Advanced Vehicle Technologies in Japan Continue to be Problematic, J.D. Power Finds

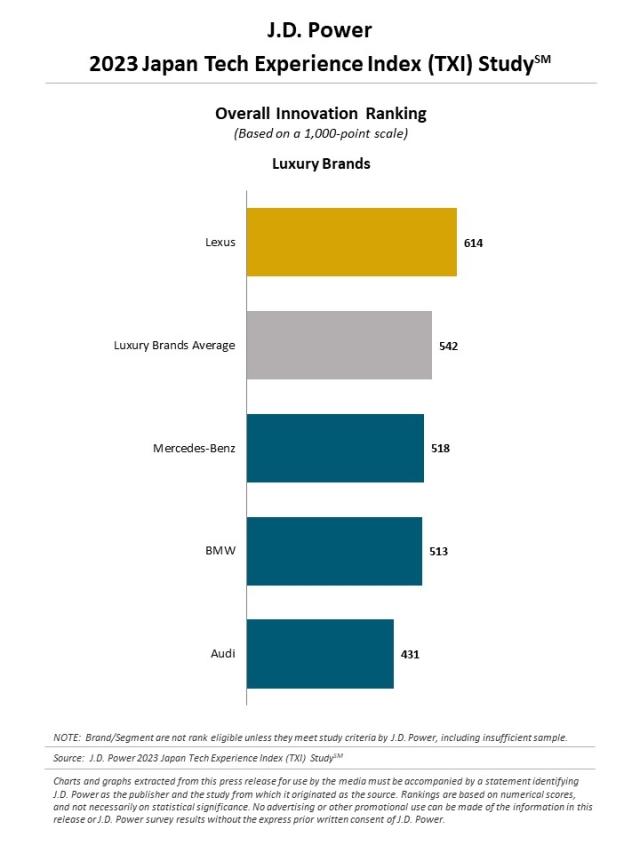

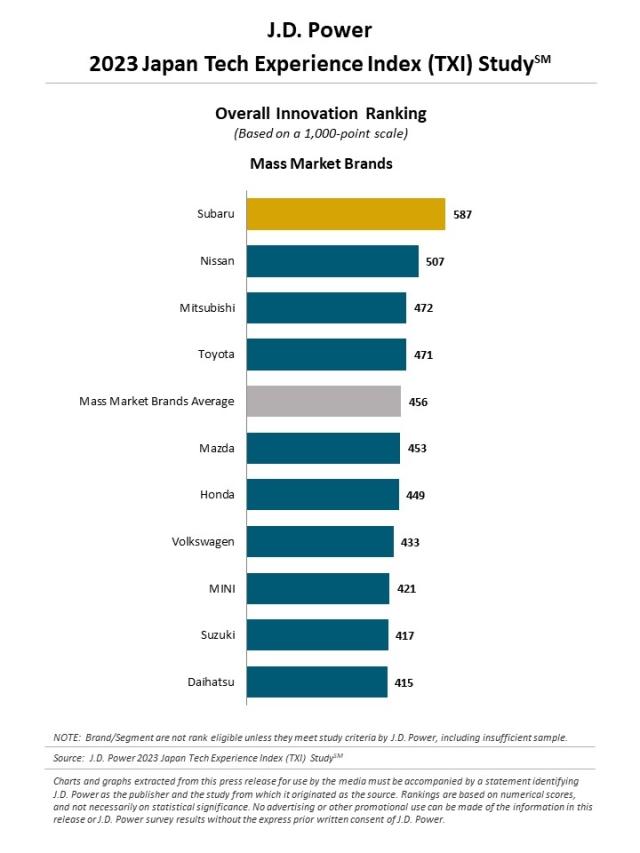

Lexus Ranks Highest among Luxury Brands; Subaru Ranks Highest among Mass Market Brands

TOKYO: 15 Nov. 2023 — Advanced technologies in new vehicles in Japan have become more problematic, according to the J.D. Power 2023 Japan Tech Experience Index (TXI) Study,SM released today. Specifically, 14 of the 23 advanced technologies are the same technologies as in 2022, but the average number of PP100 for these 14 technologies in 2023 is 13.3 PP100, which is a worse score than 11.9 PP100 in 2022.

“There has been an increase since 2022 in new-vehicle advanced technologies installation and an increase in problems cited,” said Yuji Sasaki, director of the research division at J.D. Power. “If the technologies with unsatisfactory performance and operability continue to be installed on new vehicles it will lead to a decrease in initial quality satisfaction. Moving forward, it is necessary for manufacturers of these technologies to resolve the existing issues before installation and to provide drivers with a thorough explanation when they purchase their new vehicle to negate the current dissatisfaction.”

The study specifically focuses on the installation of advanced technologies on new vehicles and usage and problems experienced with these features, as well as user intentions to recommend and repurchase, based on 34 features that include 23 advanced technologies and 11 emerging technologies. The survey calculates the market depth index, which shows the state of penetration based on the equipment rate and usage experience of 23 advanced technologies, as well as the execution index, which shows the state of technology evaluation based on ratings and problem experience. The innovation index, a comprehensive index of penetration and user evaluation, is calculated on a 1,000-point scale.

Following are key findings of the 2023 study:

- Installation of new advanced technologies increases: The study examines 23 advanced technologies. Among these, 20 are comparable to 2022 and 14 have been more frequently installed on new vehicles this year than last year. This indicates an increase in the types and number of such technologies year over year. The top three most frequently installed technologies on 2023 vehicles are drive recorders (70%); reverse automatic emergency braking systems (41%); and active driving assistance systems (36%). The top three technologies most frequently installed on 2023 vehicles compared with 2022 vehicles are rear seat reminder systems (8% in 2023 vs.4% in 2022); active lane change assist systems (4% in 2023 vs.1%); and front cross traffic warning systems (4% in 2023 vs. 1%).

- Technologies with increases in problems result in lower future installation intentions: The most frequently cited problems with advanced technologies include interior gesture controls (55.9 PP100); facial recognition systems (36.5 PP100); and direct driver monitoring systems (23.4 PP100). Future installation intentions are also lower for these technologies, with only 6% of users of interior gesture controls and 18% of users of facial recognition systems and direct monitoring systems say they “definitely will” install these technologies on their next new vehicle. This suggests that it is necessary to improve these technologies or reconsider which technologies should be installed on new vehicles.

- Lexus ranks highest overall for Tech Innovation for the first time: In the innovation rankings, which are calculated based on installations and user evaluations of the advanced technologies, Lexus ranks highest overall for Tech Innovation for the first time. In the past year, more advanced technologies have been installed on Lexus models. Among the 14 brands included in the rankings (for both luxury and mass market brands), Lexus receives the highest scores for both market depth index and execution index.

- Vehicle users more likely to use smartphone mirroring than built-in navigation systems: In the J.D. Power 2023 Japan Automotive Performance, Execution and Layout (APEAL) Study,SM which was fielded in conjunction with this study, users were asked which system they prefer to use as a navigation feature. More than three-fourths (79%) cite the built-in navigation system. However, this percentage has decreased from 81% in 2022 and 82% in 2021. Use of Android Auto/ Apple CarPlay apps is increasingly the preferred system, with 7% of users citing this in 2023, compared with 5% in 2022 and 3% in 2021.This trend is more prevalent among users who are 39 years old or younger. Users in this group have less frequently used built-in navigation systems, 68% in 2023 vs. 75% in 2021, and have more frequently used Android Auto/Apple CarPlay apps, 13% in 2023 vs. 6% in 2021. According to the J.D. Power U.S. Automotive Performance, Execution and Layout (APEAL) StudySM published in August 2023, 43% of users use built-in navigation systems and 44% use Android Auto/Apple CarPlay apps, indicating a larger shift to the smartphone mirroring than in Japan. It is important for manufacturers in Japan to note if users in Japan also shift to using smartphone mirroring.

Highest-Ranked Brands

Lexus (614) ranks highest overall for innovation. Subaru (587) ranks highest among mass market brands.

The 2023 Japan Tech Experience Index (TXI) Study is based on responses from 21,647 users of new vehicles in the first two to 13 months of ownership. The study was fielded in May-June 2023.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business.

Media Relations Contacts

Kumi Kitami; Japan; 81-3-6809-2996; release@jdpa.com

Geno Effler; USA; 714-621-6224; media.relations@jdpa.com

About J.D. Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info

# # #

NOTE: Two charts follow.