Focusing on New Technologies and Features Key to Increasing Customer Satisfaction in Japan with New Breed of Vehicles, J.D. Power Finds

Lexus Ranks Highest in Sales Satisfaction among Luxury Brands; Nissan Ranks Highest among Mass Market Domestic Brands

TOKYO: 24 Aug. 2023 — As the sales of electric vehicles (EVs) are expected to increase, it is essential to appeal to customers with new technologies and features—specifically those that differ from traditional vehicles—in order to achieve higher customer satisfaction, according to the J.D. Power 2023 Japan Sales Satisfaction Index (SSI) Study,SM released today.

“EVs have a number of advantages over vehicles powered by internal combustion engines,” said Taku Kimoto, senior managing officer of research at J.D. Power. “EVs have a lower running cost after purchase and have impressive acceleration and performance. Currently, customers perceive that EVs are relatively expensive due to the gaps between their projected budget and the actual EV price. It will become increasingly important for dealerships to adequately showcase the wide variety of services, technologies and features of EVs to help customers see the whole-vehicle value instead of only the sticker price.”

Following are some of the key findings of the 2023 study:

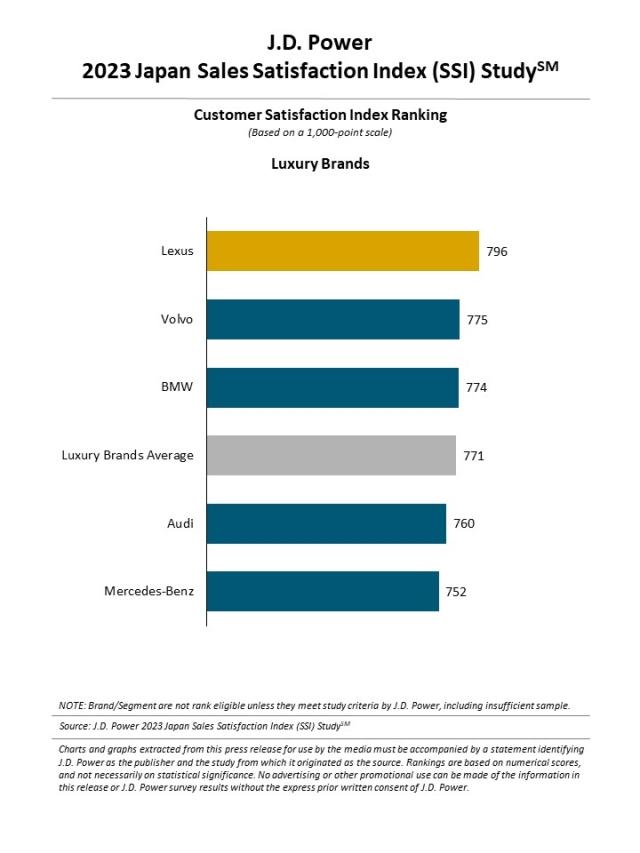

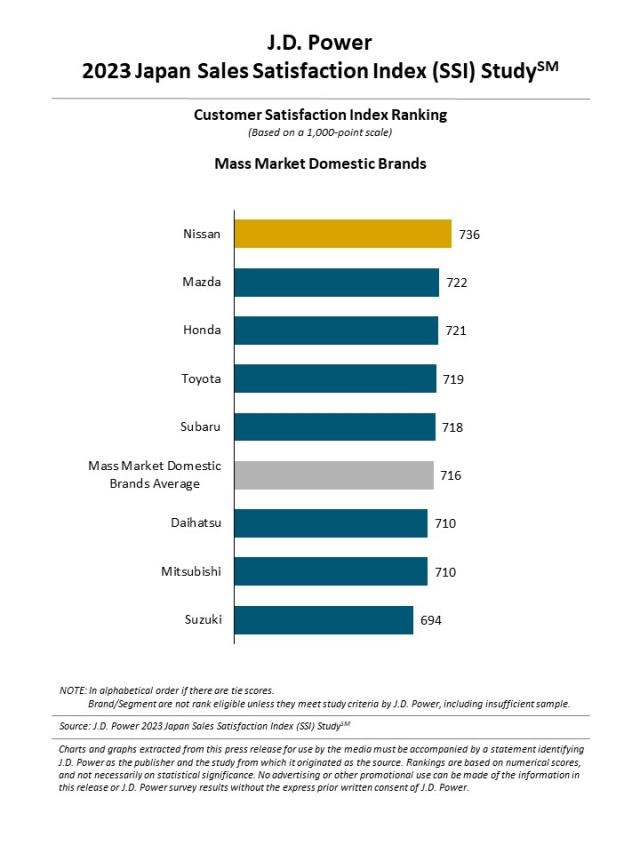

- Overall sales satisfaction decreases from 2022: In 2023, overall sales satisfaction averages 720 points (on a 1,000-point scale), down 13 points from 2022. By factor, sales satisfaction with contract procedure is 730, while the score for dealer facilities and support is 729, followed by 720 for negotiations and 705 for delivery, down by seven, nine, 13 and 21 points, respectively, from 2022. By segment, sales satisfaction for luxury brands averages 771, while the mass market domestic brand average is 716, with dealer facilities and support contributing the most to the gap.

- Longer delivery times resulting in decreased satisfaction: In the new-vehicle market, the global shortage of vehicle parts as well as the worsening war in Ukraine is accelerating disruption to distribution networks. These factors are driving a large decrease in satisfaction for vehicle delivery among those who bought their vehicle at a manufacturer-authorized dealership. Nearly half (47%) of customers this year received their vehicle more than three months after closing the deal, up from 23% in 2022. This and the unpredictability of delivery dates have caused dealerships to refrain from providing customers with an expected delivery date. The percentage of customers who received their vehicle as scheduled has also declined to 47% in 2023 from 55% in 2022. To prevent a further decrease in customer satisfaction due to long delivery times, not only should auto manufacturers find a way to shorten delivery times, but also dealerships should improve how they interact with customers on this issue.

- Appeal of new technologies is key to increased satisfaction at the time of purchase: Auto manufacturers have increasingly marketed a wider variety of EV models and extended their reach into the Japanese auto market. However, satisfaction with negotiations is comparable between EV buyers and buyers of traditional vehicles with internal combustion engines (ICE). Among EV buyers, 44% say they visited their dealer three times or more before purchasing their vehicle, compared with 35% of ICE vehicle buyers. However, EV salespeople less frequently provided suggestions that considered the buyer’s budget than salespeople for ICE vehicles, 78% vs. 83%, respectively. Additionally, 56% of EV buyers say the actual purchase price was higher than their projected budget, compared with 47% of ICE vehicle buyers. There is no difference during negotiations between EV buyers and ICE vehicle buyers in the frequency of explanations regarding competing model differences or new technologies/features, suggesting that the advantages of EVs have not been adequately explained to customers.

Study Rankings

Luxury Brands

Among the five luxury brands included in the study, Lexus (796) ranks highest. Lexus performs particularly well in the dealer facilities and support, negotiations, and contract procedure factors. Volvo (775) ranks second and BMW (774) ranks third.

Mass Market Domestic Brands

Among eight mass market domestic brands, Nissan (736) ranks highest. Nissan performs particularly well in the dealer facilities and support, contract procedure, and delivery factors. Mazda (722) ranks second and Honda (721) ranks third.

The study, now in its 22nd year, this year is based on responses from 7,219 buyers who purchased their new vehicle at a manufacturer-authorized dealer. Satisfaction is measured in four factors: contract procedure; dealer facilities and support; delivery; and negotiations. The data was collected between April 2022 and March 2023, after two to 13 months of ownership. The online survey was fielded from May through June 2023.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit https://japan.jdpower.com/.

Media Relations Contacts

Kumi Kitami; Japan; 81-3-6809-2996; release@jdpa.com

Geno Effler; USA; 714-621-6224; media.relations@jdpa.com

About J.D. Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info