利用は極めて重要となった。しかし、これらのデジタルツールは必ずしも顧客の期待に応えておらず、その結果、サポートスタッフの介入が必要となった。このような顧客の期待と実際に提供されているサービスとの間で生じた乖離が、顧客満足度の大きな足かせとなった。」

顧客満足度ランキング

第1位:Amica Mutual (アミカ) 、The Hartford (ハートフォード) (同点、886ポイント)

第3位:Farmers (ファーマーズ・グループ) (884ポイント)

《J.D. パワー 2022年米国住宅保険請求対応顧客満足度調査SM概要》

年に1回、米国の住宅保険会社の請求手続きに対する満足度を聴取し明らかにする調査。今回で15回目の実施となる。

■実施期間:2021年4月~12月

■調査方法:インターネット調査

■調査対象:住宅保険の加入者のうち、過去9か月以内に請求手続きをしたことのある顧客

■調査回答者数:5,724人

総合的な顧客満足度に影響を与えるファクターを設定し、各ファクターの詳細評価項目に関するユーザーの評価を基に1,000ポイント満点で総合満足度スコアを算出。総合満足度を構成するファクターは、影響度が大きい順に、「保険金支払」、「顧客対応」、「損害発生通知」、「損害査定プロセス」、「修理プロセス」となっている。

*本報道資料は、現地時間 2022年2月 28日に米国で発表されたリリースを要約したものです。

原文リリースはこちら

https://www.jdpower.com/business/press-releases/2022-us-property-claims-satisfaction-study

*J.D. パワーが調査結果を公表する全ての調査は、J.D. パワーが第三者機関として自主企画し実施したものです。

【ご注意】本紙は報道用資料です。弊社の許可なく本資料に掲載されている情報や結果を広告や販促活動に転用することを禁じます。

J.D. パワーについて:

J.D. パワー(本社:米国ミシガン州トロイ)は消費者のインサイト、アドバイザリーサービス、データ分析における国際的なマーケティングリサーチカンパニーです。50年以上にわたり、ビッグデータやAI、アルゴリズムモデリング機能を駆使し、消費者行動を捉え、世界を牽引する企業に、ブランドや製品との顧客の相互作用に関する鋭い業界インテリジェンスを提供するパイオニアです。