2017年日本自動車耐久品質調査

CS(顧客満足度)に関する調査・コンサルティングの国際的な専門機関である株式会社J.D. パワー アジア・パシフィック(本社:東京都港区、代表取締役社長:鈴木郁、略称:J.D. パワー)は、2017年日本自動車耐久品質調査(Vehicle Dependability Study、略称VDS)の結果を発表した。

この調査は、世界各国で実施され、日本では今年6~7月に、3回目の実施となる調査が行われた。

全16ブランド118モデルの車種、新車購入から37~54ヶ月が経過したユーザーを対象に、177の項目*1で直近1年間の不具合経験を聴取し、18,872人から回答を得た。

調査の結果、業界全体の不具合指摘件数は74ポイントで、前年の64ポイントから10ポイント増加し、どのセグメントからも改善が見られず、自動車の耐久品質が下落していることが明らかになった。

注釈*1 177の評価項目は「外装」「走行性能」「装備品/コントロール/ディスプレイ」「オーディオ/コミュニケーション/エンターテインメント/ナビゲーション」「シート」「空調」「内装」「エンジン/トランスミッション」の8カテゴリーに分かれている。全ての不具合項目は車100台当たりの不具合指摘件数(Problems Per 100 vehicles = PP100)として集計され、数値が小さいほど品質が高い。

主な不具合指摘の結果は下記の通り。

◆ほぼ全セグメントで前年に比べ不具合指摘件数が増加、耐久品質の改善は見られず

⇒前年に続き、不具合指摘件数が多いのは「外装(14.1ポイント)」「内装(12.7ポイント)」「エンジン/トランスミッション(12.5ポイント)」で、この3カテゴリーの不具合指摘件数が全体の53%を占めた。不具合指摘の多い項目は「吹き出し口から不快なにおいがする(3.5ポイント)」「ブレーキ音がうるさい(1.9ポイント)」「ナビゲーションシステム―操作しにくい(1.8ポイント)」などである。

◆軽自動車セグメントは、前年と比較して最も不具合指摘件数が増加した。

⇒特に「オーディオ/コミュニケーション/エンターテインメント/ナビゲーション」「エンジン/トランスミッション」「内装」の不具合指摘件数が増加。

◆最も顕著な不具合指摘は「オーディオ/コミュニケーション/エンターテインメント/ナビゲーション」で、全セグメントでこのカテゴリーの満足度が下がっていることがわかった。(対前年+3.5ポイント)。

⇒中でも、不具合指摘件数が多いのは「車載Bluetooth®(ブルートゥース)での携帯電話/デバイスのペアリング/接続不良」、次いで「ナビゲーションシステム―操作しにくい」と「ラジオの受信不良」で、い

ずれも前年比+0.6ポイントとなった。尚、Bluetooth®とナビゲーションシステムの車載装備率が昨年より上がり、特に軽自動車セグメントでの装備率の伸びが顕著であった。Bluetooth®は50%、ナビゲーションシステムは56%で、ユーザーが所有する半数以上の軽自動車に装備されている結果となった。

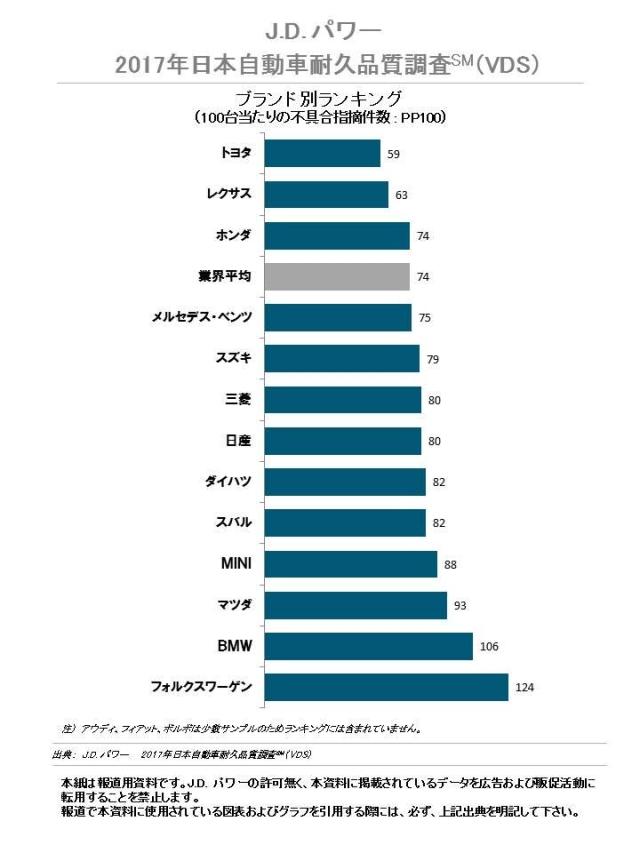

2017年日本自動車耐久品質調査のブランドランキング、車両セグメント別ランキングの結果は下記の通り。

【ブランドランキング】1位:トヨタ(59ポイント)、2位:レクサス(63ポイント)、3位:ホンダ(74ポイント)※業界平均の総合不具合指摘件数は74ポイント

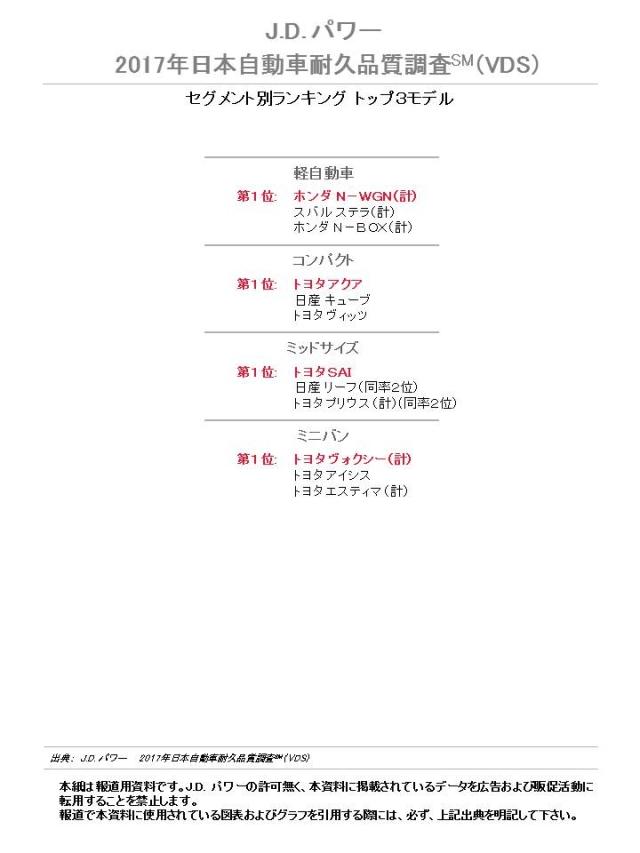

【軽自動車セグメント】1位:ホンダ N-WGN(66ポイント)、2位:スバル ステラ(67ポイント)、 3位:ホンダ N-BOX(69ポイント)

【コンパクトセグメント】1位:トヨタ アクア(49ポイント)、2位:日産 キューブ(61ポイント)、3位:トヨタ ヴィッツ(62ポイント)

【ミッドサイズセグメント】1位:トヨタ SAI(47ポイント)、2位:日産 リーフ・トヨタ プリウス(50ポイント、同率)

【ミニバンセグメント】1位:トヨタ ヴォクシー(56ポイント)、2位:トヨタ アイシス(69ポイント)、3位:トヨタ エスティマ(70ポイント)

※ラージセグメントはランキング対象モデルの市場占有率が不十分な為、セグメントランキング公表対象外

今回の調査結果について、J.D. パワーのオートモーティブ部門シニアディレクター川橋敦は次のように分析している。

―本年の調査結果では「オーディオ/コミュニケーション/エンターテインメント/ナビゲーション」での不具合指摘の増加が目立った。これは車の基本的な機能に関わるものではないものの、ユーザーにとって快適で便利なドライブに不可欠なものとなってきている。 今年の日本自動車初期品質調査*2の結果では、ナビゲーションシステムやブルートゥースの装備率が当調査よりも高い傾向が確認されている。これらの車載装備率の上昇に伴い、来年以降、当調査での不具合指摘がさらに増加することが予想される。

注釈*2 日本自動車初期品質調査、略称IQS。新車購入後2~9ヶ月のユーザーを対象にした顧客満足度調査で8月に調査結果が発表された。

この調査で、自動車耐久品質が再購入意向や推奨意向に影響を及ぼすことが明らかとなった。

例えば、保有車両に対する不具合指摘が1件もないユーザーの場合、再購入意向(必ず+たぶん同じブランドの車を購入する)の割合は70%、推奨意向(必ず+たぶん同じモデルを友人や知人に推奨する)の割合は71%と、いずれも高い数字となっている。一方、不具合指摘が3件以上あるユーザーの場合、再購入意向は56%、推奨意向は61%と低下している。

又、車両本体の耐久性だけでなく、車載機器に対する不具合経験も、顧客ロイヤリティに大きく影響することが明らかになった。

自動車耐久品質改善に向け、顧客の声に耳を傾けた今後の自動車業界への対応が期待される。

*J.D. パワーが結果を発表する調査はすべてJ.D. パワーが第三者機関として自主企画により実施したものです。

<ご注意>

本紙は報道用資料です。(株)J.D. パワー アジア・パシフィックの許可無く本資料に掲載されている情報および結果を広告または販促活動に転用することを禁止します。