Quality Concerns with Increased Usage Affect Owners’ Perception and Future Purchase Decisions of Two-Wheelers in India, JD Power Finds

TVS Wins Three Model Segment Awards; Royal Enfield Posts Best Scores at Overall Brand Level

NEW DELHI: 5 March 2025 — As two-wheeler customers in India accumulate more kilometers on their vehicles, they experience an increase in quality-related issues, according to the JD Power 2025 India Two-Wheeler Initial Quality StudySM (2WIQS), released today. Owners have an average increase of (9 PP100) in problems per 100 vehicles (PP100) among customers who have ridden their vehicles 2,500 kilometers or more than among owners who have ridden their vehicles 2,500 kilometers or less in the first six months of ownership. A lower score indicates higher vehicle quality.

The study finds that the sharpest increase in problems with higher usage is in the electric scooters segment, with nearly twice as many problems (98 PP100) than the other segments combined (53 PP100). Among owners with higher-mileage vehicles in the electric scooter segment, the most problematic areas are brakes; lights/electricals; and fit and finish.

“While initial satisfaction with vehicle’s performance and build quality is improving, faster wear and tear during the early ownership period leads to several concerns in consumers’ minds, such as performance degradation, increased vibrations, braking inefficiencies and component durability,” Pronab Gorai, engagement director at Differential in Singapore. “If initial quality expectations are not sustained over time, customers may hesitate to repurchase the same brand for their next vehicle. Instead, they may consider alternatives that promise better long-term reliability and durability.”

Overall initial quality for the industry stands at 86 PP100 in 2025, with the highest number of problems being in the engine (18 PP100). This is followed by lights and electricals (15 PP100) and brakes (15 PP100). More than half (58%) of customers say the problems experienced during their initial ownership are less than what they expected. This is a significant improvement from 2024 when 44% of customers indicated that the number of problems experienced was fewer than expected. Across all segments, the greatest proportion of electric scooter segment owners had fewer than expected problems (61%).

“Measuring new-vehicle quality in India is crucial for automakers aiming to enhance customer satisfaction and brand reputation,” said Atsushi Kawahashi, senior director of JD Power Japan. “Leveraging these insights for proactive quality improvements can enhance resale value, lower warranty expenses and strengthen competitive positioning for India’s two-wheeler manufacturers.”

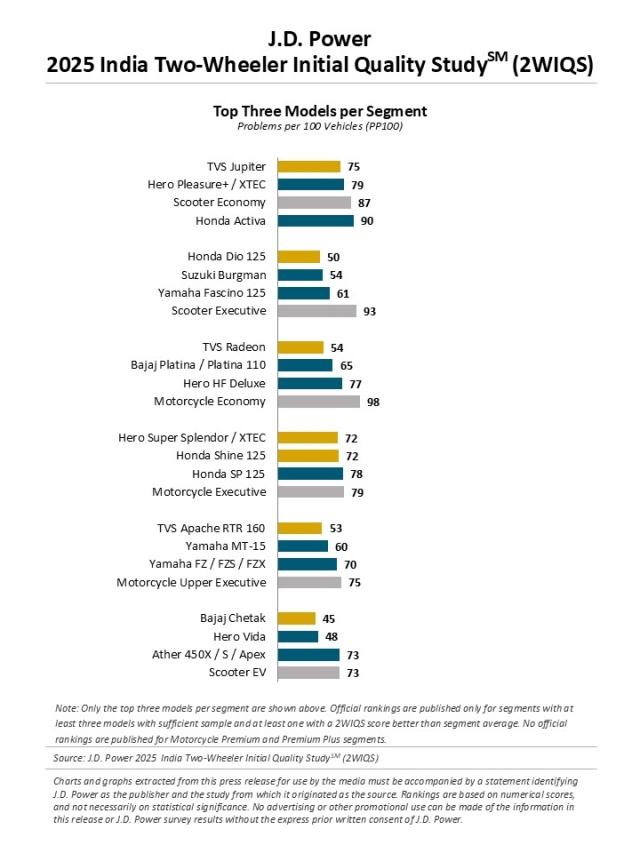

Highest-Ranking Models

- TVS Jupiter ranks highest in the scooter economy segment with 75 PP100.

- Honda Dio 125 ranks highest in the scooter executive segment with 50 PP100.

- TVS Radeon ranks highest in the motorcycle economy segment with 54 PP100.

- Hero Super Splendor / XTEC and Honda Shine 125 ranks highest in the motorcycle executive segment with 72 PP100.

- TVS Apache RTR 160 2V ranks highest in the motorcycle upper executive segment with 53 PP100.

- Bajaj Chetak ranks highest in the scooter EV segment with 45 PP100.

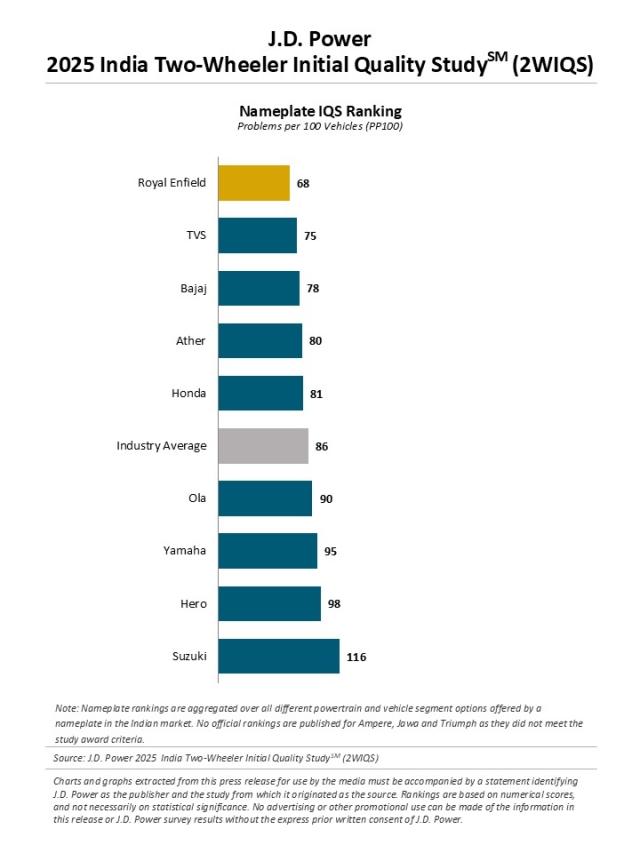

Highest-Ranking Brands

- Royal Enfield ranks highest in the overall two-wheeler initial quality study with 68 PP100

The study, redesigned for 2025, is conducted in collaboration with Differential, Singapore. It measures problems experienced in eight problem categories for internal combustion engine (ICE) models (in alphabetical order): brakes; connectivity, mobile app and navigation; engine; fit and finish; gauges and controls; lights and electricals; ride and handling; and transmission. For electric two-wheelers, the categories of engine and transmission are replaced by the categories of battery and charging; and pick-up and performance.

The 2025 India Two-Wheeler Initial Quality Study (2WIQS) is based on responses from 6,503 new two-wheeler owners, including both internal combustion engine and electric powertrains, who purchased their vehicle from May through December 2024. The study was fielded from October 2024 through January 2025. Fieldwork was conducted through face-to-face surveys in 42 major cities in India covering 80 two-wheeler models from 12 makes. Brands included in the study are ranked according to aggregate score of problems per 100 vehicles, with a lower score indicating better quality.

JD Power is a global leader in automotive data and analytics, and provides industry intelligence, consumer insights and advisory solutions to the automotive industry and selected non-automotive industries. JD Power leverages its extensive proprietary datasets and software capabilities combined with advanced analytics and artificial intelligence tools to help its clients optimize business performance.

JD Power was founded in 1968 and has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit https://japan.jdpower.com/.

Differential is a strategic consulting and research firm specializing in consumer insights, brand strategy, and market intelligence across the Asia-Pacific region. With expertise in data-driven decision-making, the firm helps businesses navigate complex market dynamics by providing deep cultural and behavioral insights. Its services range from qualitative and quantitative research to competitive analysis and trend forecasting, enabling clients to develop effective business strategies and customer engagement plans. Leveraging a strong understanding of regional nuances, Differential supports companies in various industries, including automotive, finance, and technology, to drive growth and innovation. To learn more about the company’s business offerings, visit www.differential.com.sg.

Media Relations Contacts

Ishika Arora, Differential; Singapore; +65-8428-3005 ishika.arora@differential.com.sg

Geno Effler, JD Power; USA; +1-714-621-6224; media.relations@jdpa.com

About JD Power and Advertising/Promotional Rules: http://www.jdpower.com/business/about-us/press-release-info