New-Vehicle Initial Quality Requires Improvement in Advanced Technologies and Information-Related Equipment, J.D. Power Finds

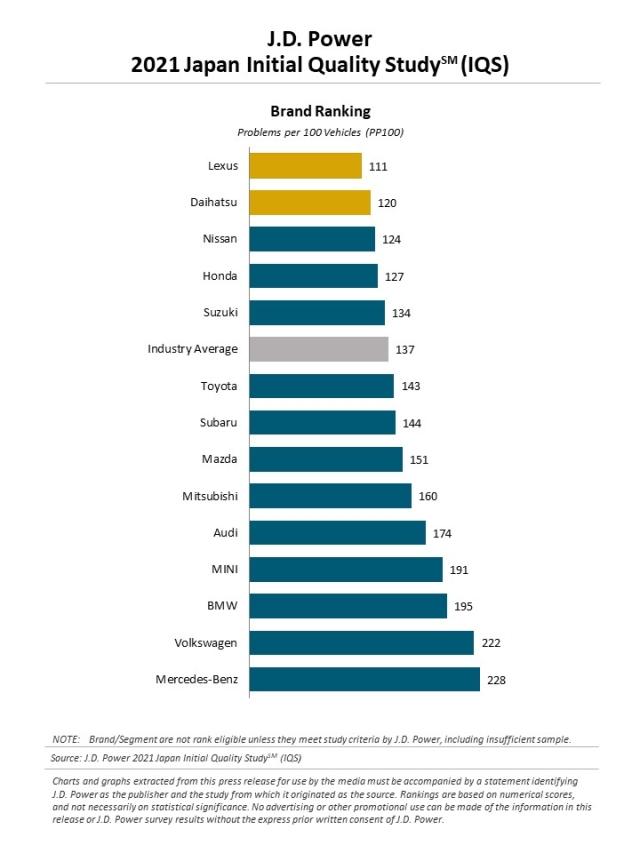

Lexus Ranks Highest for Overall Initial Quality; Daihatsu Ranks Highest among Mass Market Brands

TOKYO: 22 Sept. 2021 — The most frequently cited initial vehicle quality-related problems are in the driving assistance category, followed by those in the infotainment category, according to the J.D. Power 2021 Japan Initial Quality StudySM (IQS), released today. These problems indicate the importance of improving the quality of advanced technologies and information-related equipment as well as usability.

The study, now in its 11th year, examines problems experienced by owners of new vehicles in the first two to thirteen months of ownership. Initial quality is determined by the number of problems experienced per 100 vehicles (PP100), with a lower score reflecting higher quality.

“Recently, the problems indicated by new-vehicle owners are shifting from defects and malfunctions to design-related problems,” said Yuji Sasaki, director of research at J.D. Power. “This shift is driven by the trend for more new vehicles to be equipped with advanced technologies and a wider variety of powertrains.”

In response to the changes in the market, J.D. Power has completely redesigned the study to redefine initial quality from the user perspective. The results of this year’s study highlight the importance of improving not only the basic performance and vehicle interior and exterior, but also the quality of the advanced technologies, information-related equipment and the usability of vehicles and their functions.

Following are key findings of the 2021 study:

- Five of 14 brands are above industry average: This year, initial quality averages 137 PP100. Among the 14 brands included in the rankings, five are above the industry average in the number of problems indicated by owners. Among all brands, Lexus (111 PP100) has the fewest problems and is the only luxury brand that is better than the industry average. In the mass market segment, Daihatsu (120 PP100) has the fewest problems.

- Problems in the driving assistance and infotainment categories are most frequently reported: Among the nine categories in which vehicle quality is evaluated, problems with driving assistance (23.6 PP100) are most frequently cited, followed by infotainment (23.4 PP100). These are more frequent than problems with driving experience or vehicle interior and exterior. Infotainment-related problems are more frequent among import brands than domestic brands. Among the 221 problem areas, the most problematic is for lane departure warning/lane keeping assistance (6.3 PP100) in the driving assistance category.

- Usability and poor performance are key problematic areas: Among types of problems, those related to difficult to use are most frequently cited (48.7 PP100), accounting for 35% of the total number of problems. This suggests that usability is a high-priority issue for improving initial quality from the user perspective. The second most frequently cited type of problem relates to poor performance (25.1 PP100). Since these two problem areas account for 54% of the total number of problems, improving both may eliminate approximately half of the problems.

- Younger owners indicate more problems in infotainment and driving assistance: The number of problems in infotainment is 28.4 PP100 among owners age 39 and younger, and is 19.3 PP100 among owners age 60 and older. The same trends hold for driving assistance. In general, younger owners are familiar with information equipment and are quick learners for advanced technologies, but the reality is that younger owners more frequently cite problems in infotainment and driving assistance. To improve initial quality, it is necessary to resolve the causes of these problems indicated by younger owners as well as those by owners with a high level of technology literacy.

- Customers who switched vehicle brands more likely to cite problems: More problems are cited by owners who switched or purchased their new vehicle as a replacement or an addition from another brand than by owners who purchased their new vehicle as a replacement or an addition from the same brand. This trend applies especially to older owners. Among owners age 39 and younger, the number of problems is 158 PP100 among those who switched from another brand and 152 PP100 among those who purchased the same brand. In contrast, among owners age 60 and older, the number of problems is 143 PP100 among those who switched from another brand and 119 PP100 among those who purchased the same brand, a gap of 24 points. Also, among owners age 60 and older who switched brands, problems related to difficult to use and poor performance are more frequently cited than among those who purchased the same brand. In an aging society, acquiring older customers from competitors is one of the important challenges for increasing market share. It is desirable to manufacture vehicles with technology that is easy to use and provides good performance to attract customers who will consider switching brands.

Highest-Ranked Brands

Lexus ranks highest in overall initial quality. Daihatsu ranks highest in the mass market segment.

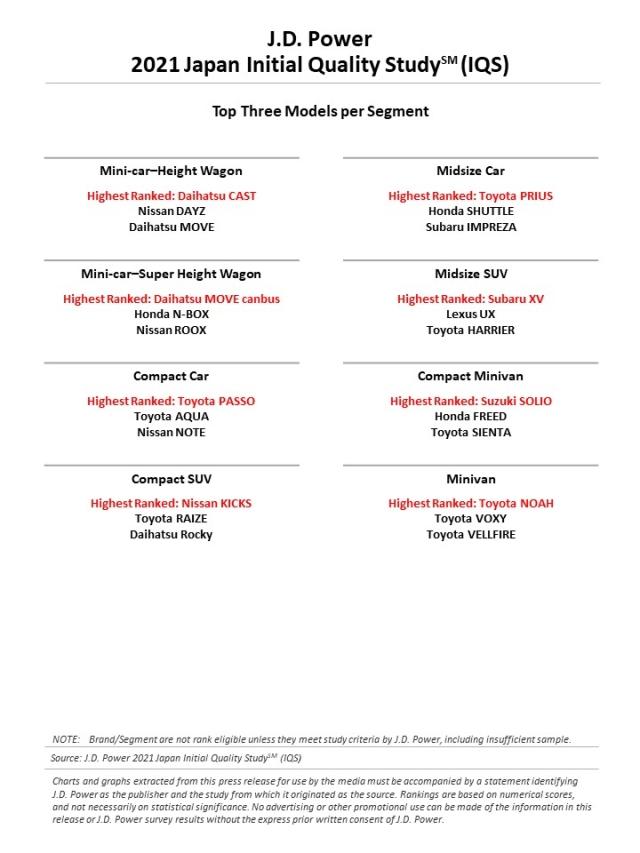

Segment-Leading Models

- Mini-car–Height Wagon segment: Daihatsu CAST

- Mini-car–Super Height Wagon segment: Daihatsu MOVE canbus

- Compact Car segment: Toyota PASSO

- Compact SUV segment: Nissan KICKS

- Midsize Car segment: Toyota PRIUS

- Midsize SUV segment: Subaru XV

- Compact Minivan segment: Suzuki SOLIO

- Minivan segment: Toyota NOAH

The 2021Japan Initial Quality Study is based on responses from 19,615 purchasers of new vehicles in the first two to thirteen months of ownership. Vehicle quality is evaluated by owners across 221 questions organized into nine vehicle categories: infotainment; features, controls and displays; exterior; driving assistance; interior; powertrain; seats; driving experience; and climate. The study was fielded from May through June 2021.

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific.

Media Relations Contacts

Kumi Kitami; Japan; 81-3-4570-8410; release@jdpa.com

Geno Effler; USA; 714-621-6224; media.relations@jdpa.com

About J.D. Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info