CS(顧客満足度)に関する調査・コンサルティングの国際的な専門機関である J.D. Power(本社:米国ミシガン州 トロイ)は、現地時間6月2日にリテールバンクおよびクレジットカード会社が提供するデジタルチャネルの顧客満足度に関する4調査*1の結果を発表した。これらの調査は、リテールバンクおよびクレジットカード会社のデジタルチャネルに対する満足度を測定している。

*1

J.D. Power 2022 U.S. Banking Mobile App Satisfaction StudySM(J.D. パワー 2022 年米国銀行モバイルアプリ顧客満足度調査 SM)

J.D. Power 2022 U.S. Online Banking Satisfaction StudySM(J.D. パワー 2022 年米国オンラインバンキング顧客満足度調査 SM)

J.D. Power 2022 U.S. Credit Card Mobile App Satisfaction StudySM(J.D. パワー 2022 年米国クレジットカードモバイルアプリ顧客満足度調査 SM)

J.D. Power 2022 U.S. Online Credit Card Satisfaction StudySM(J.D. パワー 2022 年米国オンラインクレジットカード顧客満足度調査 SM)

顧客の期待の高まりと経済の低迷が重なり、ウェブサイトとモバイルアプリに新たな課題

顧客の多くは財政的に圧迫されており、銀行やクレジットカード会社がそれを認識し、ウェブサイトやモバイルアプリを通じて適切な財務管理を支援することを望んでいる。

しかし、高レベルにパーソナライズ化されたサービスを高頻度にコンタクトのあるデジタルチャネルで提供できているかを調べた結果、ほとんどの銀行やクレジットカード会社は的外れな対応をしていることが分かった。本調査によると、ほとんどのデジタルチャネルに対する総合満足度は、利用量が増えるにつれて低下した。

2022年調査の主なポイントは以下の通り:

ほとんどのセグメントで総合満足度が低下

全国系銀行のウェブサイトでは顧客満足度がやや上昇(+5ポイント、1,000ポイント満点)した一方で、全国系銀行のモバイルアプリ、クレジットカード会社のモバイルアプリとウェブサイト、地方系銀行のモバイルアプリとウェブサイトでは顧客満足度が低下した。全国系銀行のモバイルアプリの顧客満足度が-17ポイントと最も低下した。

財務健全性*2が深刻な問題に

1年足らずの間に、「財務的に健全である」と定義される顧客の割合は 53%から 43%へと-10 ポイント低下した。一方、「財務的に脆弱」と判定された顧客の割合は、25%から32%に増加した。

リテール銀行の総合満足度スコアは、「財務的に脆弱」な顧客の方が、財務的に健全な顧客よりも平均-113ポイントも低くなった。

*2 J.D. パワーは、消費者の財務健全性を、支出/貯蓄比率、信用度、保険の適用範囲などのセーフティーネットの項目を組み合わせた指標で測定している。消費者は健全な状態から脆弱な状態までの連続的な指標において測定される。

デジタルチャネルはパーソナライズ化に失敗

支店を訪れるリテール銀行の顧客のうち、73%がその銀行と個人ニーズ等を理解した親密な関係を持っていると回答した。銀行のデジタルチャネルを主に利用している顧客の間では、その割合は53%に低下した。

支出・予算管理ツールは、顧客満足度にプラスの効果

本調査により、明るい材料として、支出分析・予算管理のデジタルツールは全てのセグメントにおいて、顧客満足度の大幅な向上に寄与していることがわかった。

しかし、これらのツールの利用率は横ばいで、現在の利用率は銀行やクレジットカードの顧客のわずか27~38%に止まる。

J.D. パワー バンキング・アンド・ペイメント・インテリジェンス部門シニアコンサルタント、ジェニファー・ホワイトのコメント

「デジタル体験のあるべき姿に対する顧客の期待の高まりと相まって、デジタルバンキングとクレジットカードの分野では顧客満足度のスコアに大きな変動が見られるようになった。消費者のニーズを先取りし、高度にパーソナライズ化された顧客体験を提供する他の消費者向けアプリやウェブサイトの利用経験を踏まえ、銀行やクレジットカードの顧客はデジタルソリューションにさらなる期待を寄せている。さらに、厳しい経済的状況により顧客の期待は切迫したものとなっている。」

顧客満足度ランキング

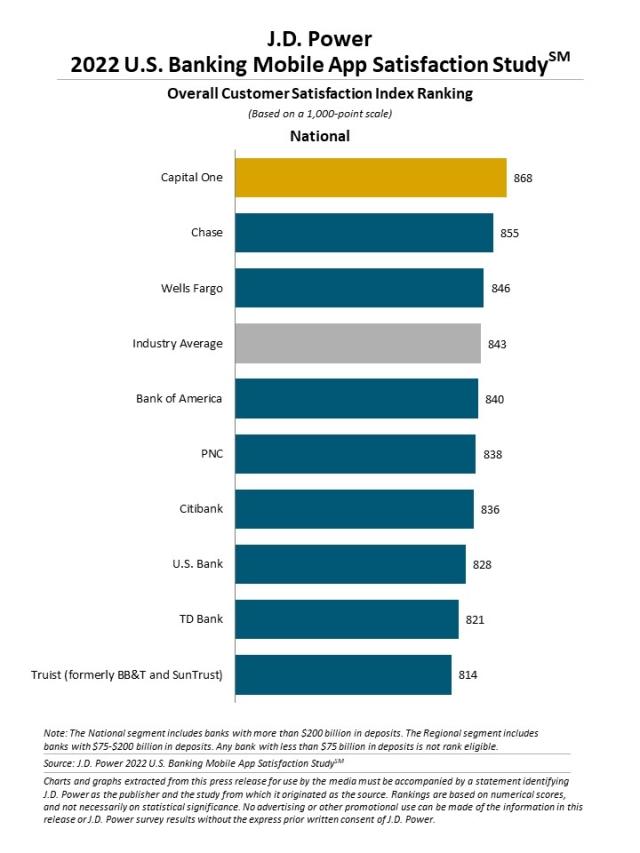

【全国系銀行モバイルアプリ部門】

第1位:Capital One (キャピタル・ワン)(868ポイント)

第2位:Chase(チェース)(855ポイント)

第3位:Wells Fargo (ウェルス・ファーゴ)(846ポイント)

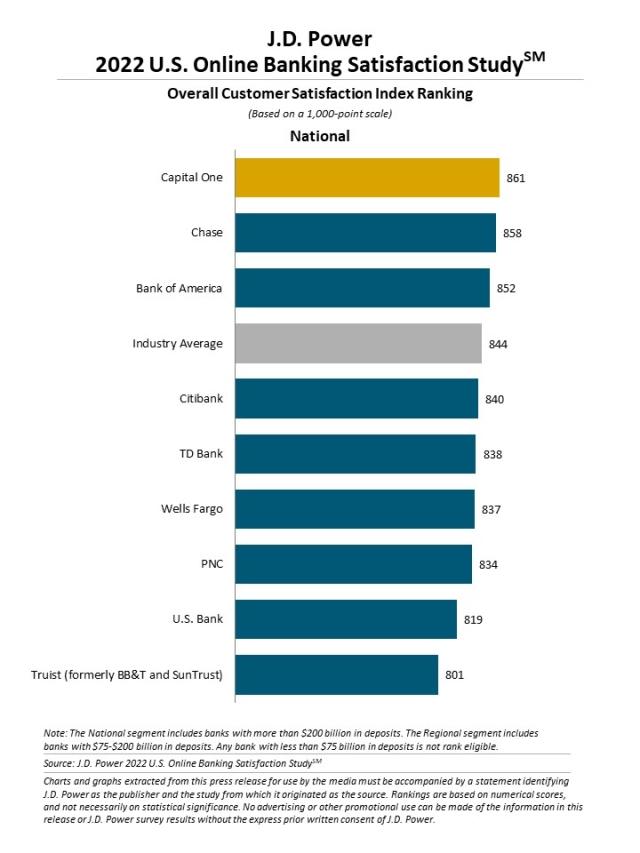

【全国系銀行オンラインバンキング部門】

第1位:Capital One (キャピタル・ワン)(861ポイント)

第2位:Chase(チェース)(858ポイント)

第3位:Bank of America(バンク・オブ・アメリカ)(852ポイント)

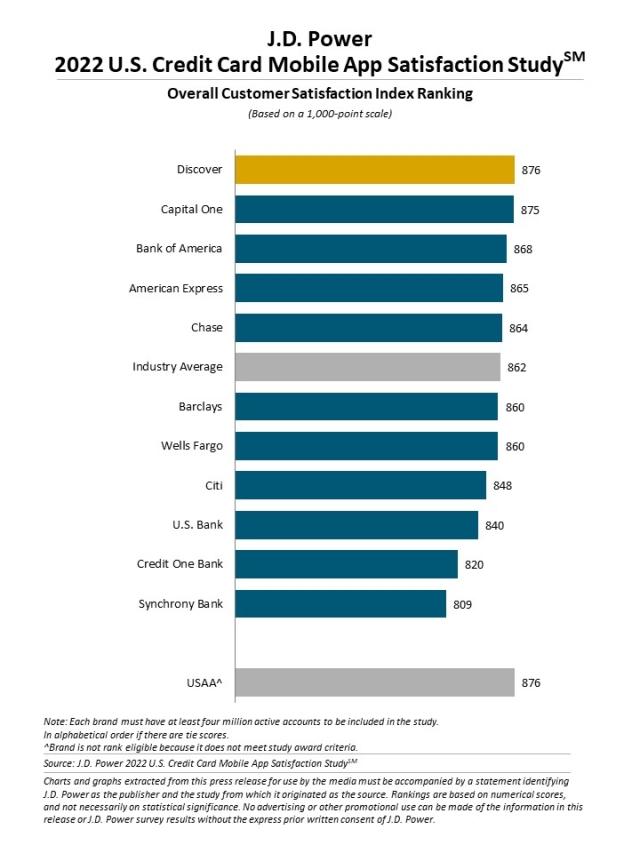

【クレジットカードモバイルアプリ部門】

第1位:Discover (ディスカバー) (876ポイント)

第2位:Capital One (キャピタル・ワン)(875ポイント)

第3位:Bank of America(バンク・オブ・アメリカ)(868ポイント)

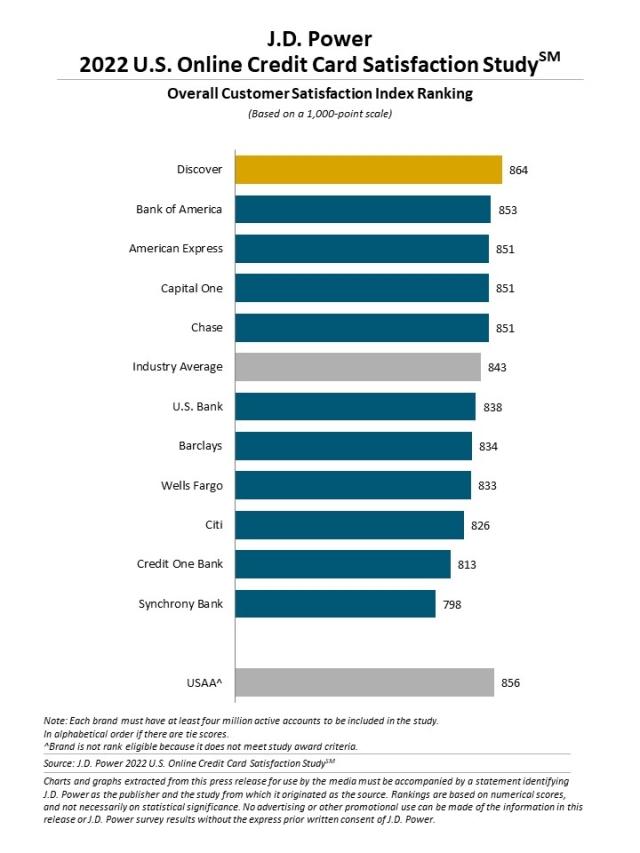

【オンラインクレジットカード部門】

第1位:Discover (ディスカバー) (864ポイント)

第2位:Bank of America(バンク・オブ・アメリカ)(853ポイント)

第3位:American Express (アメリカン・エキスプレス)、Capital One (キャピタル・ワン)、Chase(チェース)(同点、851ポイント)

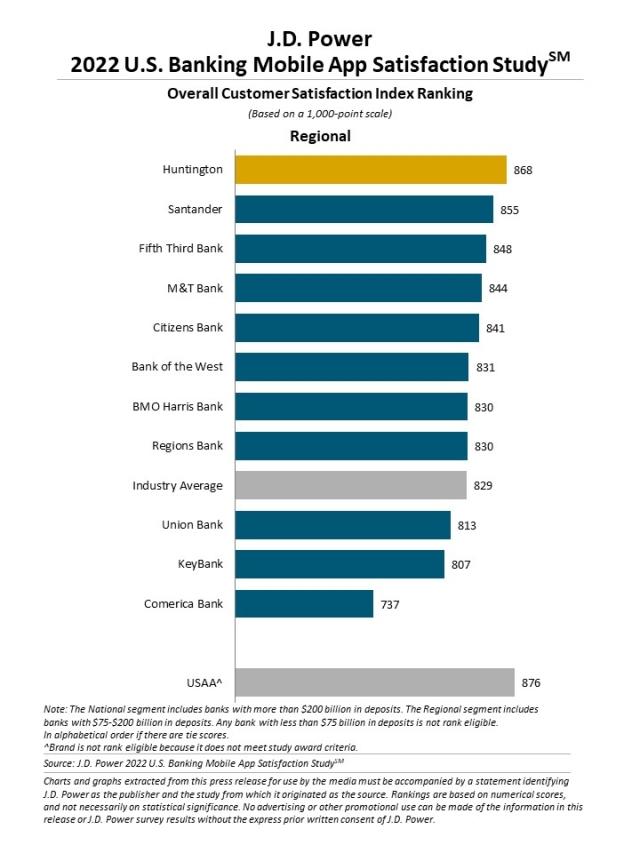

【地方系銀行モバイルアプリ部門】

第1位:Huntington(ハンチントン)(868ポイント、3年連続の1位)

第2位:Santander (サンタンデール)(855ポイント)

第3位:Fifth Third Bank(フィフス・サード・バンク)(848ポイント)

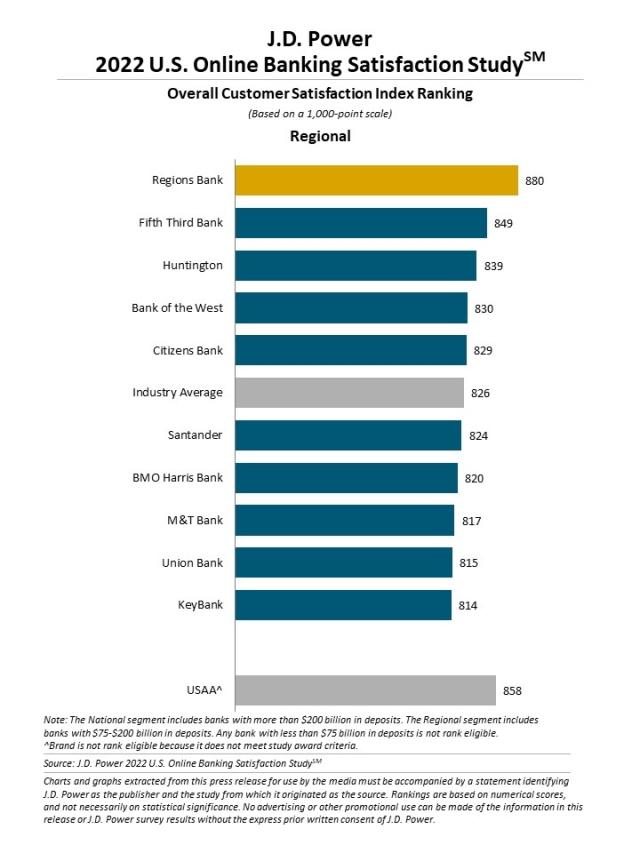

【地方系銀行オンラインバンキング部門】

第1位:Regions Bank (リージョンズ・バンク)(880ポイント、3年連続の1位)

第2位:Fifth Third Bank(フィフス・サード・バンク)(849ポイント)

第3位:Huntington(ハンチントン)(839ポイント)

《調査概要》

J.D. パワー 2022年米国銀行モバイルアプリ顧客満足度調査℠

J.D. パワー 2022年米国オンラインバンキング顧客満足度調査℠

J.D. パワー 2022年米国クレジットカードモバイルアプリ顧客満足度調査℠

J.D. パワー 2022年米国オンラインクレジットカード顧客満足度調査℠

年に1回、リテールバンクとクレジットカード会社の顧客を対象に、銀行やクレジットカード会社のデジタルチャネルに対する満足度を聴取し明らかにする調査。今回で6回目の実施となる。

■実施期間:2022年2月~4月

■調査方法:インターネット調査

■調査対象: リテールバンクとクレジットカード会社の顧客

■調査回答者数:16,132人

総合的な顧客満足度に影響を与えるファクターを設定し、各ファクターの詳細評価項目に関するユーザーの評価を 基に 1,000 ポイント満点で総合満足度スコアを算出。総合満足度を構成するファクターは、総合満足度に対する影 響度が大きい順に、「操作のしやすさ」、「速度」、「見やすさ」、「掲載情報」の4ファクターとなっている。

*本報道資料は、現地時間 2022年6月2日に米国で発表されたリリースを要約したものです。

原文リリースはこちら

*J.D. パワーが調査結果を公表する全ての調査は、J.D. パワーが第三者機関として自主企画し実施したものです。

【ご注意】本紙は報道用資料です。弊社の許可なく本資料に掲載されている情報や結果を広告や販促活動に転用することを禁じます。

J.D. パワーについて:

J.D. パワー(本社:米国ミシガン州トロイ)は消費者のインサイト、アドバイザリーサービス、データ分析における国際的なマーケティングリサーチカンパニーです。50年以上にわたり、ビッグデータやAI、アルゴリズムモデリング機能を駆使し、消費者行動を捉え、世界を牽引する企業に、ブランドや製品との顧客の相互作用に関する鋭い業界インテリジェンスを提供するパイオニアです。